Correct Answer

verified

Correct Answer

verified

True/False

Under the Uniform Unclaimed Property Act, any unclaimed paychecks must be turned over to the state after the next payday.

Correct Answer

verified

Correct Answer

verified

True/False

In the garnishment process, federal tax levies take secondary priority to wages withheld for child support orders.

Correct Answer

verified

Correct Answer

verified

True/False

The FICA taxes on the employer represent both business expenses and liabilities of the employer.

Correct Answer

verified

Correct Answer

verified

True/False

Tax withholdings from employees' pays reduce the amount of the debit to Salary Expense in the payroll entry.

Correct Answer

verified

Correct Answer

verified

True/False

In the adjusting entry to accrue wages at the end of the accounting period, there is no need to credit any tax withholding accounts.

Correct Answer

verified

Correct Answer

verified

True/False

Once the journal entry for the payroll is complete, the information is posted to the appropriate general ledger accounts.

Correct Answer

verified

Correct Answer

verified

True/False

Under the provisions of the Consumer Credit Protection Act, an employer can discharge an employee simply because the employee's wage is subject to garnishment for a single indebtedness.

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record the employer's payroll taxes usually includes credits to the liability accounts for FICA (OASDI and HI), FUTA, and SUTA taxes.

Correct Answer

verified

Correct Answer

verified

True/False

At the time that the entry is made to record the employer's payroll taxes, the SUTA tax is recorded at the net amount (0.6%).

Correct Answer

verified

Correct Answer

verified

True/False

Since the credit against the FUTA tax (for SUTA contributions) is made on Form 940, the employer's payroll tax entries should include the FUTA tax at the gross amount (6.0%).

Correct Answer

verified

Correct Answer

verified

True/False

When withheld union dues are turned over to the union by the employer, a journal entry is made debiting the liability account and crediting the cash account.

Correct Answer

verified

Correct Answer

verified

Essay

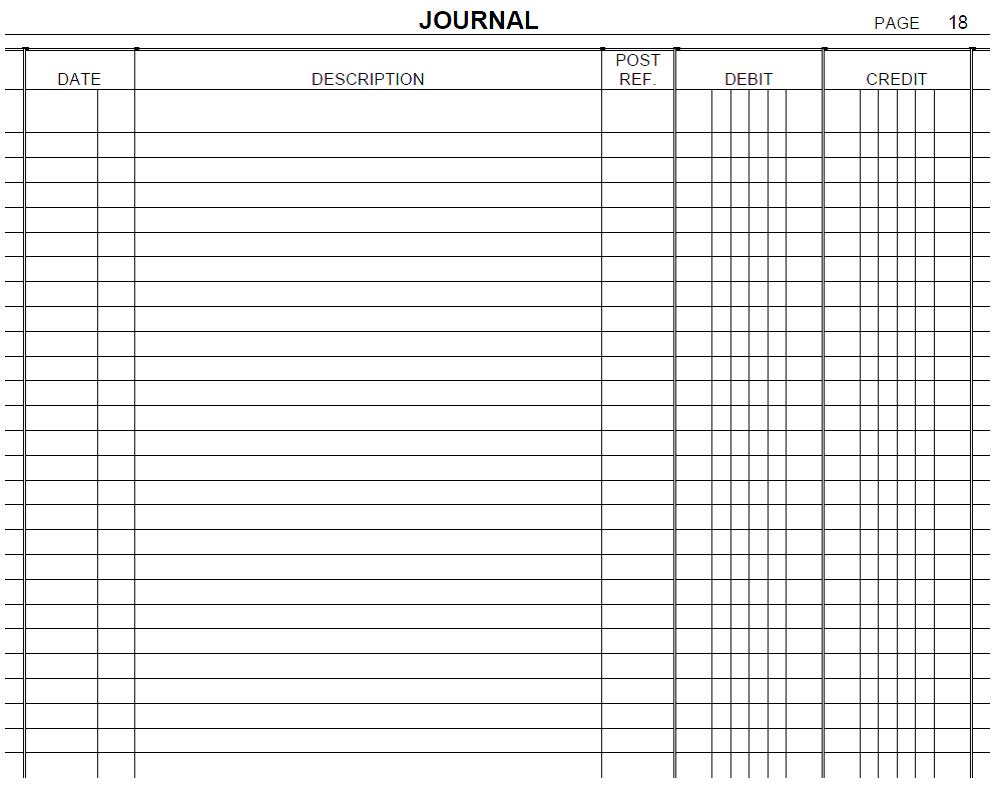

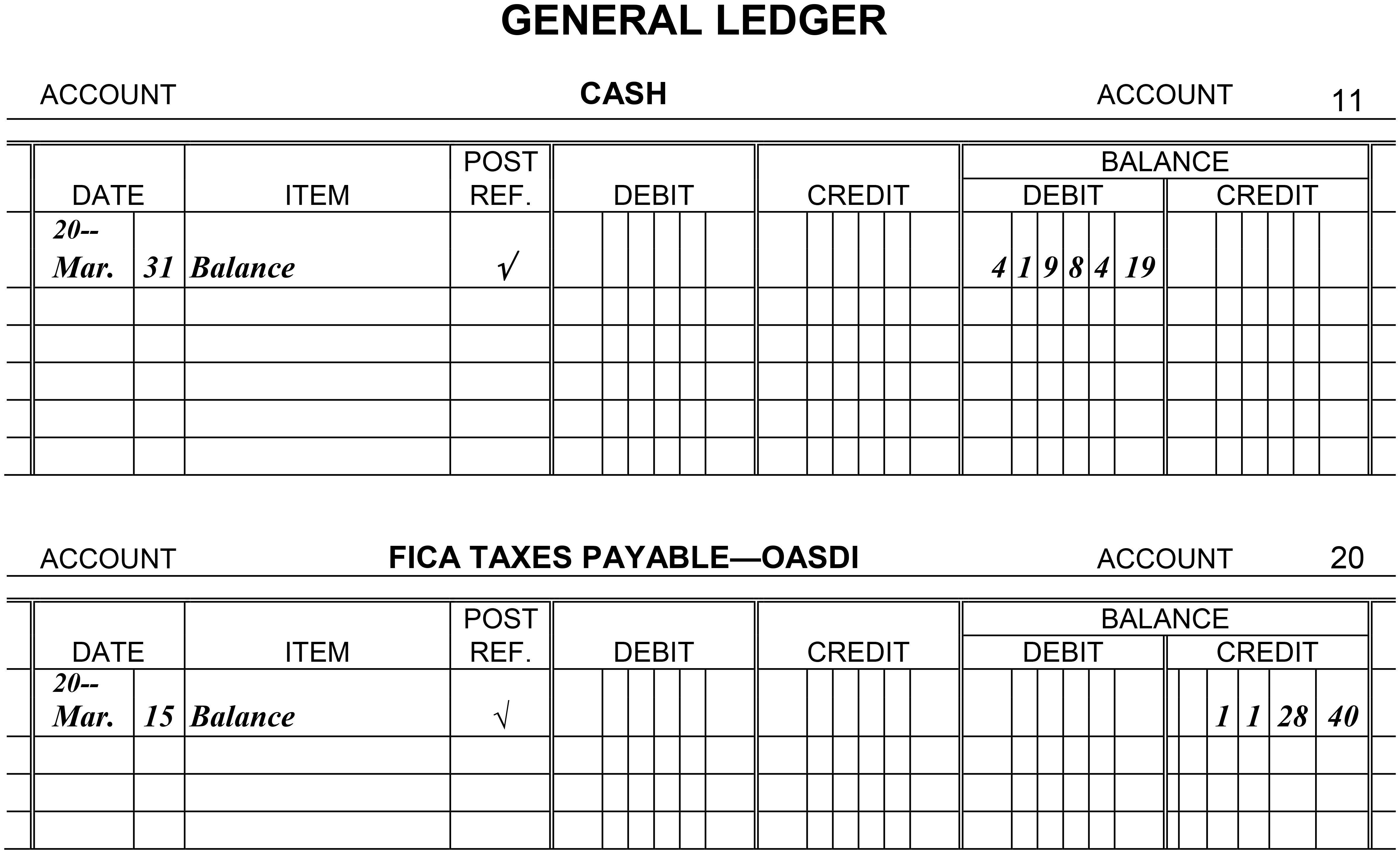

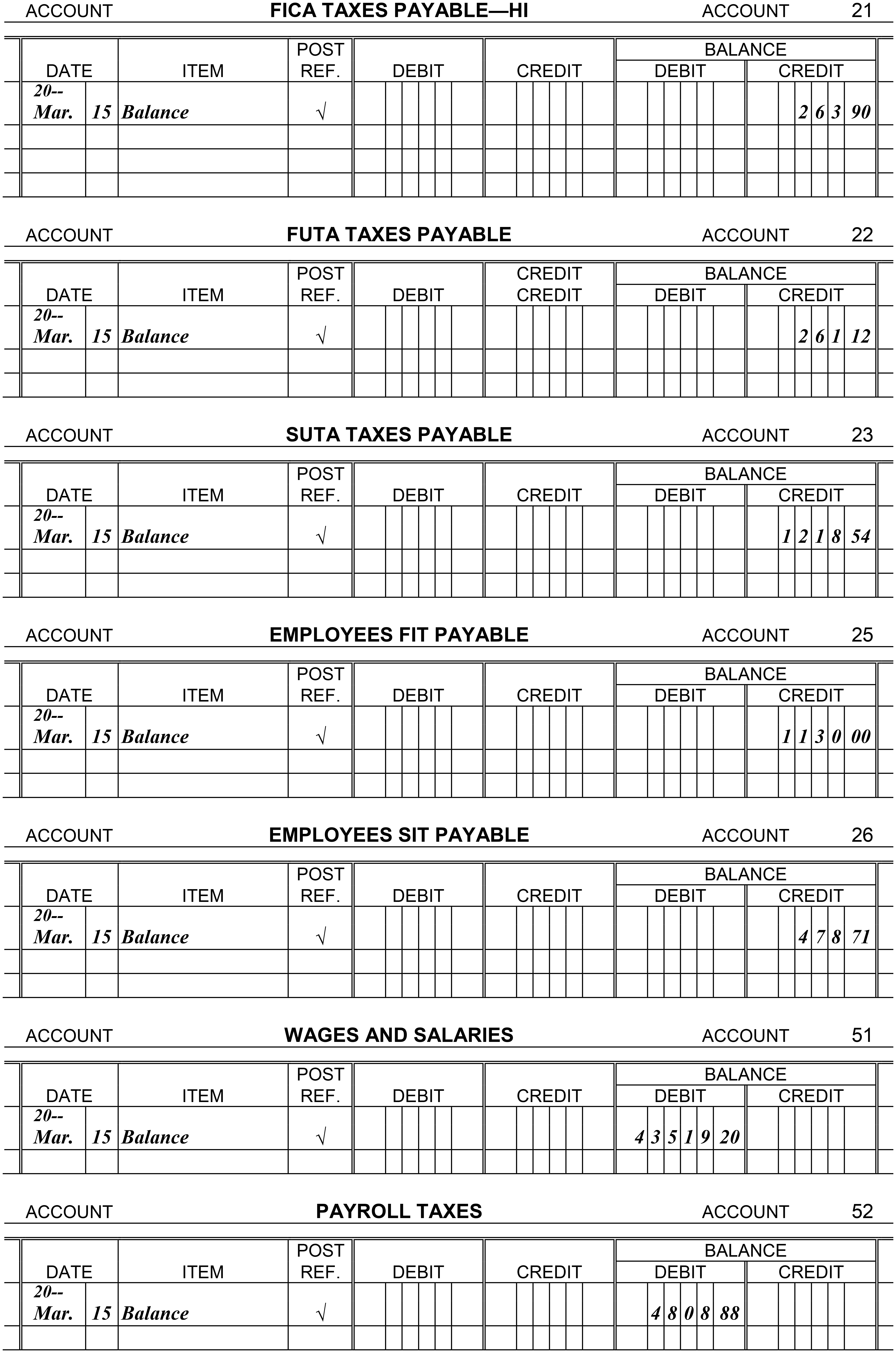

Journalize each of the payroll transactions listed below. Omit the writing of a description or explanation for each journal entry, and do not skip a line between each entry . Then post all entries except the last two to the appropriate general ledger accounts.

The balances listed in the general ledger accounts for Cash, FUTA Taxes Payable, SUTA Taxes Payable, Employees SIT Payable, Wages and Salaries, and Payroll Taxes are the results of all payroll transactions for the first quarter, not including the last pay of the quarter. The balances in FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable are the amounts due from

the March 15 payroll.

March 31, 20--: Paid total wages of $9,350.00. These are the wages for the last semimonthly pay of March. All of this amount is taxable under FICA (OASDI and HI). In addition, withhold $1,175 for federal income taxes and $102.03 for state income taxes. These are the only deductions made from the employees' wages.

March 31, 20--: Record the employer's payroll taxes for the last pay in March. All of the earnings are taxable under FICA (OASDI and HI), FUTA (0.6%), and SUTA (2.8%).

April 15, 20--: Made a deposit to remove the liability for the FICA taxes and the employees' federal income taxes withheld on the two March payrolls.

May 2, 20--: Made the deposit to remove the liability for FUTA taxes for the first quarter of 20--.

May 2, 20--: Filed the state unemployment contributions return for the first quarter of 20-- and paid the total amount owed for the quarter to the state unemployment compensation fund.

May 2, 20--: Filed the state income tax return for the first quarter of 20-- and paid the total amount owed for the quarter to the state income tax bureau.

December 31, 20--: In July 20--, the company changed from a semimonthly pay system to a weekly pay system. The employees were paid every Friday through the rest of 20--. Record the adjusting entry for wages accrued at the end of December ($770) but not paid until the first Friday in January. Do not post this entry.

December 31, 20--: The company has determined that employees have earned $19,300 in unused vacation time. Record the adjusting entry to put this expense on the books. Do not post this entry.

Correct Answer

verified

Correct Answer

verified

True/False

The payment of the FUTA tax and the FICA taxes by the employer to the IRS is recorded in the same journal entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recording the monthly adjusting entry for accrued wages at the end of the accounting period, the amount of the adjustment would usually be determined by:

A) collecting the timesheets for the days accrued.

B) using the same amount as the prior month's adjustment.

C) using the wages of the salaried workers only.

D) a percentage of the previous week's gross payroll.

E) a percentage of the previous week's net payroll.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 75 of 75