A) refers to how much money the individual would like to have

B) refers to the amount of money an individual needs to maintain her desired standard of living

C) refers to her wealth constraint

D) refers to the amount of her wealth that an individual chooses to hold in the form of money

E) is virtually unlimited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bond prices rise in the secondary market,

A) the interest rate rises in the secondary market

B) the interest rate rises in the primary market

C) this has no impact on the primary market

D) they fall in the primary market

E) they also rise in the primary market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government spending will lead to which of the following?

A) an increase in equilibrium GDP,a decrease in money demand,a decrease in the interest rate,and an increase in investment spending

B) a decrease in equilibrium GDP,a decrease in money demand,an increase in the interest rate,and a decrease in investment spending

C) an increase in equilibrium GDP,an increase in money demand,an increase in the interest rate,and an increase in investment spending

D) a decrease in equilibrium GDP,a decrease in money demand,a decrease in the interest rate,and an increase in investment spending

E) an increase in equilibrium GDP,an increase in money demand,an increase in the interest rate,and a decrease in investment spending

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is an excess demand for money,there is an excess

A) supply of bonds and the price of bonds will increase.

B) supply of bonds and the price of bonds will decrease.

C) demand for bonds and the price of bonds will increase.

D) demand for bonds and the price of bonds will decrease.

E) supply of bonds and the price of bonds will not change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between an interest rate and some other,benchmark interest rate is known as the

A) spread.

B) rate difference

C) rate of return differential.

D) rent.

E) income differential.

Correct Answer

verified

Correct Answer

verified

True/False

The money market is in equilibrium when there is no excess supply of or excess demand for bonds.

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the interest rate reduces the opportunity cost of holding money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply is

A) positively related to the interest rate

B) negatively related to the interest rate

C) positively related to income

D) negatively related to income

E) set by the Fed and therefore independent of the interest rate and income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Cathy has a bond that will pay $1,000 one year from now and its current price is $800,what is the current interest rate?

A) 10 percent

B) 25 percent

C) 20 percent

D) 200 percent

E) 2 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

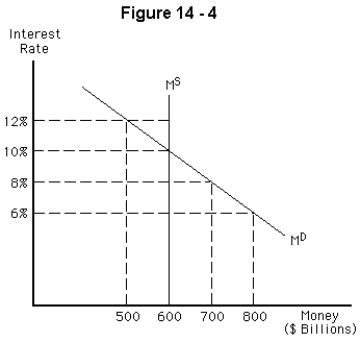

-Refer to Figure 14-4.If the interest rate is currently 8 percent,we would expect the

-Refer to Figure 14-4.If the interest rate is currently 8 percent,we would expect the

A) interest rate to rise to 10 percent

B) interest rate to rise to 12 percent

C) interest rate to fall to 6 percent

D) quantity of money held to decrease to $500 billion

E) money supply to increase to $700 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the aggregate expenditure line has shifted downward,which of the following is the most likely cause?

A) There have been reports of good economic news.

B) The Fed has conducted an open market sale of bonds.

C) Income tax rates have been lowered.

D) The Fed has conducted an open market purchase of bonds.

E) Exports have increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crowding out occurs

A) when an increase in government spending crowds out tax revenues.

B) when an increase in government spending increases investment spending.

C) when an increase in government spending crowds out bonds.

D) when an increase in government spending crowds out other types of spending.

E) when an increase in government spending crowds out the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

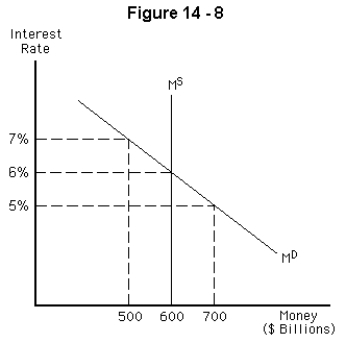

-Refer to Figure 14-8 above.If the interest rate is currently 5%,

-Refer to Figure 14-8 above.If the interest rate is currently 5%,

A) the interest rate must fall to restore equilibrium.

B) the interest rate will not change.

C) the interest rate must rise to restore equilibrium.

D) there is an excess supply of money.

E) the excess demand for money is $200 billion.

Correct Answer

verified

Correct Answer

verified

True/False

An increase in government spending can lead to a decrease in GDP if the interest rate changes enough.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If businesses become very pessimistic and reduce spending,which of the following is the most likely in the short run?

A) An increase in output,an increase in money demand and an increase in the interest rate.

B) A decrease in output,an increase in money demand and an increase in the interest rate.

C) A decrease in output,a decrease in money demand and a decrease in the interest rate.

D) An increase in output,a decrease in money demand and a decrease in the interest rate.

E) A decrease in output,a decrease in money demand and an increase in the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The demand for curve for money

A) shows the amount of money people actually hold

B) shows the amount of money people would like to hold,given the constraints they face

C) shifts if the interest rate changes

D) is independent of the price level

E) changes whenever the Fed changes the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply curve is vertical because

A) real income does not influence the quantity of money supplied

B) the price level does not influence the level of spending

C) only the interest rate influences the quantity of money supplied

D) the Federal Reserve sets the money supply

E) nominal income does not influence the quantity of money supplied

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed decreases the money supply,we should expect the interest rate

A) to fall,spending on automobiles and business investment spending to rise,and the price of bonds to increase

B) to rise,spending on automobiles and business investment spending to fall,and the price of bonds to decrease

C) to rise,spending on automobiles and business investment spending to fall,and the price of bonds to increase

D) to fall,spending on automobiles and business investment spending to fall,and the price of bonds to decrease

E) to rise,spending on automobiles to fall,business investment to rise,and the price of bonds to decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will decrease if the Fed sells bonds?

A) autonomous consumption.

B) business investment.

C) real GDP.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is an excess demand for money in the economy,

A) there is also an excess supply of money.

B) there is also an excess demand for bonds.

C) there is also an excess supply of bonds.

D) the interest rate will fall.

E) there is also an excess supply of housing.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 176

Related Exams