A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following auditor concerns most likely could be so serious that the auditor concludes that a financial statement audit cannot be performed?

A) Management fails to modify prescribed internal controls for changes in information technology.

B) Internal control activities requiring segregation of duties are rarely monitored by management.

C) Management is dominated by one person who is also the majority stockholder.

D) There is a substantial risk of intentional misapplication of accounting principles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

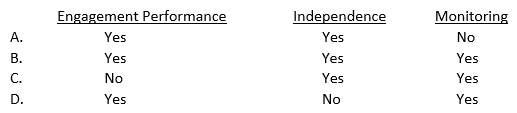

Which of the following are elements of a CPA firm's quality control that should be considered in establishing its quality control policies and procedures?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management of Edington Industries plans to disclose an uncertainty as follows: The Company is a defendant in a lawsuit alleging infringement of certain patent rights and claiming damages. Discovery proceedings are in progress. The ultimate outcome of the litigation cannot presently be determined. Accordingly, no provision for any liability that may result upon adjudication has been made in the accompanying financial statements. The auditor is satisfied that sufficient audit evidence supports management's assertions about the nature and disclosure of the uncertainty. What type of opinion should the auditor express under these circumstances?

A) Unqualified without an explanatory paragraph.

B) "Subject to" qualified.

C) "Except for" qualified.

D) Disclaimer of opinion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In evaluating the reasonableness of an accounting estimate, an auditor most likely would concentrate on key factors and assumptions that are:

A) Consistent with prior periods.

B) Similar to industry guidelines.

C) Objective and not susceptible to bias.

D) Deviations from historical patterns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In analyzing a company's financial statements, which financial statement would a potential investor primarily use to assess the company's liquidity and financial flexibility?

A) Balance sheet.

B) Income statement.

C) Statement of retained earnings.

D) Statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In connection with a proposal to obtain a new client, an accountant in public practice is asked to prepare a written report on the application of accounting principles to a specific transaction. The accountant's report should include a statement that:

A) Any difference in the facts, circumstances, or assumptions presented may change the report.

B) The engagement was performed in accordance with Statements on Standards for Consulting Services.

C) The guidance provided is for management use only and may not be communicated to the prior or continuing auditors.

D) Nothing came to the accountant's attention that caused the accountant to believe that the accounting principles violated GAAP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An auditor most likely would analyze inventory turnover rates to obtain evidence concerning management's assertions about:

A) Existence.

B) Rights and obligations.

C) Understandability and classification.

D) Valuation and allocation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following fraudulent activities most likely could be perpetrated due to the lack of effective internal controls in the revenue cycle?

A) Merchandise received is not promptly reconciled to the outstanding purchase order file.

B) Obsolete items included in inventory balances are rarely reduced to the lower of cost or market value.

C) The write-off of receivables by personnel who receive cash permits the misappropriation of cash.

D) Fictitious transactions are recorded that cause an understatement of revenue and overstatement of receivables.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The confirmation of customers' accounts receivable rarely provides reliable evidence about the completeness assertion because:

A) Many customers merely sign and return the confirmation without verifying its details.

B) Recipients usually respond only if they disagree with the information on the request.

C) Customers may not be inclined to report understatement errors in their accounts.

D) Auditors typically select many accounts with low recorded balances to be confirmed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following controls is least likely to be relevant to a financial statement audit?

A) Procedures that prevent the excess use of materials in production.

B) Policies that relate to compliance with income tax regulations.

C) Use of computer passwords to limit access to data files.

D) Generation of production statistics used to evaluate variances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What effect would the sale of a company's trading securities at their carrying amounts for cash have on each of the following ratios?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of segregating the duties of hiring personnel and distributing payroll checks is to separate the:

A) Human resources function from the controllership function.

B) Administrative controls from the internal accounting controls.

C) Authorization of transactions from the custody of related assets.

D) Operational responsibility from the recordkeeping responsibility.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct concerning an auditor's use of the work of a specialist?

A) The work of a specialist who is related to the client may be acceptable under certain circumstances.

B) If an auditor believes that the determinations made by a specialist are unreasonable, only a qualified opinion may be issued.

C) If there is a material difference between a specialist's findings and the assertions in the financial statements, only an adverse opinion may be issued.

D) An auditor may not use a specialist in the determination of physical characteristics relating to inventories.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An auditor wishes to perform tests of controls on a client's cash disbursements procedures. If the control activities leave no audit trail of documentary evidence, the auditor most likely will test the procedures by:

A) Inquiry and analytical procedures.

B) Confirmation and observation.

C) Observation and inquiry.

D) Analytical procedures and confirmation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Several sources of GAAP consulted by an auditor are in conflict as to the application of an accounting principle. Which of the following should the auditor consider the most authoritative?

A) FASB Technical Bulletins.

B) AICPA Accounting Interpretations.

C) FASB Statements of Financial Accounting Concepts.

D) AICPA Technical Practice Aids.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grant Company's financial statements adequately disclose uncertainties that concern future events, the outcome of which are not susceptible of reasonable estimation. The auditor's report should include a (an) :

A) Unqualified opinion.

B) "Subject to" qualified opinion.

C) "Except for" qualified opinion.

D) Adverse opinion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In testing long-term investments, an auditor ordinarily would use analytical procedures to ascertain the reasonableness of the:

A) Completeness of recorded investment income.

B) Classification between balance sheet portfolios.

C) Valuation of marketable equity securities.

D) Existence of unrealized gains or losses in the portfolio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An accountant is required to comply with the provisions of Statements on Standards for Accounting and Review Services when:

A) Reproducing client-prepared financial statements without modification, as an accommodation to a client. II. Preparing standard monthly journal entries for depreciation and expiration of prepaid expenses.

B) I only.

C) II only.

D) Both I and II.

E) Neither I nor II.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson & Company, CPAs, plan to audit the financial statements of Perigee Technologies, an issuer as defined under the Sarbanes-Oxley Act of 2002. Which of the following situations would impair Jackson's independence?

A) Provision of personal tax services to Johnson, the accounts payable manager of Perigee.

B) Preparation of Perigee's routine annual tax return, where Jackson's fee will be calculated as a percentage of the tax refund obtained.

C) An audit of Perigee's internal control is performed contemporaneously with the annual financial statement audit.

D) Discovering that Lowe, the chief financial officer of Perigee, started his accounting career ten years earlier as a staff accountant for Jackson & Company, and continues to maintain ties with current partners at the firm.

Correct Answer

verified

Correct Answer

verified

Showing 741 - 760 of 1050

Related Exams