Correct Answer

verified

Correct Answer

verified

True/False

Variable costs remain the same for all units of production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will be required to determine selling prices for products and services when using an activity based costing (ABC) system? Please select all that apply.

A) Costs allocated to cost pools.

B) Cost drivers for each cost pool.

C) The direct costs of products and services.

D) Total machine or labour hours for the period of operations.

Correct Answer

verified

A,B,C

Correct Answer

verified

True/False

In an activity based costing system, overheads are allocated to products on the basis of activities consumed by each product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Activity-based costing allocates overheads to products on the basis of:

A) Expected levels of production

B) Labour or machine hours used

C) Costs consumed by a product

D) Services consumed on the basis of departmental usage

Correct Answer

verified

Correct Answer

verified

True/False

The fixed costs line on the total costs graph is a horizontal line starting at the level of fixed costs on the y axis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Modigliani Limited manufactures large speaker cabinets. Each speaker cabinet has material costs of £50, direct labour cost of £25 and direct expenses of £15. Each speaker requires 5 hours of machining department time and 6 hours of finishing department time. Total overheads in the machining department are £300,000 per annum while the finishing department incurs total overheads of £150,000. The finishing department's employees work 25,000 labour hours each year while the machining department machines run for 30,000 hours during the year. What is the absorption cost of each large speaker cabinet?

A) £90

B) £126

C) £140

D) £176

Correct Answer

verified

Correct Answer

verified

True/False

Costing relies heavily on estimation and the costs allocated to a product or service are a best guess, not an absolutely correct figure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the odd one out?

A) Not designed for planning purposes.

B) Information with a historical perspective.

C) Presents summarised accounting information.

D) A focus on the future.

Correct Answer

verified

D

Correct Answer

verified

True/False

All direct costs of production are variable costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Direct costs are

A) The costs directly attributable to producing a product or delivering a service.

B) The variable costs of producing a product or service.

C) The marginal cost of a product or service.

D) The costs incurred in producing one more unit of product or service.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are descriptions of management accounting? Please select all that apply.

A) Future focus

B) Expected v actual comparisons

C) External parties reporting

D) Accounting data at the micro level

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Production overheads for a year are totalled up and then absorbed into the cost of products on a labour or machine hour basis. Which one of the following expenses will not be classified as a production overhead?

A) Machinery depreciation

B) Factory rent

C) Product advertising

D) Maintenance department costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is not true?

A) Financial accounting reports are aimed at internal users of accounting information while management accounting reports are aimed at external users of accounting information

B) Financial accounting summarizes accounting data while management accounting breaks down costs into their detailed components.

C) Financial accounting reports report on what has happened while management accounting reports focus on current activity and future projections.

D) Financial accounting reports are used by investors to make investment decisions while management accounting reports are used by managers to make business decisions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the odd one out?

A) Direct labour

B) Direct material

C) Factory overhead.

D) Direct expense

Correct Answer

verified

Correct Answer

verified

True/False

The variable cost line on the total costs graph starts at zero and rises in a linear fashion in line with the production of goods and services.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not a limitation of traditional absorption costing?

A) Under- or over-allocates overheads to products on machine or labour hour allocation bases.

B) Allocates costs on the basis of labour or machine hours rather than on the basis of the number of activities consumed by each product.

C) Assumes that costs can be determined with the required precision to enable overhead cost to be allocated to products on the basis of labour or machine hours.

D) Recognizes that variable costs do not necessarily remain the same for all units of production.

Correct Answer

verified

Correct Answer

verified

True/False

Fixed costs remain fixed over a given time period and over all levels of production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Omega Manufacturing has three production departments, milling, finishing and painting. The painting department has allocated overheads of £120,000 and a normal level of activity of 10,000 labour hours per annum. The repairs and maintenance service department has allocated overheads of £100,000 and the painting department's usage of the repairs and maintenance department is 30% of the total capacity of that department. Of the 28 employees in the firm, 7 are in the painting department. Canteen costs for Omega Manufacturing are £80,000 per annum. What is the painting department's hourly overhead absorption rate on a labour-hour basis?

A) £12

B) £17

C) £20

D) £22

Correct Answer

verified

Correct Answer

verified

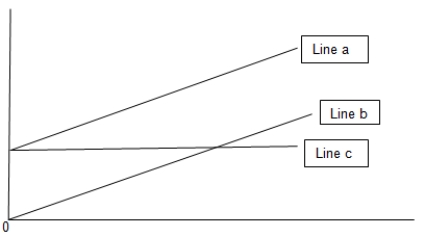

Multiple Choice

What does line b on the graph represent?

A) Variable cost

B) Fixed cost

C) Total cost

D) Revenue

Correct Answer

verified

A

Correct Answer

verified

Showing 1 - 20 of 40

Related Exams