A) 6

B) 1

C) 2

D) 5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

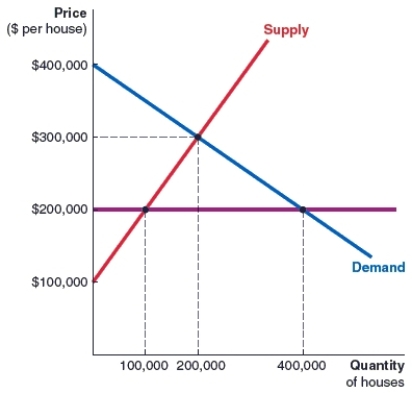

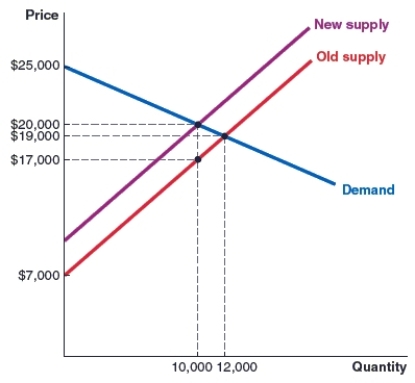

(Figure: Market for Printed Houses) Consider the market for environmentally friendly three-dimensional printed houses that is shown in the figure. The government wants to encourage buyers to buy such houses and places a price ceiling on the market at $200,000 per house. After the implementation of the price ceiling, the market quantity sold falls by _____ houses.

A) 200,000

B) 400,000

C) 300,000

D) 100,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

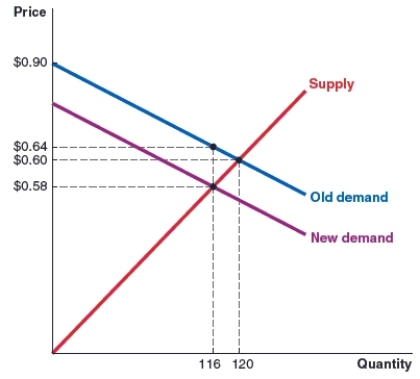

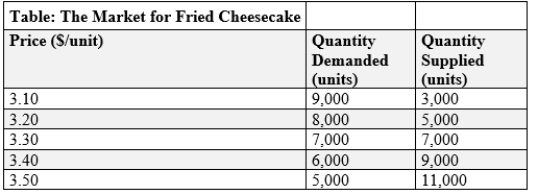

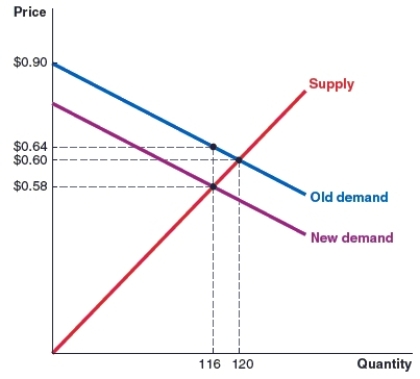

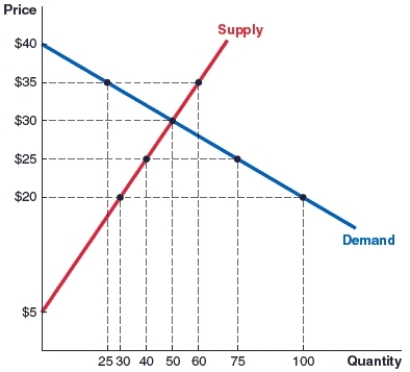

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. The amount of the tax is _____ cents.

A) 6

B) 8

C) 4

D) 2

Correct Answer

verified

Correct Answer

verified

Short Answer

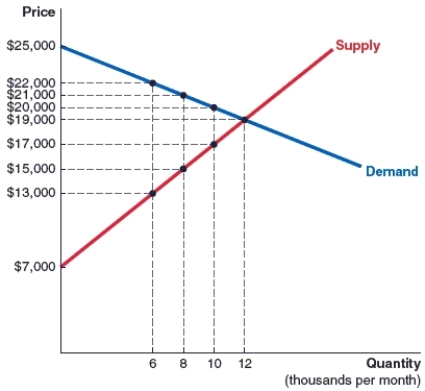

(Figure: Market for Logs) Suppose that the government is trying to decide between taxes and quotas in order to limit the use of forest wood. Refer to the graph that shows the market for logs of forest wood. The government has set a goal of reducing the consumption of forest wood to 8,000 logs per month.

(a) What is the amount of the tax (per 1000 logs) that would achieve the goal?

(b) If the government sets a quota at 8,000 logs per month, how much will consumers end up paying?

(a) What is the amount of the tax (per 1000 logs) that would achieve the goal?

(b) If the government sets a quota at 8,000 logs per month, how much will consumers end up paying?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

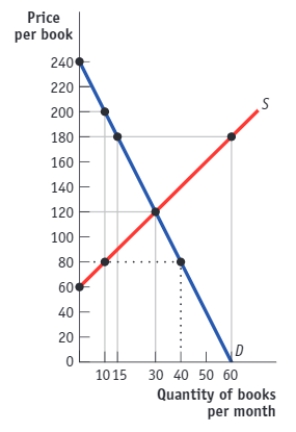

(Figure: The Market for Microeconomics Textbooks) Use Figure: The Market for Microeconomics Textbooks. Suppose the government believes that microeconomics textbooks are too expensive and wants to make them more affordable, ensuring that they are available to students. The relevant type of price control would be a price _____, and one possible binding price control would be _____.

A) floor; $100

B) floor; $40

C) ceiling; $40

D) ceiling; $140

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax that the government collects from the consumers of a good:

A) shifts the supply curve upward.

B) decreases tax revenue for the government.

C) shifts the demand curve downward.

D) shifts the demand curve upward.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a quota?

A) The United States sets a minimum or maximum price that can be charged for baked goods.

B) The United States limits the number of immigrants allowed to enter the country.

C) The United States sets a limit on how many firms can operate in the market for cell phones.

D) The United States imposes a regulation requiring consumers to be licensed before buying pens.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

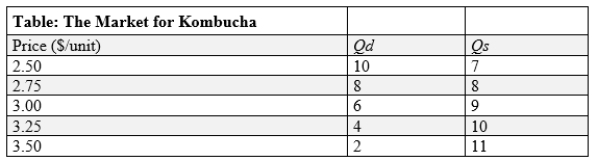

(Table: The Market for Kombucha) Use Table: The Market for Kombucha. The table shows the quantity demanded (Qd) and quantity supplied (Qs) of kombucha at various prices. If the government imposes a price ceiling of $3 per bottle of kombucha, the quantity of soda demanded will be _____ bottles.

A) 10

B) 8

C) 6

D) 4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government imposes a $15 tax on cheap wine, and the price of cheap wine increases by $12:

A) the government will receive less tax revenue than anticipated.

B) consumers are paying more of the tax than producers are.

C) producers are paying more of the tax than consumers are.

D) the quantity of cheap wine sold will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Table: The Market for Kombucha) Use Table: The Market for Kombucha. The table shows the quantity demanded (Qd) and quantity supplied (Qs) of kombucha at various prices. If the government imposes a price ceiling of $3 per bottle of kombucha, the quantity of kombucha supplied will be _____ bottles.

A) 7

B) 8

C) 9

D) 10

Correct Answer

verified

Correct Answer

verified

Essay

This question has two parts: (a) What is a quota? (b) Are housing zoning laws closest to taxes or quotas? Explain.

Correct Answer

verified

Correct Answer

verified

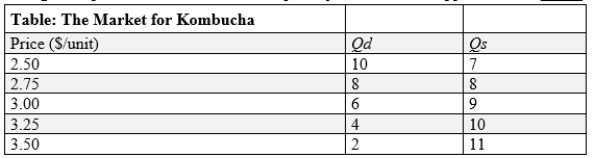

Multiple Choice

(Table: Market for Fried Cheesecake) Use Table: Market for Fried Cheesecake. The government decides to tax fried cheesecake at a rate of $0.30 per cheesecake and collect the tax from buyers. After paying the tax, producers will receive _____ per cheesecake, and they will sell _____ cheesecakes after the tax.

A) $3.10; 3,000

B) $3.20; 5,000

C) $3.30; 7,000

D) $3.50; 5,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. After the introduction of the tax, the equilibrium quantity in this market _____ by _____ units.

A) increased, 4

B) decreased, 4

C) increased, 6

D) decreased, 6

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Figure: Market for Timber) Refer to the figure which shows the market for timber. Which of the following statements is correct?

A) The incidence of the tax on the buyer is 10% and on the seller is 90%.

B) The incidence of this tax is greater on the buyer.

C) The incidence of this tax is 50% on the buyer and 50% on the seller.

D) The incidence of this tax is greater on the seller.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Figure: Market) A quota of 25 units is placed on the market that is shown in the figure. The equilibrium quantity sold in the market before the implementation of the quota was _____ units.

A) 40

B) 50

C) 60

D) 30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a quota?

A) A government limits the amount of a product that can be sold in a market.

B) A government sets a minimum or maximum price that can be charged.

C) A government sets a limit on how many inputs can be used in the production process.

D) A government places a regulation on how many consumers are allowed in a market.

Correct Answer

verified

Correct Answer

verified

Short Answer

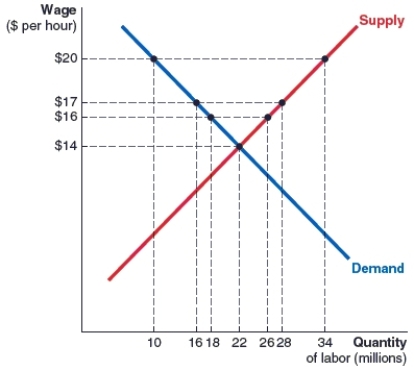

(Figure: Minimum Wage) Suppose a minimum wage of Canadian $17 is implemented in Ontario Province. Suppose the graph represents a small sector of the labor market in Ontario. Using the graph, answer the following questions:

(a) What is the number of workers hired (in millions) after the implementation of the minimum wage of $17?

(b) After the implementation of the wage, the number of workers hired fell by _______ million workers

(a) What is the number of workers hired (in millions) after the implementation of the minimum wage of $17?

(b) After the implementation of the wage, the number of workers hired fell by _______ million workers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Californian and Italian wines are substitutes in consumption. If the American government imposes a quota on the amount of Italian wine allowed into the United States, with the quota set at a quantity below the equilibrium quantity, the price of Italian wine in the United States will _____, while the price of California-produced wine will _____.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A subsidy for a seller of a product shifts the:

A) supply curve to the left.

B) supply curve to the right.

C) demand curve to the left.

D) demand curve to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling is:

A) a maximum price sellers can charge for a good or service.

B) the difference between the price consumers pay for a good and the price producers receive for selling the good.

C) a minimum price buyers must pay for a good or service.

D) the deadweight loss caused by the incidence of price over marginal cost.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 265

Related Exams