A) 0.

B) 1.

C) 2.

D) 3.

E) 4.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

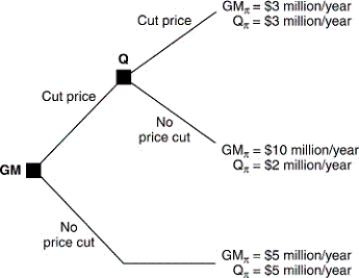

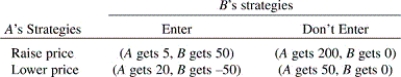

Consider the following decision tree.This tree illustrates hypothetical payoffs to General Mills (GM) and Quaker Oats (Q) if they engage in a price war.If GM cuts prices and Quaker Oats follows this behavior:

A) GM loses $10 million.

B) Quaker Oats loses $10 million.

C) GM loses $2 million.

D) Quaker Oats loses $2 million.

E) both firms gain $3 million.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following decision tree.This tree illustrates hypothetical payoffs to General Mills (GM) and Quaker Oats (Q) if they engage in a price war.  If GM cuts prices,the greatest potential gain is:

If GM cuts prices,the greatest potential gain is:

A) $5 million per year.

B) $10 million per year.

C) $2 million per year.

D) $3 million per year.

E) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

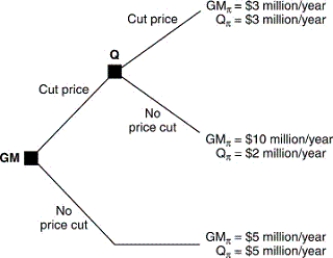

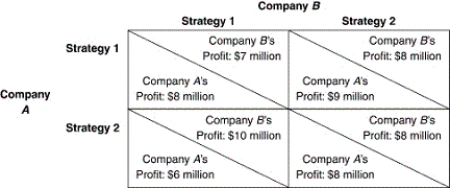

Refer to the accompanying payoff matrix.Which of the following is a Nash equilibrium?

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

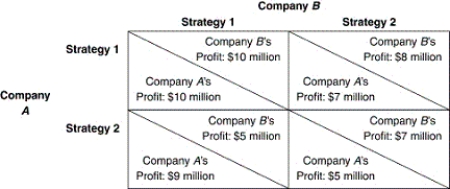

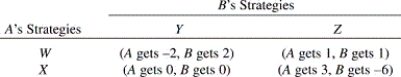

Suppose that firm A finds itself facing the following payoff matrix in its rivalry with firm B:  A threatens to play strategy W.This threat is:

A threatens to play strategy W.This threat is:

A) credible because the Nash equilibrium occurs where A plays W and B plays Z.

B) credible because the joint optimal solution occurs where A plays W and B plays Z.

C) not credible because A's dominant strategy is to play X.

D) credible because A's dominant strategy is to play W.

E) not credible because B will never play strategy Z.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

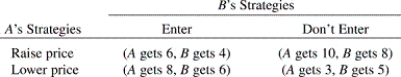

Refer to the accompanying matrix.Which of the following is a Nash equilibrium?

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A player in a game theoretic model is:

A) anyone working for a firm that is operating strategically.

B) a decision-making entity at a firm involved in a strategic game.

C) a firm that is operating as a perfect competitor.

D) a monopolist who produces a unique product with no close substitutes.

E) a stockholder at a firm involved in a strategic game.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between game trees and decision trees is:

A) that game trees are not useful in strategic situations.

B) that decision trees describe actions that depend on the behavior of rivals.

C) that game trees have interactive payoffs.

D) that decision trees are a function of many individuals and the state of nature.

E) none of the above.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A dominant strategy is one that:

A) beats all others, regardless of the opponent's choice.

B) beats all others, given the opponent's choice.

C) is beaten by all others, regardless of the opponent's choice.

D) is beaten by all others, given the opponent's choice.

E) beats at least one other, given the opponent's choice.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Nash equilibrium occurs when:

A) each player has a dominant strategy.

B) each player receives the same final payoff.

C) each player believes it is doing the best it can given the behavior of rivals.

D) there is no dominant strategy for any player.

E) payoffs are independent of the actions taken by rivals.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Given the following payoff matrix,who has a dominant strategy?

A) It depends on what the other player does.

B) Both players have it.

C) Neither player has it.

D) A does; B doesn't.

E) B does; A doesn't.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Radio City promises if you can find a lower advertised price for anything you bought at Radio City,anywhere in town within 30 days,it will return the difference plus 20%.A sophisticated game theoretic analysis suggests Radio City may be:

A) losing money in the long run.

B) colluding with other stores.

C) using a commitment to threaten competitors.

D) preempting competitors.

E) using price leadership.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Getting to a Nash equilibrium requires:

A) each knowing the opponent's payoffs and cooperation.

B) knowing the opponent's payoffs but not cooperation.

C) cooperation but not knowing the opponent's payoffs.

D) neither cooperation nor knowing the opponent's payoffs.

E) either cooperation or knowing the opponent's payoffs, depending on the game.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A feasible strategy set is:

A) all actions with a nonzero probability of occurring.

B) only actions that have a 50% or greater probability of occurring.

C) actions that result in positive profits for the firm.

D) actions that a decision maker is willing to take.

E) the one outcome that the decision maker chooses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which pair of strategies would cooperative cartel members A and B choose given this payoff matrix?

A) W, Y.

B) W, Z.

C) X, Y.

D) X, Z.

E) Either X, Y or W, Z.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How many Nash equilibria are there in this payoff matrix?

A) 0.

B) 1.

C) 2.

D) 3.

E) 4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By definition,a Nash equilibrium in a duopoly is the situation in which each player:

A) plays a dominant strategy.

B) plays the best strategy given the other's strategies.

C) gets the highest possible payoff.

D) gets the highest payoff possible without lowering the opponent's payoff.

E) is happy with the outcome.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Potential entrant E threatens to enter incumbent I's market and I threatens to lower price to P should E enter.It is crucial for E to believe I's threat that:

A) P > I's average total cost.

B) P > I's average variable cost.

C) P is low enough to discourage E.

D) I could conceivably charge P without E's threat.

E) I's profit with P and no entry are better than expected profits with entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If player 1 has a dominant strategy,then player 2:

A) must also have a dominant strategy.

B) may or may not have a dominant strategy, but will always lead to a Nash equilibrium.

C) may or may not have a dominant strategy.

D) will not be able to reach an optimal solution to the game.

E) will block this dominant strategy and force player 1 to another strategy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm has a dominant strategy:

A) its optimal strategy depends on the play of rivals.

B) its optimal strategy is always the same, even if payoffs change.

C) it is determined by the behavior of only one key rival.

D) it receives the same profits regardless of the strategy of rivals.

E) its optimal strategy is independent of the play of rivals.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 28

Related Exams