A) b, e, g, and h

B) a, b, d, and i

C) b, e, f, and g

D) d, f, g, and h

E) b, d, g, and i

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the transactions listed. Match them to the financial statement effects listed -Purchase inventory for cash

A) Decrease assets and decrease equity

B) Decrease liabilities and decrease assets

C) Increase assets and decrease assets

D) Increase assets and increase equity

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Identify the financial statements in which you would find each of the items listed below. Some items may appear on more than one statement. Indicate all financial statements that apply to each item. The possible choices are: -Revenue

A) Balance Sheet

B) Statement of Stockholders' Equity

C) Income Statement

D) Statement of Cash Flows

Correct Answer

verified

Correct Answer

verified

Short Answer

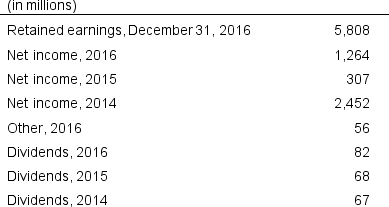

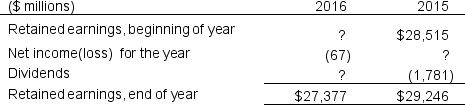

Following is information for Goodyear Tire & Rubber Company for three recent years. Reconcile the retained earnings account for the three-year period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2016, Kohl's Corporation had net working capital of $2,273 million and current liabilities of $2,974 million. The firm's current assets are:

A) $ 8,221 million

B) $ (8,221) million

C) $ 5,247 million

D) $ 2,974 million

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Assets are reported on the balance sheet at their current market value.

Correct Answer

verified

Correct Answer

verified

Short Answer

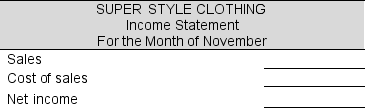

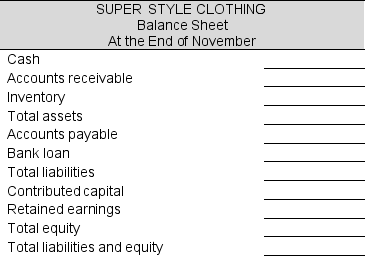

Super Style Clothing begins operations in November. During the month the company receives $46,000 from a shareholder for common stock and gets a $6,000 loan from a bank. The company buys $38,000 of inventory for cash and sells half of the inventory for $30,000 on credit. The company had no other transactions in November. Fill in the missing amounts below.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

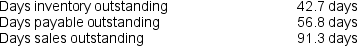

Prestige Company has determined the following information for its recent fiscal year.

Compute Prestige Company's cash conversion cycle.

Compute Prestige Company's cash conversion cycle.

A) 8.2 days

B) 77.2 days

C) 105.4 days

D) 99.5 days

E) None of the above

Correct Answer

verified

B

Correct Answer

verified

True/False

A customer's prepayment for services not yet rendered is initially recorded as unearned revenue (a liability). Then, at the end of the accounting period, the unearned revenue is moved from the balance sheet to the income statement. This is an example of the revenue recognition principle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the financial statements in which you would find each of the items listed below. Some items may appear on more than one statement. Indicate all financial statements that apply to each item. The possible choices are: -Cost of goods sold

A) Balance Sheet

B) Statement of Stockholders' Equity

C) Income Statement

D) Statement of Cash Flows

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash conversion cycle is computed as

A) Days sales outstanding + Days inventory outstanding - Days payable outstanding

B) Days sales outstanding - Days payable outstanding

C) Days sales outstanding - Days inventory outstanding

D) Days sales outstanding - Days inventory outstanding + Days payable outstanding

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

All companies must file with the SEC a detailed annual report and discussion of their business activities in their Form 10-K.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

choose the best match from the following: -Unearned revenue

A) Assets

B) Liabilities

C) Equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the financial statements in which you would find each of the items listed below. Some items may appear on more than one statement. Indicate all financial statements that apply to each item. The possible choices are: -Inventories

A) Balance Sheet

B) Statement of Stockholders' Equity

C) Income Statement

D) Statement of Cash Flows

Correct Answer

verified

Correct Answer

verified

Multiple Choice

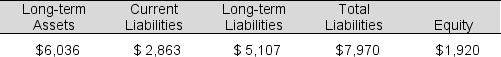

In its December 31, 2016 financial statements, Harley-Davidson reported the following (in millions) :

At December 31, 2016, current assets amount to:

At December 31, 2016, current assets amount to:

A) $2,863 million

B) $3,854 million

C) $7,970 million

D) $5,519 million

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Intel reports retained earnings at the end of fiscal 2016 of $40,747 million and retained earnings at the end of fiscal 2015 of $37,614 million. The company reported dividends of $4,925 million and other transactions with shareholders that reduced retained earnings during the year by $2,258 million. How much net income did the firm report in fiscal 2016?

A) $ 3,133 million net income

B) $ 3,133 million net loss

C) $10,316 million net income

D) $10,316 million net loss

E) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The book value of stockholders' equity (the amount reported on the balance sheet) is most typically equal to the market value of the equity of a company.

Correct Answer

verified

Correct Answer

verified

Short Answer

Use the accounts below for Stanley Black & Decker, Inc. to prepare an income statement for the year ended December 31, 2016.

Correct Answer

verified

Correct Answer

verified

Short Answer

Caterpillar Inc.'s statement of stockholders' equity for 2016 and 2015 shows the following amounts. Fill in the missing items to show how retained earnings articulate across the years.

Correct Answer

verified

Correct Answer

verified

Short Answer

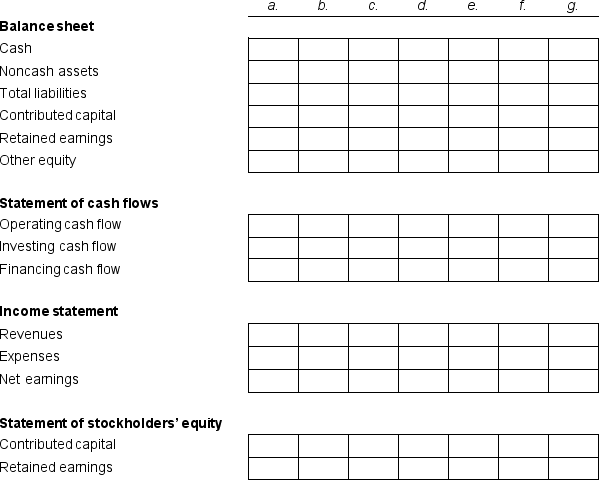

Consider the effects of the independent transactions, a through g, on a company's balance sheet, income statement, statement of cash flows, and statement of stockholders' equity.

a. The company issued stock in exchange for cash.

b. The company paid cash for rent.

c. The company performed services for clients and immediately received cash.

d. The company performed services for clients and sent a bill with payment due in 30 days.

e. The company compensated its employees with cash for wages.

f. The company received cash as payment on the amount owed from clients.

g. The company paid cash in dividends.

Complete the table below to explain the effects and financial statement linkages. Use "+" to indicate the account increases and "-" to indicate the account decreases.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 90

Related Exams