A) then the supply curve shifts upward by the amount of the tax.

B) then the quantity demanded decreases for all conceivable prices of the good.

C) this means that the sellers of the good will receive a lower price from buyers, not that the sellers are actually responsible for paying the tax to the government.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

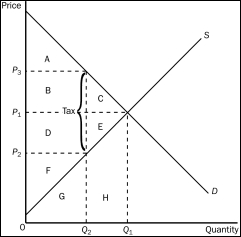

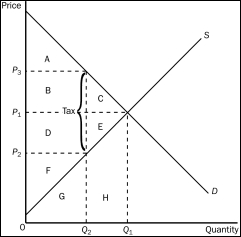

Figure 8-4

-Refer to Figure 8-4.The price that sellers effectively receive after the tax is imposed is

-Refer to Figure 8-4.The price that sellers effectively receive after the tax is imposed is

A) P₁.

B) P₂.

C) P₃.

D) impossible to determine from the figure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ideas is the most plausible?

A) Reducing a high tax rate is less likely to increase tax revenue than is reducing a low tax rate.

B) Reducing a high tax rate is more likely to increase tax revenue than is reducing a low tax rate.

C) Reducing a high tax rate will have the same effect on tax revenue as reducing a low tax rate.

D) Reducing a tax rate can never increase tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During Ronald Reagan's presidency,the top tax rate on income fell from

A) 36 percent to 22 percent.

B) 50 percent to 22 percent.

C) 50 percent to 28 percent.

D) 70 percent to 28 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the tax on a good increases from $1 per unit to $2 per unit to $3 per unit and so on,

A) the tax revenue increases at first, but it eventually peaks and then decreases.

B) the deadweight loss increases at first, but it eventually peaks and then decreases.

C) the tax revenue always increases and the deadweight loss always increases.

D) the tax revenue always decreases and the deadweight loss always increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

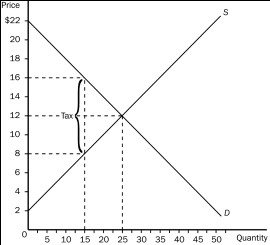

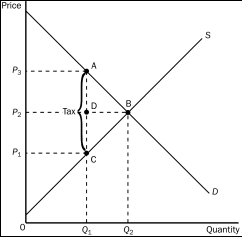

Figure 8-6

-Refer to Figure 8-6.Before the tax is imposed,

-Refer to Figure 8-6.Before the tax is imposed,

A) the equilibrium price is $16 and the equilibrium quantity is 15.

B) the equilibrium price is $12 and the equilibrium quantity is 25.

C) the equilibrium price is $12 and the equilibrium quantity is 25

D) the equilibrium price is $8 and the equilibrium quantity is 15.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

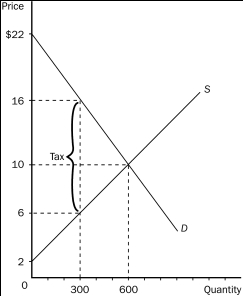

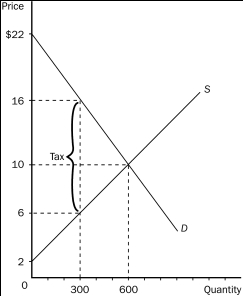

Figure 8-3

-Refer to Figure 8-3.The per-unit burden of the tax on buyers is

-Refer to Figure 8-3.The per-unit burden of the tax on buyers is

A) $16.

B) $14.

C) $8.

D) $6.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a good to which a per-unit tax applies.The greater the price elasticities of demand and supply for the good,the

A) smaller the deadweight loss from the tax.

B) greater the deadweight loss from the tax.

C) more efficient is the tax.

D) more equitable is the distribution of the tax burden between buyers and sellers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following quantities decrease in response to a tax on a good?

A) the size of the market for the good, the effective price of the good paid by buyers, and consumer surplus

B) the size of the market for the good, producer surplus, and the well-being of buyers of the good

C) the effective price received by sellers of the good, the wedge between the effective price paid by buyers and the effective price received by sellers, and consumer surplus

D) None of the above is necessarily correct unless we know whether the tax is levied on buyers or on sellers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1776,the American Revolution was sparked by anger over

A) the extravagant lifestyle of British royalty.

B) the crimes of British soldiers stationed in the American colonies.

C) British taxes imposed on the American colonies.

D) the failure of the British to protect American colonists from attack by hostile Native Americans.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

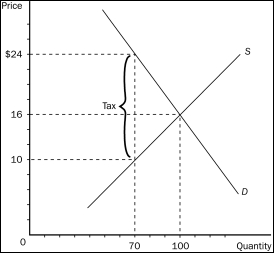

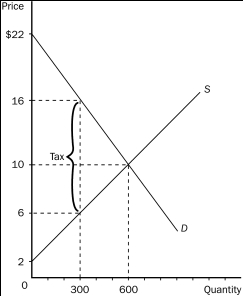

Figure 8-5

-Refer to Figure 8-5.Without a tax,the equilibrium price and quantity are

-Refer to Figure 8-5.Without a tax,the equilibrium price and quantity are

A) $16 and 300.

B) $10 and 600.

C) $10 and 300.

D) $6 and 300.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

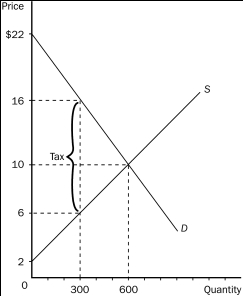

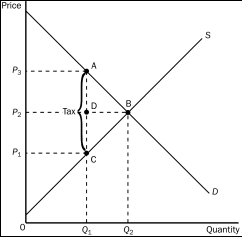

Figure 8-2

-Refer to Figure 8-2.The price that sellers effectively receive after the tax is imposed is

-Refer to Figure 8-2.The price that sellers effectively receive after the tax is imposed is

A) P₁.

B) P₂.

C) P₃.

D) impossible to determine from the figure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sellers of a product will bear the larger part of the tax burden,and buyers will bear a smaller part of the tax burden,when

A) the tax is placed on the sellers of the product.

B) the tax is placed on the buyers of the product.

C) the supply of the product is more elastic than the demand for the product.

D) the demand for the product is more elastic than the supply of the product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-2

-Refer to Figure 8-2.The amount of tax revenue received by the government is equal to the area

-Refer to Figure 8-2.The amount of tax revenue received by the government is equal to the area

A) P₃ A C P₁.

B) A B C.

C) P₂ D A P₃.

D) P₁ C D P₂.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

-Refer to Figure 8-5.When a tax is placed on this good,the quantity sold

-Refer to Figure 8-5.When a tax is placed on this good,the quantity sold

A) is 600 and buyers effectively pay $10.

B) is 300 and buyers effectively pay $10.

C) is 600 and buyers effectively pay $16.

D) is 300 and buyers effectively pay $16.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

-Refer to Figure 8-4.After the tax is levied,producer surplus is represented by area

-Refer to Figure 8-4.After the tax is levied,producer surplus is represented by area

A) a.

B) A + B + C.

C) D + E + F.

D) F.

Correct Answer

verified

Correct Answer

verified

True/False

Economists disagree on whether labor taxes have a small or large deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

-Refer to Figure 8-5.The tax results in a deadweight loss that amounts to

-Refer to Figure 8-5.The tax results in a deadweight loss that amounts to

A) $600.

B) $900.

C) $1,500.

D) $1,800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

-Refer to Figure 8-5.When a tax is imposed in this market,producer surplus is

-Refer to Figure 8-5.When a tax is imposed in this market,producer surplus is

A) $450.

B) $600.

C) $900.

D) $1,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists generally agree that the most important tax in the U.S.economy is

A) the income tax.

B) the tax on labor.

C) the inheritance or death tax.

D) corporate profit taxes.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 245

Related Exams