A) issuing currency and acting as the fiscal agent for the federal government.

B) handling the Fed's collection of checks and adjusting legal reserves among banks.

C) setting the Fed's monetary policy and directing the buying and selling of government securities.

D) supervising bank operations to make sure they follow regulations and monitoring banks for fraud.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. currency has value primarily because it:

A) is legal tender, is generally acceptable in exchange for goods or services, and is backed by the gold and silver of the federal government.

B) is generally acceptable in exchange for goods or services, is backed by the gold and silver of the federal government, and facilitates trade.

C) is relatively scarce, is legal tender, and is generally acceptable in exchange for goods and services.

D) facilitates trade, is legal tender, and permits the use of credit cards and near-monies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If actual reserves in the banking system are $8,000, checkable deposits are $70,000, and the legal reserve ratio is 10 percent, then excess reserves are:

A) zero.

B) $1,000.

C) $2,000.

D) $500.

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve is prohibited from lending money to banks and thrifts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following U.S. cities is one of the 12 Federal Reserve Banks located?

A) New York City

B) Seattle

C) Miami

D) Denver

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All coins in circulation within the United States are:

A) near monies.

B) checkable deposits.

C) token money.

D) time deposits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the 12 Federal Reserve Banks?

A) They are privately owned and privately controlled central banks whose basic goal is to provide an ample and orderly market for U.S. Treasury securities.

B) They are privately owned and publicly controlled central banks whose basic function is to minimize the risks in commercial banking in order to make it a reasonably profitable industry.

C) They are privately owned and publicly controlled central banks whose basic goal is to control the money supply and interest rates in promoting the general economic welfare.

D) They are privately owned and publicly controlled central banks whose basic goal is to earn profits for their owners.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, credit cards account for about what percentage of the dollar volume of transactions for goods and services?

A) 10 percent

B) 25 percent

C) 40 percent

D) 65 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of a credit card is most similar to:

A) creating legal tender.

B) reducing the value of the U.S. dollar.

C) purchasing a certificate of deposit at a commercial bank.

D) obtaining a short-term loan from a financial institution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

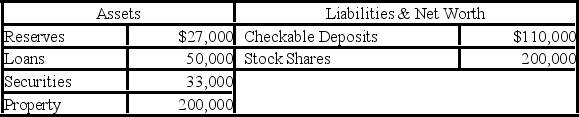

Use the following balance sheet for the ABC National Bank in answering the next question. Assume the required reserve ratio is 20 percent.

-Refer to the above data. If the original balance sheet was for the commercial banking system, rather than a single bank, loans and checkable deposits could have been expanded by a maximum of:

-Refer to the above data. If the original balance sheet was for the commercial banking system, rather than a single bank, loans and checkable deposits could have been expanded by a maximum of:

A) $8,000.

B) $15,000.

C) $48,000.

D) $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms that help corporations and governments raise money by selling stocks and bonds are known as:

A) insurance companies

B) thrifts

C) mutual fund companies

D) investment banks

Correct Answer

verified

Correct Answer

verified

True/False

Federal deposit insurance is currently capped at $100,000 per account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash held by a bank is sometimes called:

A) token money.

B) legal tender.

C) vault cash.

D) fractional reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One reason that "near-monies" are important is because:

A) they simplify the definition of money and therefore the formulation of monetary policy.

B) they can be easily converted into money or vice versa, and thereby can influence the stability of the economy.

C) they do not reflect the level of consumer spending, but they have a critical impact on saving and investment in the economy.

D) credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How are the following items treated in the calculation of M1?

A) Small time deposits and currency are both included.

B) Small time deposits and money market mutual funds of individuals are both included.

C) Checkable deposits are excluded and currency is included.

D) Checkable deposits and currency are both included.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The M1 money supply is composed of:

A) money market mutual funds held by individuals.

B) money market mutual funds held by businesses.

C) savings deposits and time deposits.

D) checkable deposits and currency.

Correct Answer

verified

Correct Answer

verified

True/False

The United States faced the most serious financial crisis since the Great Depression during the period of 2007-2008.

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Open Market Committee (FOMC) is made up of the presidents of the Federal Reserve Banks, the secretary of the Treasury, and the chair of the President's Council of Economic Advisers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Commercial banks, mutual fund companies, and securities firms are all part of the ________ services industry.

A) government

B) economic

C) financial

D) political

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If excess reserves in the banking system are $4,000, checkable deposits are $40,000, and the legal reserve ratio is 10 percent, then actual reserves are:

A) $4,000.

B) $6,000.

C) $8,000.

D) $5,000.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 58

Related Exams