A) Public good demand is found by horizontally adding individual demand curves; private good demand is found by vertically adding individual demand curves.

B) Private good demand is found by horizontally adding individual demand curves; public good demand is found by vertically adding individual demand curves.

C) Both public and private good demand are found by horizontally adding individual demand curves.

D) Both public and private good demand are found by vertically adding individual demand curves.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Payroll taxes (Social Security and Medicare) are:

A) progressive, leading to a more equitable distribution of income.

B) progressive, like the federal income tax.

C) proportional, because all pay the same rate.

D) regressive, because the tax applies to only a fixed amount of income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rationale for ability-to-pay taxation and the contention that those with large incomes should pay more taxes both absolutely and relatively is that:

A) high-income receivers are generally in a better position to shift taxes than are low-income receivers.

B) the transfer system is regressive and it is therefore essential to have an offsetting progressive tax structure.

C) rational consumers spend their first dollars of income on the most urgently desired goods and successive dollars on less essential goods.

D) taxes should be paid for financing public goods in direct proportion to the satisfaction an individual derives from those goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is an example of a market failure?

A) There are not enough tickets available to concerts of extremely popular performers.

B) The price of medical care has risen dramatically as a result of the introduction of sophisticated equipment and techniques.

C) Polio shots and chest x-rays provide widespread benefits to the community as a whole as well as to the individuals who get them.

D) Extensive decreases in the prices of electronic equipment resulted in large numbers of bankruptcies in the computer industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mandated reductions in tailpipe emissions from automobiles are an example of:

A) direct controls.

B) specific taxes.

C) the Coase Theorem.

D) government provision.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Suppose the government imposed a carbon tax on firms that emit pollution. Then

A) the firms' marginal cost of production would increase, and the supply curves within the market would shift to the left.

B) the firms' marginal cost of production would decrease, and the supply curves within the market would shift to the left.

C) the firms' marginal cost of production would increase, and the supply curves within the market would shift to the right.

D) the firms' marginal cost of production would decrease, and the supply curves within the market would shift to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best example of market failure?

A) Lucian wants more video games but doesn't buy them because his willingness to pay is less than the equilibrium price in the market.

B) Kara's Kitten Shop won't sell more purebred cats because the equilibrium price in the market is less than it would cost her to provide more.

C) Alex and others in a community want a new outdoor soccer field and are willing to pay to use it, but no private business is willing to build it.

D) Government fixes the price of gasoline, resulting in a shortage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wendy claims that the right mix of hamburgers and other goods is being produced, but that they are not being produced in the least costly way. How would an economist assess Wendy's claim?

A) Wendy is asserting that allocative efficiency is realized in hamburger production, but not productive efficiency. Wendy's assertion cannot be correct.

B) Wendy is asserting that allocative efficiency is realized in hamburger production, but not productive efficiency. Wendy's assertion may be correct.

C) Wendy is asserting that productive efficiency is realized in hamburger production, but not allocative efficiency. Wendy's assertion cannot be correct.

D) Wendy is asserting that productive efficiency is realized in hamburger production, but not allocative efficiency. Wendy's assertion may be correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Cap-and-trade" programs:

A) create a market for pollution rights.

B) charge polluters an emission fee.

C) are an example of a direct control.

D) use private bargaining to establish the optimal quantity of emissions.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

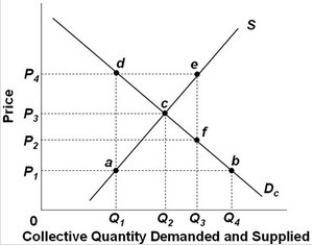

Refer to the above supply and demand graph for a public good. Which one of the following statements is correct?

Refer to the above supply and demand graph for a public good. Which one of the following statements is correct?

A) The supply curve reflects the marginal cost and the demand curve reflects the marginal benefit of this public good.

B) The demand curve reflects the marginal cost and the supply curve reflects the marginal benefit of this public good.

C) There will be an overallocation of resources at output level Q1.

D) There will be an underallocation of resources at output level Q3.

Correct Answer

verified

Correct Answer

verified

True/False

Cap-and-trade programs create a market for the right to pollute.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It has been proposed that a government agency be charged with the responsibility for determining the amount of pollution that the atmosphere or a body of water can safely recycle, and selling these limited rights to polluters. From an economist's perspective, what would be the advantage of such a market for pollution rights?

A) Government agencies can make a great deal of money.

B) Pollution would be eliminated because nobody would want to pay for such a right.

C) The quality of water or air can be maintained at some acceptable standard through economic incentives.

D) The social consciousness of people would be raised as they obtain more appreciation for the importance of conservation.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 12 of 12

Related Exams