A) $230,000

B) $305,000

C) $320,000

D) $395,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

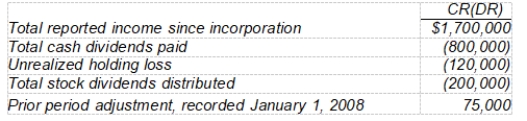

The following information was extracted from the accounts of Boone Corporation at December 31, 2008:

What should be the balance of retained earnings at December 31, 2008?

What should be the balance of retained earnings at December 31, 2008?

A) $655,000

B) $700,000

C) $580,000

D) $775,000

Correct Answer

verified

Correct Answer

verified

True/False

According to the FASB, displaying comprehensive income as a part of the statement of stockholders' equity is one of the acceptable ways of presenting comprehensive income items.

Correct Answer

verified

Correct Answer

verified

Short Answer

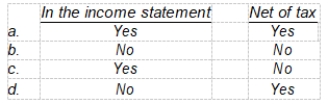

A correction of an error in prior periods' income will be reported

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shank Corporation made a very large arithmetical error in the preparation of its year-end financial statements by improper placement of a decimal point in the calculation of depreciation. The error caused the net income to be reported at almost double the proper amount. Correction of the error when discovered in the next year should be treated as

A) an increase in depreciation expense for the year in which the error is discovered.

B) a component of income for the year in which the error is discovered, but separately listed on the income statement and fully explained in a note to the financial statements.

C) an extraordinary item for the year in which the error was made.

D) a prior period adjustment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary reason the income statement is so important to investors and creditors relates to its ability to provide information helpful in

A) determining the honesty of those involved in managing the enterprise.

B) assessing the financial position of the entity at a point in time.

C) predicting the amount, timing, and uncertainty of future cash flows.

D) determining the amount of future income the entity may generate from current operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

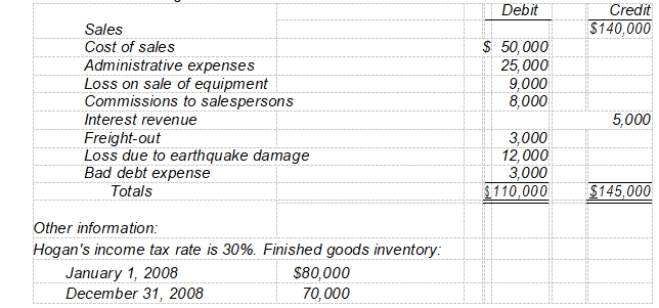

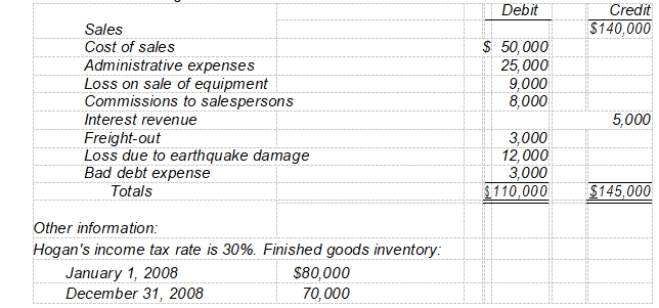

Hogan Corp.'s trial balance of income statement accounts for the year ended December 31, 2008 included the following:

On Hogan's multiple-step income statement for 2008,

-Income before extraordinary item is

On Hogan's multiple-step income statement for 2008,

-Income before extraordinary item is

A) $64,000.

B) $47,000.

C) $32,900.

D) $24,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept that reports extraordinary items in the income statement is called the

A) phase-out period concept.

B) prior period adjustment concept.

C) current operating performance concept.

D) all-inclusive concept.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be reported on the income statement as an extraordinary item?

A) The gain on disposal of a component of a business

B) The write-down of receivables deemed uncollectible

C) The loss from volcanic activity

D) The gain from a sale of equipment

Correct Answer

verified

Correct Answer

verified

True/False

A change in accounting principle is considered appropriate only when it is demonstrated that the newly adopted principle is preferable to the old one.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should not be reported on the income statement as an extra-ordinary item?

A) The write-off of major assets as a result of new environmental laws prohibiting their use

B) The write-off of a large receivable resulting from a customer's bankruptcy proceedings

C) A large loss as a result of an earthquake

D) Expropriation of assets by a foreign government

Correct Answer

verified

Correct Answer

verified

Multiple Choice

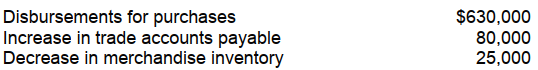

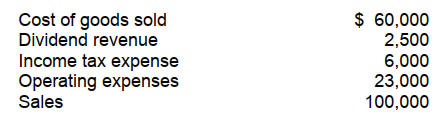

During the year 2008, Siska Corporation had the following information available related to its income statement:

Cost of goods sold for 2008 amounted to

Cost of goods sold for 2008 amounted to

A) $735,000.

B) $685,000.

C) $575,000.

D) $525,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A review of the December 31, 2008, financial statements of Baden Corporation revealed that under the caption "extraordinary losses," Baden reported a total of $515,000. Further analysis revealed that the $515,000 in losses was comprised of the following items: (1) Baden recorded a loss of $150,000 incurred in the abandonment of equipment formerly used in the business. (2) In an unusual and infrequent occurrence, a loss of $250,000 was sustained as a result of hurricane damage to a warehouse. (3) During 2008, several factories were shut down during a major strike by employees, resulting in a loss of $85,000. (4) Uncollectible accounts receivable of $30,000 were written off as uncollectible. Ignoring income taxes, what amount of loss should Baden report as extraordinary on its 2008 income statement?

A) $150,000

B) $250,000

C) $400,000

D) $515,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

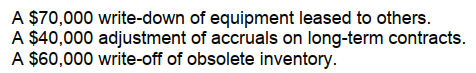

Snead, Inc. incurred the following infrequent losses during 2008:

In its 2008 income statement, what amount should Snead report as total infrequent losses that are not considered extraordinary?

In its 2008 income statement, what amount should Snead report as total infrequent losses that are not considered extraordinary?

A) $170,000

B) $130,000

C) $110,000

D) $100,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

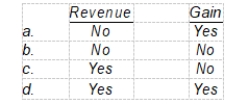

For Garret Wolfe Company, the following information is available:

-In Garret Wolfe's single-step income statement, gross profit

-In Garret Wolfe's single-step income statement, gross profit

A) should not be reported.

B) should be reported at $13,500.

C) should be reported at $40,000.

D) should be reported at $42,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hogan Corp.'s trial balance of income statement accounts for the year ended December 31, 2008 included the following:

On Hogan's multiple-step income statement for 2008,

-Inventory purchases are

On Hogan's multiple-step income statement for 2008,

-Inventory purchases are

A) $63,000.

B) $60,000.

C) $43,000.

D) $40,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a required disclosure in the income statement when reporting the disposal of a component of the business?

A) The gain or loss on disposal should be reported as an extraordinary item.

B) Results of operations of a discontinued component should be disclosed immediately below extraordinary items.

C) Earnings per share from both continuing operations and net income should be disclosed on the face of the income statement.

D) The gain or loss on disposal should not be segregated, but should be reported together with the results of continuing operations.

Correct Answer

verified

Correct Answer

verified

Short Answer

When a manufacturing company sells one of its plant assets at a price in excess of its book value, it should recognize

Correct Answer

verified

Correct Answer

verified

Multiple Choice

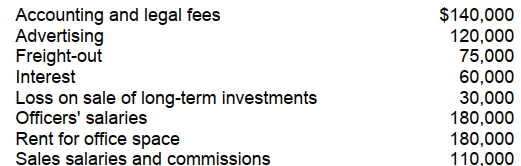

Meyer Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 2008, included the following expense accounts:

One-half of the rented premises is occupied by the sales department

-How much of the expenses listed above should be included in Meyer's general and administrative expenses for 2008?

One-half of the rented premises is occupied by the sales department

-How much of the expenses listed above should be included in Meyer's general and administrative expenses for 2008?

A) $410,000

B) $440,000

C) $470,000

D) $500,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about intraperiod tax allocation?

A) It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return.

B) It is required for extraordinary items and cumulative effect of accounting changes but not for prior period adjustments.

C) Its purpose is to allocate income tax expense evenly over a number of accounting periods.

D) Its purpose is to relate the income tax expense to the items which affect the amount of tax.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 50

Related Exams