Correct Answer

verified

Correct Answer

verified

Multiple Choice

An extra benefit of a defined-contribution retirement plan is that most employers offer full or partial ____ to employees accounts.

A) tax breaks

B) earned income credit

C) matching contributions

D) pretax income

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer with a taxable income greater than $100,000 must use the tax-rate schedules rather than the tax tables to find his or her tax liability.

Correct Answer

verified

Correct Answer

verified

True/False

A long-term capital gain (or loss) occurs when the asset is held for over one year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjustments to gross income

A) are subtracted from gross income.

B) help one qualify for other deductions.

C) can be taken even if one takes the standard deduction.

D) all of these.

Correct Answer

verified

Correct Answer

verified

True/False

All of the income received from Social Security benefits must be reported as gross income on your federal income tax return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A casualty or theft loss is difficult to qualify for because the loss must

A) be unreimbursed.

B) exceed 10 percent of adjusted gross income plus $100.

C) be in cash rather than property.

D) be unreimbursed and exceed 10 percent of adjusted gross income plus $100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Qualified tuition programs include

A) 529 plans.

B) prepaid tuition plans.

C) college savings plans.

D) (all of these)

Correct Answer

verified

Correct Answer

verified

True/False

Flexible spending accounts reduce taxes because contributions to these accounts are made with pretax dollars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

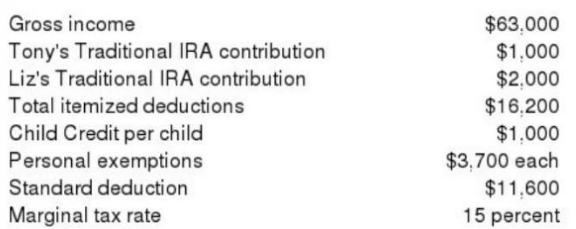

Figure 4-1

-Refer to Figure 4-1.Tony and Liz have just inherited $25,000.Which of the following statements is true?

-Refer to Figure 4-1.Tony and Liz have just inherited $25,000.Which of the following statements is true?

A) The $25,000 will be taxable income in the year received.

B) The $25,000 is an exclusion for federal income taxes.

C) They should invest this money in corporate bonds to save on taxes.

D) The $25,000 will be taxable income in the year received, and they should invest this money in corporate bonds to save on taxes.

Correct Answer

verified

Correct Answer

verified

True/False

An employed taxpayer's effective marginal tax rate on income is higher than his or her federal marginal tax rate.

Correct Answer

verified

Correct Answer

verified

True/False

Most tax shelters are methods permitting an investor to avoid taxes forever.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following deductible expenses can be prepaid for tax purposes?

A) Personal property taxes

B) Charitable contributions

C) Medical expenses

D) All of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following investments normally produce(s) tax-exempt income?

A) Stocks

B) Municipal bonds

C) Corporate bonds

D) All of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You just sold your comic book collection that you had worked on for the past ten years for a capital gain of $7,500.Assuming you are in the 15 percent marginal tax bracket,how much federal income tax will be due on this gain?

A) $0

B) $1,125

C) $375

D) $750

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax credit(s) for qualifying higher education expenses is

A) the American Opportunity credit.

B) the earned income credit.

C) the lifetime learning credit.

D) the American Opportunity credit and lifetime learning credit.

Correct Answer

verified

Correct Answer

verified

True/False

The health insurance premium tax credit can help anyone defray the cost of health insurance.

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer in the 35 percent marginal tax bracket would pay less tax by holding an investment with capital gains over one year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A single individual pays $7,813 on a taxable income of $47,810 and $7,838 on a taxable income of $47,910.What is the marginal tax rate?

A) 15 percent

B) 16 percent

C) 25 percent

D) 50 percent

Correct Answer

verified

Correct Answer

verified

True/False

Estimating taxes requires taxpayers to send quarterly installment payments to the IRS.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 201

Related Exams