A) The increase of $8,000 will be subtracted from purchases to determine payments to suppliers.

B) The increase of $8,000 will be added to net income.

C) The increase of $8,000 will be added to purchases to determine payments to suppliers.

D) The increase of $8,000 will be subtracted from net income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cash flow statement shows $13,000 from operations, ($9,000) from investing, and $21,000 from financing. The cash balance must have increased or decreased by:

A) $13,000.

B) $25,000.

C) $ 9,000.

D) $34,000.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

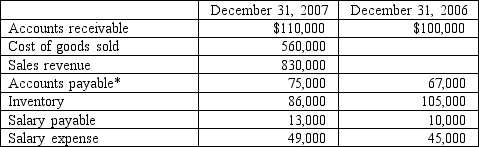

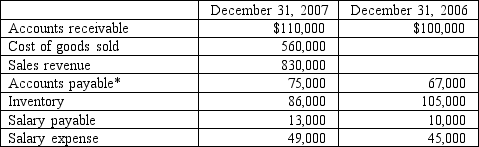

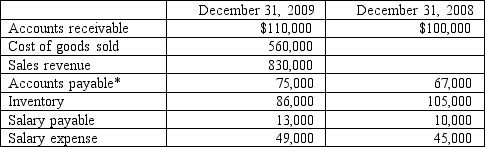

A company uses the indirect method to prepare the statement of cash flows. It presents the following amounts on its December 31, 2007 financial statements.

*Relates solely to the acquisition of inventory

What will appear in the operating activities section related to accounts receivable?

*Relates solely to the acquisition of inventory

What will appear in the operating activities section related to accounts receivable?

A) The increase of $10,000 will be subtracted from sales revenue.

B) The increase of $10,000 will be added to net income.

C) The increase of $10,000 will be added to sales revenue.

D) The increase of $10,000 will be subtracted from net income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company acquires its own stock to hold as treasury stock. Where would this transaction appear if the company prepares the statement of cash flows using the indirect method or the direct method?

A) The acquisition of treasury stock would be presented in the operating activities section as a reduction in net income under the indirect method and as a cash payment under the direct method.

B) The acquisition of treasury stock would be presented in the financing activities section as a cash payment under both methods.

C) The acquisition of treasury stock would be presented in the non-cash investing and financing activities section under both methods.

D) The acquisition of treasury stock would be presented in the investing activities section as a cash payment under both methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sections from the statement of cash flows includes activities that create revenue, expenses, gains and losses?

A) Activities that create revenue, expenses, gains and losses are included in the investing section.

B) Activities that create revenue, expenses, gains and losses are included in the financing section.

C) Activities that create revenue, expenses, gains and losses are included in the operating section.

D) Activities that create revenue, expenses, gains and losses are not included in any of the above-mentioned sections.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Which of the following sections from the statement of cash flows would include the payment of a note payable by issuing common stock?

A) The payment of a note payable by issuing common stock would be included in the investing section.

B) The payment of a note payable by issuing common stock would be included in the financing section.

C) The payment of a note payable by issuing common stock would be included in the operating section.

D) The payment of a note payable by issuing common stock would not be included in any of the above-mentioned sections.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the indirect method to prepare the statement of cash flows. It presents the following amounts on its December 31, 2007 financial statements.

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to accounts payable?

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to accounts payable?

A) The increase of $8,000 will be added to net income.

B) The increase of $8,000 will be subtracted from net income.

C) The increase of $8,000 will be subtracted from cost of goods sold.

D) The increase of $8,000 will be added to cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sections from the statement of cash flows would include the acquisition of a building by issuing common stock?

A) The acquisition of a building by issuing common stock would be included in the investing section.

B) The acquisition of a building by issuing common stock would be included in the financing section.

C) The acquisition of a building by issuing common stock would be included in the operating section.

D) The acquisition of a building by issuing common stock would not be included in any of the above-mentioned sections.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sections from the statement of cash flows includes activities that affect net income on the income statement?

A) Activities that affect net income on the income statement are included in the financing section.

B) Activities that affect net income on the income statement are included in the operating section.

C) Activities that affect net income on the income statement are included in the investing section.

D) Activities that affect net income on the income statement are not included in any of the above-mentioned sections.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

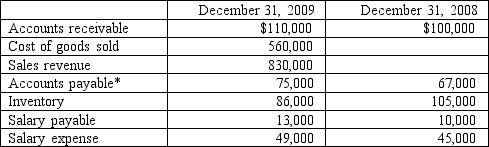

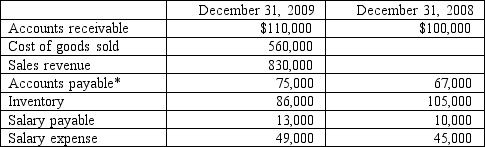

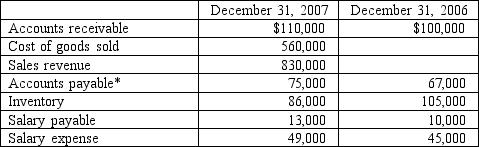

A company uses the direct method to prepare the statement of cash flows. It presents the following amounts on its December 31, 2009 financial statements.

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to salary payable?

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to salary payable?

A) The increase of $3,000 will be subtracted from net income.

B) The increase of $3,000 will be subtracted from salary expense to determine payments to employees.

C) The increase of $3,000 will be added to salary expense to determine payments to employees.

D) The increase of $3,000 will be added to net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchases equipment for use in its business activities. Where would this transaction appear if the company prepares the statement of cash flows using the indirect method or the direct method?

A) The purchase of equipment would be presented in the non-cash investing and financing activities section under both methods.

B) The purchase of equipment would be presented in the financing activities section as a cash payment under both methods.

C) The purchase of equipment would be presented in the operating activities section as a reduction in net income under the indirect method and as a cash payment under the direct method.

D) The purchase of equipment would be presented in the investing activities section as a cash payment under both methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the direct method to prepare the statement of cash flows. It presents the following amounts on its December 31, 2009 financial statements.

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to accounts receivable?

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to accounts receivable?

A) The increase of $10,000 will be subtracted from sales to determine cash received from customers.

B) The increase of $10,000 will be subtracted from net income.

C) The increase of $10,000 will be added to sales to determine cash received from customers.

D) The increase of $10,000 will be added to net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct order of the sections on a statement of cash flows?

A) The correct order is operating, financing, investing.

B) The correct order is financing, investing, operating.

C) The correct order is investing, operating, financing.

D) The correct order is operating, investing, financing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sells equipment at a loss. Where would this transaction appear if the company prepares the statement of cash flows using the indirect method or the direct method?

A) The sale of equipment at a loss would be presented in the investing activities section as a cash receipt under the both methods.

B) The sale of equipment at a loss would be presented in the investing activities section as a cash payment under the both methods.

C) The sale of equipment at a loss would be presented in the operating activities section as a reduction in net income under the indirect method and as a cash receipt under the direct method.

D) The sale of equipment at a loss would be presented in the financing activities section as a cash receipt under the both methods.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A company sells treasury stock for an amount less than its acquisition cost. Where would this transaction appear if the company prepares the statement of cash flows using the indirect method or the direct method?

A) The sale of treasury stock would be presented in the investing activities section as a cash receipt under the both methods.

B) The sale of treasury stock would be presented in the financing activities section as a cash receipt under the both methods.

C) The sale of treasury stock would be presented in the operating activities section as a reduction in net income under the indirect method and as a cash receipt under the direct method.

D) The sale of treasury stock would be presented in the non-cash investing and financing activities section under both methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sections from the statement of cash flows includes loans to others and collections on loans?

A) Loans to others and collections of loans are included in the financing section.

B) Loans to others and collections of loans are included in the investing section.

C) Loans to others and collections of loans are included in the operating section.

D) Loans to others and collections of loans are not included in any of the above-mentioned sections.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sections from the statement of cash flows includes activities that affect current assets and current liabilities on the balance sheet?

A) Activities that affect current assets and current liabilities on the balance sheet are included in the investing section.

B) Activities that affect current assets and current liabilities on the balance sheet are included in the financing section.

C) Activities that affect current assets and current liabilities on the balance sheet are included in the operating section.

D) Activities that affect current assets and current liabilities on the balance sheet are not included in any of the above-mentioned sections.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the direct method to prepare the statement of cash flows. It presents the following amounts on its December 31, 2009 financial statements.

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to inventory?

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to inventory?

A) The decrease of $19,000 will be subtracted from net income.

B) The decrease of $19,000 will be added to net income.

C) The decrease of $19,000 will be added to cost of goods sold to determine payments to suppliers.

D) The decrease of $19,000 will be subtracted from cost of goods sold to determine payments to suppliers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the indirect method to prepare the statement of cash flows. It presents the following amounts on its December 31, 2007 financial statements.

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to inventory?

*Relates solely to the acquisition of inventory

-

What will appear in the operating activities section related to inventory?

A) The decrease of $19,000 will be subtracted from net income

B) The decrease of $19,000 will be subtracted from cost of goods sold.

C) The decrease of $19,000 will be added to cost of goods sold.

D) The decrease of $19,000 will be added to net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the indirect method to prepare the statement of cash flows. How will the adjustment to reflect the amount of cash payments to suppliers be presented on the statement?

A) The adjustment will be for the increase or decrease in accounts payable for the period and will adjust net income in the operating activities section.

B) The adjustment will be for the increase or decrease in inventory for the period and will adjust net income in the operating activities section.

C) The adjustment will be for the increase or decrease in accrued expenses for the period and will adjust net income in the operating activities section.

D) The adjustment will be for the increase or decrease in accounts receivable for the period and will adjust net income in the operating activities section.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 27

Related Exams