A) Social Security.

B) Medicare.

C) Defense spending.

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget surplus occurs when government

A) outlays exceeds tax revenues.

B) tax revenues exceeds outlays.

C) tax revenues equals outlays.

D) tax revenues equal social security expenditures.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes and government expenditures that,without need for additional government action,change in response to changes in the level of economic activity are examples of

A) discretionary fiscal variables.

B) automatic fiscal policy.

C) built-in monetary stabilizers.

D) cyclically balanced budgets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-What is the amount of the surplus or deficit incurred in year 5 by the government shown in the above table?

A) $15 billion deficit

B) $35 billion surplus

C) $5 billion surplus

D) $325 billion surplus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that real GDP equals potential GDP,but the government believes that the economy is in a below full-employment equilibrium.As a result,the government increases its expenditure on goods and services.In response to the government's fiscal policy,

A) aggregate demand will increase.

B) an equilibrium with real GDP less than potential GDP will occur.

C) potential GDP decreases.

D) None of the above answers is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Laffer curve is the relationship between

A) government purchases and potential GDP.

B) tax rates and potential GDP.

C) tax revenue and potential GDP.

D) tax rates and tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ the interest rate,the ________ the present value of a given future amount.

A) higher; larger

B) higher; smaller

C) lower; lower

D) None of the above answers is correct because the interest rate has nothing to do with the present value.

Correct Answer

verified

Correct Answer

verified

True/False

An increase in taxes on labor income decreases potential GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

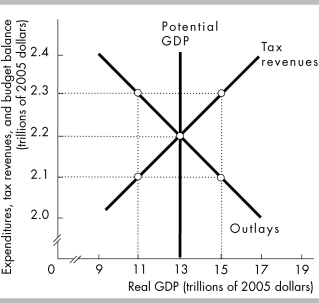

-In the above figure,if actual GDP = $15 trillion,there is a budget ________ equal to ________.

-In the above figure,if actual GDP = $15 trillion,there is a budget ________ equal to ________.

A) surplus; $0.2 trillion

B) surplus; $1.3 trillion

C) deficit; $0.2 trillion

D) deficit; $1.1 trillion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the largest source of revenue for the federal government?

A) Social Security taxes

B) corporate income taxes

C) personal income taxes

D) sales tax

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of the Employment Act of 1946 was to

A) establish goals for the federal government that would promote maximum employment, purchasing power, and production.

B) establish an unemployment compensation system.

C) set up the Federal Reserve System.

D) set targets for the unemployment rate to be achieved by the president.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comparing the U.S.budget position for 2012 to the rest of the world,we see that as a percentage of GDP,the ________ than in most other countries.

A) U.S. budget deficit is smaller

B) U.S. budget deficit is larger

C) U.S. budget surplus is smaller

D) U.S. budget surplus is larger

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government's budget is in surplus even when the economy is at full employment,the surplus is said to be

A) persisting.

B) cyclical.

C) discretionary.

D) structural.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Between 2000 and 2005,Finland increased its tax on interest income. As a result,the supply curve for loanable funds shifted ________ and the tax wedge ________.

A) leftward; increased

B) rightward; increased

C) leftward; decreased

D) rightward; decreased

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expenditures such as Social Security benefits,farm subsidies and grants are considered

A) expenditures on goods and services

B) transfer payments

C) debt reduction

D) debt interest

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-What is the amount of the surplus or deficit incurred in year 2 by the government shown in the above table?

A) $0

B) $5 billion surplus

C) $5 billion deficit

D) $250 billion surplus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the tax on interest income ________ the supply of loanable funds and ________ the equilibrium investment.

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax cut increases people's labor supply,then

A) tax cuts increase potential GDP.

B) tax cuts decrease aggregate demand.

C) tax cuts cannot affect aggregate demand.

D) Both answers A and B are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Automatic fiscal policy is at work if,as real GDP increases,________.

A) transfer payments decrease and interest rates decrease

B) transfer payments increase and tax revenues decrease

C) tax revenues increase and transfer payments decrease

D) tax revenues decrease and interest rates increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

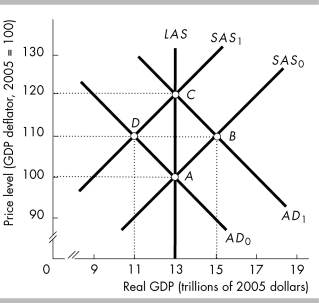

-In the above figure,if the economy is initially at point D and taxes are cut,if potential GDP does not change then the economy will move to point

-In the above figure,if the economy is initially at point D and taxes are cut,if potential GDP does not change then the economy will move to point

A) move to point C.

B) move to point A.

C) move to point B.

D) stay at point D.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 263

Related Exams