A) 215 percent.

B) 15 percent.

C) 5 percent.

D) 7.5 percent.

E) 8 percent.

Correct Answer

verified

Correct Answer

verified

True/False

Suppose the consumer price index (CPI)for a given year is 150.This means the rate of inflation for the given year is 50 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the real rate of interest is 5 percent and a lender charges a nominal interest rate of 15 percent.If a borrower expects that the rate of inflation next year will be 10 percent and the actual rate of inflation next year is 12 percent:

A) neither the borrower nor the lender benefits from inflation.

B) both the borrower and the lender lose from inflation.

C) the borrower benefits from inflation, while the lender loses from inflation.

D) the lender benefits from inflation, while the borrower loses from inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year the Olsen family earned $70,000.This year their income is $77,000.In an economy with an inflation rate of 8 percent,we can conclude that the Olsen's nominal income:

A) and real income both increased.

B) and real income both decreased.

C) increased, but their real income decreased.

D) decreased, but their real income increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation refers to a:

A) decreasing relative prices.

B) decreasing price level.

C) slowing down of the rate of inflation.

D) federal government policy of running budget surpluses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you received a 5 percent increase in your nominal wage.Over the year,inflation ran about 2 percent.Which of the following is true?

A) Your real wage increased.

B) Your nominal wage decreased.

C) Both your nominal and real wages decreased.

D) Although your nominal wage rose, your real wage decreased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real interest rate can be expressed as the:

A) nominal interest rate minus the real interest rate.

B) inflation rate minus the nominal interest rate.

C) nominal interest rate minus the inflation rate.

D) nominal interest rate plus the inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

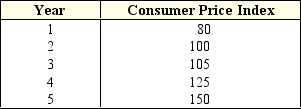

Exhibit 13-2 Consumer Price Index

-As shown in Exhibit 13-2,the rate of inflation for Year 5 is:

-As shown in Exhibit 13-2,the rate of inflation for Year 5 is:

A) 5 percent

B) 10 percent.

C) 20 percent.

D) 25 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real income in Year X is equal to:

A)

B)

C) ![]()

D)

Correct Answer

verified

Correct Answer

verified

True/False

The real interest rate can be negative.

Correct Answer

verified

Correct Answer

verified

True/False

Inflation occurs when there is an increase in the purchasing power of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the real rate of interest is 5 percent and a lender charges a nominal interest rate of 15 percent.If a borrower expects that the rate of inflation next year will be 10 percent and the actual rate of inflation next year is 10 percent,:

A) the lender benefits from inflation, while the borrower loses from inflation.

B) the borrower benefits from inflation, while the lender loses from inflation.

C) neither the borrower nor the lender benefits from inflation.

D) both the borrower and the lender lose from inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Organization of Petroleum Exporting Countries (OPEC) sharply increased the price of oil,which triggered higher inflation rates in the United States.This type of inflation is best classified as:

A) pseudo-inflation.

B) demand-pull inflation.

C) cost-push inflation.

D) hyperinflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the rate of inflation in a given time period turns out to be higher than lenders and borrowers anticipated,then the effect will be:

A) no change in the distribution of wealth between lenders and borrowers.

B) a net gain in purchasing power for lenders relative to borrowers.

C) a redistribution of wealth from borrowers to lenders.

D) a redistribution of wealth from lenders to borrowers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the consumer price index (CPI) stands at 250 this year.If the inflation rate is 10 percent,then next year's CPI will equal:

A) 250.

B) 260.

C) 275.

D) 500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A measure comparing the prices of consumer goods and services that a household typically purchases to the prices of those goods and services purchased in a base year is

A) the GDP deflator.

B) the consumer price index.

C) the price level.

D) inflation.

E) the base measure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation is an increase in:

A) prices of all products in the economy.

B) homes, autos and basic resources.

C) the general price level of products.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

True/False

People with fixed incomes fare best in an inflationary period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost-push inflation is due to:

A) "too much money chasing too few goods".

B) the economy operating at full employment.

C) increases in production costs.

D) all of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can create demand-pull inflation?

A) Excessive aggregate spending.

B) Sharply rising oil prices.

C) Higher labor costs.

D) Recessions and depressions.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 127

Related Exams