Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Assume the demand for cigarettes is relatively inelastic, and the supply of cigarettes is relatively elastic. When cigarettes are taxed, we would expect

A) most of the burden of the tax to fall on sellers of cigarettes, regardless of whether buyers or sellers of cigarettes are required to pay the tax to the government.

B) most of the burden of the tax to fall on buyers of cigarettes, regardless of whether buyers or sellers of cigarettes are required to pay the tax to the government.

C) the distribution of the tax burden between buyers and sellers of cigarettes to depend on whether buyers or sellers of cigarettes are required to pay the tax to the government.

D) a large percentage of smokers to quit smoking in response to the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of cereal will increase the price of cereal paid by buyers,

A) decrease the effective price of cereal received by sellers, and decrease the equilibrium quantity of cereal.

B) decrease the effective price of cereal received by sellers, and increase the equilibrium quantity of cereal.

C) increase the effective price of cereal received by sellers, and decrease the equilibrium quantity of cereal.

D) increase the effective price of cereal received by sellers, and increase the equilibrium quantity of cereal.

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set above the equilibrium price causes quantity demanded to exceed quantity supplied.

Correct Answer

verified

Correct Answer

verified

True/False

Discrimination is an example of a rationing mechanism that may naturally develop in response to a binding price floor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is not binding, then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) there will be no effect on the market price or quantity sold.

D) the market will be less efficient than it would be without the price floor.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Rent control

A) serves as an example of how a social problem can be alleviated or even solved by government policies.

B) serves as an example of a price ceiling.

C) is regarded by most economists as an efficient way of helping the poor.

D) is the most efficient way to allocate scarce housing resources.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Some states in the U.S. mandate minimum wages above the federal level.

B) Most European nations have minimum-wage laws.

C) The U.S. minimum wage is significantly higher than the minimum wages in France and the United Kingdom.

D) The U.S. Congress first instituted a minimum wage with the Fair Labor Standards Act.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

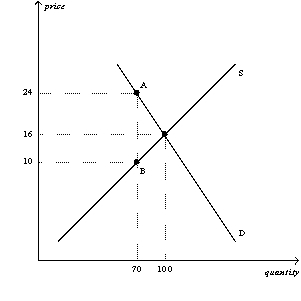

Figure 6-14

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-14. The amount of the tax per unit is

-Refer to Figure 6-14. The amount of the tax per unit is

A) $6.

B) $8.

C) $14.

D) $18.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In response to a shortage caused by the imposition of a binding price ceiling on a market,

A) price will no longer be the mechanism that rations scarce resources.

B) long lines of buyers may develop.

C) sellers could ration the good or service according to their own personal biases.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls

A) always produce a fair outcome.

B) always produce an efficient outcome.

C) can generate inequities of their own.

D) All of the above are correct.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The imposition of a binding price floor on a market causes quantity demanded to be

A) greater than quantity supplied.

B) less than quantity supplied.

C) equal to quantity supplied.

D) Both a) and b) are possible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a binding price floor from a market, then the price received by sellers will

A) decrease, and the quantity sold in the market will decrease.

B) decrease, and the quantity sold in the market will increase.

C) increase, and the quantity sold in the market will decrease.

D) increase, and the quantity sold in the market will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Rent control and the minimum wage are both examples of price ceilings.

B) Rent control is an example of a price ceiling, and the minimum wage is an example of a price floor.

C) Rent control is an example of a price floor, and the minimum wage is an example of a price ceiling.

D) Rent control and the minimum wage are both examples of price floors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government passes a law requiring buyers of college textbooks to send $5 to the government for every textbook they buy, then

A) the demand curve for textbooks shifts downward by $5.

B) buyers of textbooks pay $5 more per textbook than they were paying before the tax.

C) sellers of textbooks are unaffected by the tax.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent-control laws dictate

A) the exact rent that landlords must charge tenants.

B) a maximum rent that landlords may charge tenants.

C) a minimum rent that landlords may charge tenants.

D) both a minimum rent and a maximum rent that landlords may charge tenants.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $1,000 tax per boat on sellers of boats, then the price paid by buyers of boats would

A) increase by more than $1,000.

B) increase by exactly $1,000.

C) increase by less than $1,000.

D) decrease by an indeterminate amount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

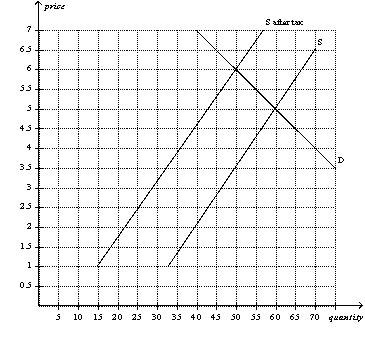

Figure 6-18  -Refer to Figure 6-18. Buyers pay how much of the tax per unit?

-Refer to Figure 6-18. Buyers pay how much of the tax per unit?

A) $1.

B) $1.50.

C) $2.50.

D) $3.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of a product, buyers pay

A) more, and sellers receive more than they did before the tax.

B) more, and sellers receive less than they did before the tax.

C) less, and sellers receive more than they did before the tax.

D) less, and sellers receive less than they did before the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1990, Congress passed a new luxury tax on items such as yachts, private airplanes, furs, jewelry, and expensive cars. The goal of the tax was to

A) raise revenue from the wealthy.

B) prevent wealthy people from buying luxuries.

C) force producers of luxury goods to reduce employment.

D) limit exports of luxury goods to other countries.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 556

Related Exams