A) production is greater than last year.

B) actual overhead is greater than expected.

C) actual overhead is greater than allocated overhead.

D) estimated overhead is greater than actual overhead.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When job costing is used as a service firm

A) indirect costs are traced to client jobs.

B) direct costs are allocated to client jobs.

C) indirect costs are allocated to client jobs.

D) all costs are allocated to client jobs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

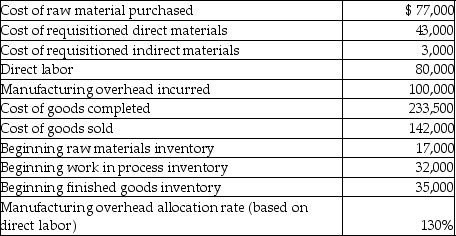

Here is selected data for Lori Corporation:  The journal entry to close manufacturing overhead would include a

The journal entry to close manufacturing overhead would include a

A) credit to manufacturing overhead for $4,000.

B) debit to work in process inventory for $4,000.

C) debit to manufacturing overhead for $4,000.

D) debit to cost of goods sold for $4,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

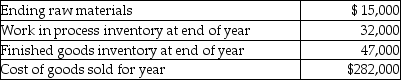

Matthew Company uses a job cost system. The overhead account shows a $5,000 overallocated balance at the end of the year. Actual overhead incurred was $100,000. Other balances are:  The entry to close manufacturing overhead would include a

The entry to close manufacturing overhead would include a

A) debit to manufacturing overhead for $5,000.

B) debit to work in process inventory for $5,000.

C) debit to cost of goods sold for $5,000.

D) credit to work in process for $5,000.

Correct Answer

verified

Correct Answer

verified

True/False

Companies should always use job costing rather than process costing.

Correct Answer

verified

Correct Answer

verified

True/False

If the actual amount of the manufacturing overhead allocation base is greater than the estimated amount of the allocation base used to calculate the predetermined rate, then manufacturing overhead must have been underallocated.

Correct Answer

verified

Correct Answer

verified

True/False

The overhead allocation base should be the cost driver of manufacturing overhead costs.

Correct Answer

verified

Correct Answer

verified

True/False

If manufacturing overhead has been underallocated during the year, it means the jobs have been undercosted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

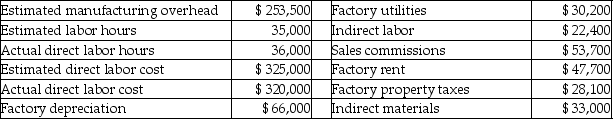

Here are selected data for Stehli Company:  If the company allocates overhead based on direct labor cost, what is the predetermined manufacturing overhead rate?

If the company allocates overhead based on direct labor cost, what is the predetermined manufacturing overhead rate?

A) 78% of direct labor cost

B) 128% of direct labor cost

C) 79% of direct labor cost

D) 102% of direct labor cost

Correct Answer

verified

Correct Answer

verified

True/False

Job costing should only be used by manufacturers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of direct labor used in production is recorded as a

A) credit to manufacturing overhead.

B) credit to work in process inventory.

C) credit to wages expense.

D) credit to wages payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Here are selected basic data for Wilson Company:  If the company allocates overhead based on direct labor cost, what are the total actual manufacturing overhead costs?

If the company allocates overhead based on direct labor cost, what are the total actual manufacturing overhead costs?

A) $280,500

B) $171,400

C) $258,100

D) $226,800

Correct Answer

verified

Correct Answer

verified

Matching

State whether each company below would be more likely to use a job costing system or a process costing system.

Correct Answer

Multiple Choice

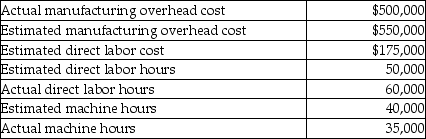

Hilltop Manufacturing uses a predetermined manufacturing overhead rate based on machine hours to allocate manufacturing overhead to jobs. Selected data about the company's operations follows:  By how much was manufacturing overhead overallocated or underallocated for the year?

By how much was manufacturing overhead overallocated or underallocated for the year?

A) $118,750 underallocated

B) $118,750 overallocated

C) $112,500 underallocated

D) $112,500 overallocated

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturing overhead costs cannot be directly traced to jobs.

Correct Answer

verified

Correct Answer

verified

True/False

A production schedule always covers a one-year period of time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold is debited and finished goods inventory is credited for

A) purchase of goods on account.

B) transfer of goods to the finished goods storeroom.

C) transfer of materials into work in process inventory.

D) the sale of goods to a customer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to assign $1,700 of direct labor and $300 of indirect labor involves a debit to

A) manufacturing overhead for $2,000.

B) work in process inventory for $2,000.

C) work in process inventory for $1,700 and a credit to manufacturing overhead for $300.

D) work in process inventory for $1,700 and manufacturing overhead for $300.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When job costing is used at a service firm, the bill to the client shows

A) the billing rate and hours spent on the job.

B) the allocation of indirect costs.

C) the profit on the job.

D) actual direct cost of providing the service.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry needed to record the completion of a job includes a

A) credit to work in process inventory.

B) credit to finished goods inventory.

C) debit to work in process inventory.

D) debit to cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 334

Related Exams