Correct Answer

verified

Correct Answer

verified

True/False

Businesses earn returns for security holders by purchasing and operating physical assets.The relevant risk of any physical asset must be measured in terms of its effect on the risk of the firm's securities.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Which type of risk can be eliminated through diversification?

A) total risk

B) market risk

C) firm specific risk

D) none of the above

Correct Answer

verified

Correct Answer

verified

True/False

It is possible that the actual return on a risky asset is significantly different from expected return on that risky asset only when the market is not in equilibrium.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A complete probability distribution is always an objective listing of all possible events.Since it is impossible to list all the possible outcomes from a single event,probability distributions are of limited benefit in assessing risk.

B) A peaked probability distribution centered around the expected value will make a stock more desirable,thereby increasing its expected return.

C) In the real world,there are an infinite number of possible states or outcomes that can occur.Thus,probability distributions actually are continuous;however,for simplicity,financial managers typically reduce the number of states for analysis to a manageable number.

D) Risk refers to the chance that some unfavorable event will occur while a probability distribution is completely described as a listing of the likelihood of unfavorable events.

E) The higher the probability that the return from an investment will pay off its average promised value the lower will be the expected return,regardless of the distribution of the investment's returns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a diversified portfolio consisting of a $10,000 investment in each of 20 different common stocks .The portfolio beta is equal to 1.2.You have decided to sell one of your stocks which has a beta equal to 0.7 for $10,000.You plan to use the proceeds to purchase another stock which has a beta equal to 1.4.What will be the beta of the new portfolio?

A) 1.165

B) 1.235

C) 1.250

D) 1.284

E) 1.333

Correct Answer

verified

Correct Answer

verified

True/False

The realized portfolio return is the weighted average of the relative weights of securities in the portfolio multiplied by their respective expected returns.

Correct Answer

verified

Correct Answer

verified

True/False

If we develop a weighted average of the possible return outcomes,multiplying each outcome or "state" by its respective probability of occurrence for a particular stock,we can construct a payoff matrix of expected returns.

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of variation is useful in evaluating the total risk in situations where assets have different total risk and expected returns.

Correct Answer

verified

Correct Answer

verified

True/False

Market risk refers to the tendency of a stock to move with the general stock market.A stock with above-average market risk will tend to be more volatile than an average stock,and it will have a beta which is greater than 1.0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about risk is false?

A) Risk requires the possibility of at least one outcome less favorable than the expected value.

B) Risk requires the possibility of more than one outcome.

C) Risk is one of the determinants of the required return.

D) Risk aversion generally is assumed in finance to be a characteristic of the "marginal investor."

E) All of the above statements are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) The expected return on a portfolio of financial assets is equal to the summation of the products of the expected returns of the individual assets multiplied by the probability of each return being realized.

B) When adding new securities to a portfolio,the higher or more positive the degree of correlation between the new securities and those already in the portfolio,the greater the benefits of the additional portfolio diversification.

C) In portfolio analysis,we rarely use ex post (historical) returns and standard deviations,because we are interested in ex ante (future) data.

D) Portfolio diversification reduces the variability of returns on each security held in the portfolio.

E) All of the above statements are false.

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of variation gives you a measure risk per unit of return.All else equal investors would prefer a higher coefficient of variation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, (1) if the expected inflation rate decreases,and (2) investors become more risk averse,the Security Market Line would shift

A) Down and have steeper slope.

B) Up and have less steep slope.

C) Up and keep same slope.

D) Down and keep same slope.

E) Down and have less steep slope.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

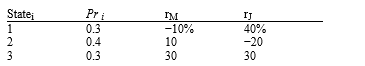

Given the following probability distributions,what are the expected returns for the Market and for Security J?

A) 10.0%;11.3%

B) 9.5%;13.0%

C) 10.0%;9.5%

D) 10.0%;13.0%

E) 13.0%;10.0%

Correct Answer

verified

Correct Answer

verified

True/False

Investment risk can be measured by the variability of all the investment's returns,both "good" and "bad."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Philadelphia Corporation's stock recently paid a dividend of $2.00 per share (D0 = $2) ,and the stock is in equilibrium.The company has a constant growth rate of 5 percent and a beta equal to 1.5.The required rate of return on the market is 15 percent,and the risk-free rate is 7 percent.Philadelphia is considering a change in policy which will increase its beta coefficient to 1.75.If market conditions remain unchanged,what new constant growth rate will cause the common stock price of Philadelphia to remain unchanged?

A) 8.85%

B) 18.53%

C) 6.77%

D) 5.88%

E) 13.52%

Correct Answer

verified

Correct Answer

verified

True/False

Risk in financial assets only occurs when there is a chance that the actual return is less than expected.It is not considered risk if there is a chance that the actual return is greater than expected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

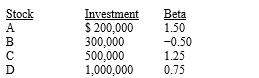

Consider the following information,and then calculate the required rate of return for the Scientific Investment Fund.The total investment in the fund is $2 million.The market required rate of return is 15 percent,and the risk-free rate is 7 percent.

A) 14.3%

B) 15.0%

C) 13.1%

D) 12.7%

E) 10.3%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) If investors become more risk averse,but rRF remains constant,the required rate of return on high beta stocks will rise,the required return on low beta stocks will decline,but the required return on an average risk stock will not change.

B) If Mutual Fund A held equal amounts of 100 stocks,each of which had a beta of 1.0,and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0,then the two mutual funds would both have betas of 1.0 and thus would be equally risky from an investor's standpoint.

C) An investor who holds just one stock will be exposed to more risk than an investor who holds a portfolio of stocks,assuming the stocks are all equally risky.Since the holder of the 1-stock portfolio is exposed to more risk,he or she can expect to earn a higher rate of return to compensate for the greater risk.

D) Assume that the required rate of return on the market,rM,is given and fixed.If the yield curve were upward-sloping,then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

E) Statements a,b,c,and d are all false.

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 104

Related Exams