A) consumer surplus after the tax.

B) consumer surplus before the tax.

C) producer surplus after the tax.

D) producer surplus before the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

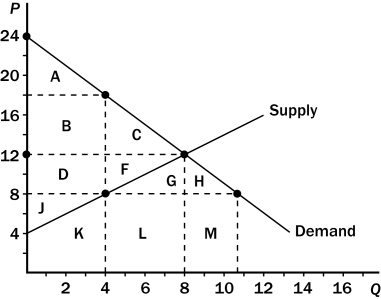

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7.Which of the following statements is correct?

-Refer to Figure 8-7.Which of the following statements is correct?

A) Total surplus before the tax is imposed is $45.

B) After the tax is imposed,consumer surplus is 25 percent of its pre-tax value.

C) After the tax is imposed,producer surplus is 36 percent of its pre-tax value.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The more freedom young mothers have to work outside the home,the

A) more elastic the supply of labor will be.

B) less elastic the supply of labor will be.

C) more vertical the labor supply curve will be.

D) smaller is the decrease in employment that will result from a tax on labor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7.The deadweight loss associated with this tax amounts to

-Refer to Figure 8-7.The deadweight loss associated with this tax amounts to

A) $60,and this figure represents the amount by which tax revenue to the government exceeds the combined loss of producer and consumer surpluses.

B) $60,and this figure represents the surplus that is lost because the tax discourages mutually advantageous trades between buyers and sellers.

C) $40,and this figure represents the amount by which tax revenue to the government exceeds the combined loss of producer and consumer surpluses.

D) $40,and this figure represents the surplus that is lost because the tax discourages mutually advantageous trades between buyers and sellers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the sellers of a good shifts the

A) supply curve upward (or to the left) .

B) supply curve downward (or to the right) .

C) demand curve upward (or to the right) .

D) demand curve downward (or to the left) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes are costly to market participants because they

A) transfer resources from market participants to the government.

B) alter incentives.

C) distort market outcomes.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on the sellers of a good,the

A) demand curve shifts downward by less than the amount of the tax.

B) demand curve shifts downward by the amount of the tax.

C) supply curve shifts upward by less than the amount of the tax.

D) supply curve shifts upward by the amount of the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a tax on labor?

A) Medicare tax

B) Social Security tax

C) federal income tax

D) All of the above are labor taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

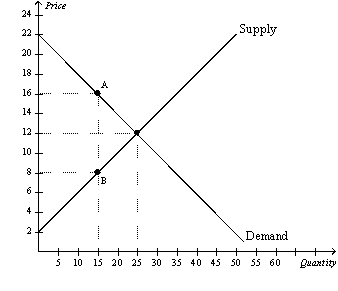

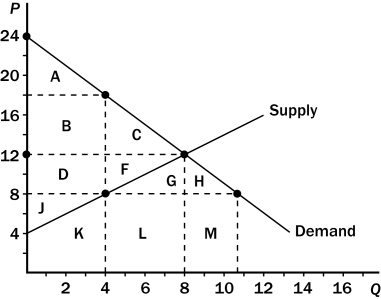

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8.One effect of the tax is to

-Refer to Figure 8-8.One effect of the tax is to

A) reduce consumer surplus from $60 to $24.

B) reduce producer surplus from $32 to $8.

C) create a deadweight loss of $24.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

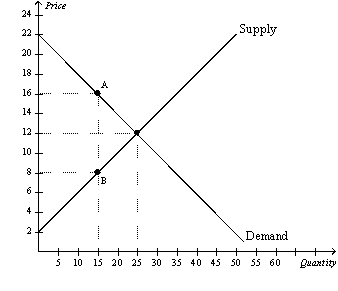

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The tax results in a loss of producer surplus that amounts to

-Refer to Figure 8-4.The tax results in a loss of producer surplus that amounts to

A) $90.

B) $180.

C) $420.

D) $510.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-1 Claudia would be willing to pay as much as $100 per week to have her house cleaned.John's opportunity cost of cleaning Claudia's house is $70 per week. -Refer to Scenario 8-1.If Claudia pays John $80 to clean her house,Claudia's consumer surplus is

A) $80.

B) $30.

C) $20.

D) $10.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nobel Prize-winning economist Milton Friedman said that,"In my opinion,the least bad tax is the property tax on the unimproved value of land." Why?

A) Land owners can afford the tax better than other people.

B) A tax on unimproved land would be sufficient to fund government,so all other taxes could be abolished.

C) Such a tax could generate more government revenue than any tax on labor or capital.

D) A tax on unimproved land would have no deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buyers of a product will bear the larger part of the tax burden,and sellers will bear a smaller part of the tax burden,when the

A) tax is placed on the sellers of the product.

B) tax is placed on the buyers of the product.

C) supply of the product is more elastic than the demand for the product.

D) demand for the product is more elastic than the supply of the product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As more people become self-employed,which allows them to determine how many hours they work per week,we would expect the deadweight loss from the Social Security tax to

A) increase,and the revenue generated from the tax to increase.

B) increase,and the revenue generated from the tax to decrease.

C) decrease,and the revenue generated from the tax to increase.

D) decrease,and the revenue generated from the tax to decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

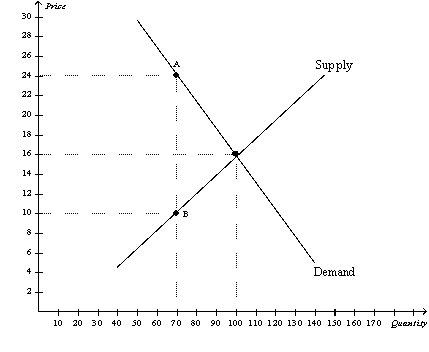

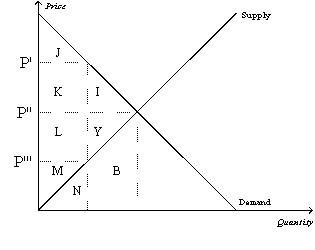

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The tax revenue is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The tax revenue is measured by the area

A) K+L.

B) I+Y.

C) J+K+L+M.

D) I+J+K+L+M+Y.

Correct Answer

verified

Correct Answer

verified

True/False

If the size of a tax doubles,the deadweight loss doubles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country is on the downward-sloping side of the Laffer curves,a cut in the tax rate will

A) decrease tax revenue and decrease the deadweight loss.

B) decrease tax revenue and increase the deadweight loss.

C) increase tax revenue and decrease the deadweight loss.

D) increase tax revenue and increase the deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that for good X the supply curve for a good is a typical,upward-sloping straight line,and the demand curve is a typical downward-sloping straight line.If the good is taxed,and the tax is doubled,the

A) base of the triangle that represents the deadweight loss doubles.

B) height of the triangle that represents the deadweight loss doubles.

C) deadweight loss of the tax quadruples.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8.After the tax goes into effect,producer surplus is the area

-Refer to Figure 8-8.After the tax goes into effect,producer surplus is the area

A) D+F+G+H+J.

B) D+F+G+H.

C) D+F+J.

D) J.

Correct Answer

verified

Correct Answer

verified

True/False

As the price elasticities of supply and demand increase,the deadweight loss from a tax increases.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 353

Related Exams