A) perfectly inelastic.

B) perfectly elastic.

C) upward sloping.

D) downward sloping.

Correct Answer

verified

Correct Answer

verified

True/False

When firms internalize a negative externality,the market supply curve shifts to the left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government were to limit the release of air-pollution produced by a steel mill to 75 parts per million,the policy would be considered a

A) regulation.

B) corrective tax.

C) subsidy.

D) market-based policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

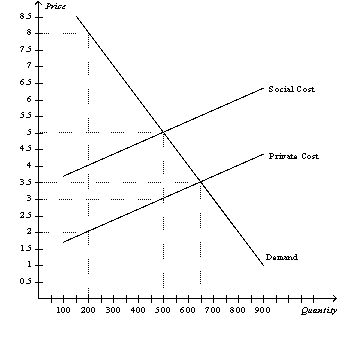

Figure 10-2  -Refer to Figure 10-2.Assume the production of plastic imposes a cost on society of $2.00 per unit.If the free market equilibrium output is 650 units,the government should

-Refer to Figure 10-2.Assume the production of plastic imposes a cost on society of $2.00 per unit.If the free market equilibrium output is 650 units,the government should

A) impose a tax of $1.50 per unit.

B) increase the output of the firm by 50 units.

C) offer a subsidy of $2.00 per unit..

D) impose a tax of $2.00 per unit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Gasoline taxes are an example of an EPA regulation.

B) Gasoline taxes are higher in many European countries than in the United States.

C) Gasoline taxes contribute to global warming.

D) Gasoline taxes are an example of a command-and-control policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of tradable pollution permits?

A) Each firm is allowed to pollute exactly the same amount.

B) Revenue from the sale of permits is greater than revenue from a corrective tax.

C) The initial allocation of permits to firms does not affect the efficiency of the market.

D) Firms will engage in joint research efforts to reduce pollution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When technology spillover occurs,

A) it is the government's responsibility to own firms that are engaged in high-tech research.

B) a firm's research yields technological knowledge that can then be used by society as a whole.

C) those firms engaged in technology research should be taxed by the government.

D) when firms invest in the latest production technology,the cost of that technology "spills over" to the prices consumers must pay for the product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax on gasoline is an example of

A) a consumption tax.

B) a corrective tax.

C) an income tax.

D) a command-and-control policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Singapore,littering fines are strictly enforced.This is an example of a policy that

A) relies on moral codes to reduce the pollution externality.

B) relies on the Coase Theorem.

C) discriminates against foreigners.

D) relies on incentives to reduce the pollution externality.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two firms,A and B,each currently emit 100 tons of chemicals into the air.The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution emitted into the air.The government gives each firm 40 pollution permits,which it can either use or sell to the other firm.It costs Firm A $200 for each ton of pollution that it eliminates before it is emitted into the air,and it costs Firm B $100 for each ton of pollution that it eliminates before it is emitted into the air.After the two firms buy or sell pollution permits from each other,we would expect that Firm A will emit

A) 20 fewer tons of pollution into the air,and Firm B will emit 100 fewer tons of pollution into the air.

B) 100 fewer tons of pollution into the air,and Firm B will emit 20 fewer tons of pollution into the air.

C) 50 fewer tons of pollution into the air,and Firm B will emit 50 fewer tons of pollution into the air.

D) 20 more tons of pollution into the air,and Firm B will emit 100 fewer tons of pollution into the air.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dick owns a dog whose barking annoys Dick's neighbor Jane.Suppose that the benefit of owning the dog is worth $200 to Dick and that Jane bears a cost of $400 from the barking.Assuming Dick has the legal right to keep the dog,a possible private solution to this problem is that

A) Jane pays Dick $150 to give the dog to his parents who live on an isolated farm.

B) Dick pays Jane $350 for her inconvenience.

C) Jane pays Dick $300 to give the dog to his parents who live on an isolated farm.

D) There is no private transaction that would improve this situation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following cases is the Coase theorem most likely to solve the externality?

A) Ed is allergic to his roommate's cat.

B) Chemicals from manufacturing plants in the Midwest are causing acid rain in Canada.

C) Polluted water runoff from farms is making residents of a nearby town sick.

D) Industrialization around the world is causing global warming.

Correct Answer

verified

Correct Answer

verified

Showing 341 - 352 of 352

Related Exams