A) It rises by $600 billion.

B) It rises by $125 billion.

C) It falls by $2,500 billion.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best illustrates the unit of account function of money?

A) You list prices for candy sold on your Web site,www.sweettooth.com,in dollars.

B) You pay for your theater tickets with dollars.

C) You keep 6 ounces of gold in your safe-deposit box at the bank for emergencies.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Travelers checks are included in

A) M1 but not M2.

B) M2 but not M1.

C) M1 and M2.

D) neither M1 nor M2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

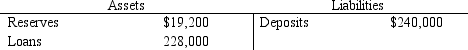

Table 29-6.

Bank of Springfield

-Refer to Table 29-6.If the Fed requires a reserve ratio of 6 percent,then what quantity of excess reserves does the Bank of Springfield now hold?

-Refer to Table 29-6.If the Fed requires a reserve ratio of 6 percent,then what quantity of excess reserves does the Bank of Springfield now hold?

A) $1,200

B) $2,400

C) $2,880

D) $4,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money multiplier equals

A) 1/R,where R represents the quantity of reserves in the economy.

B) 1/R,where R represents the reserve ratio for all banks in the economy.

C) 1/(1+R) ,where R represents the reserve ratio for all banks in the economy.

D) 1/(1+R) ,where R represents the largest reserve ratio among all banks in the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 29-2. The Monetary Policy of Tazi is controlled by the country's central bank known as the Bank of Tazi.The local unit of currency is the Taz.Aggregate banking statistics show that collectively the banks of Tazi hold 300 million Tazes of required reserves,75 million Tazes of excess reserves,have issued 7,500 million Tazes of deposits,and hold 225 million Tazes of Tazian Treasury bonds.Tazians prefer to use only demand deposits and so all money is on deposit at the bank. -Refer to Scenario 29-2.Assuming the only other thing Tazian banks have on their balance sheets is loans,what is the value of existing loans made by Tazian banks?

A) 6,900 million Tazes

B) 7,125 million Tazes

C) 7,350 million Tazes

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds rate is the interest rate that

A) banks charge one another for loans.

B) banks charge the Fed for loans.

C) the Fed charges banks for loans.

D) the Fed charges Congress for loans.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio for all banks is 8 percent,then an additional $1,000 of reserves can increase the money supply by as much as

A) $6,400.

B) $8,000.

C) $12,500.

D) $20,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you deposit $100 of currency into a demand deposit at a bank,this action by itself

A) does not change the money supply.

B) increases the money supply.

C) decreases the money supply.

D) has an indeterminate effect on the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Writing in The New York Times in 2004,economist Hal R.Varian asserted that dollars are valuable as a result of

A) the fact that they are backed by gold.

B) the cost incurred by the government when it prints paper currency.

C) "network effects."

D) "commodity effects."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a system of 100-percent-reserve banking,

A) banks do not accept deposits.

B) banks do not influence the supply of money.

C) loans are the only asset item for banks.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 29-1. The monetary policy of Salidiva is determined by the Salidivian Central Bank.The local currency is the salido.Salidivian banks collectively hold 100 million salidos of required reserves,25 million salidos of excess reserves,250 million salidos of Salidivian Treasury Bonds,and their customers hold 1,000 million salidos of deposits.Salidivians prefer to use only demand deposits and so the money supply consists of demand deposits. -Refer to Scenario 29-1 .Suppose the Central Bank of Salidiva purchases 25 million salidos of Salidivian Treasury Bonds from banks.Suppose also that both the reserve requirement and the percentage of deposits held as excess reserves stay the same.By how much would the money supply of Salidiva change?

A) 200 million salidos

B) 150 million salidos

C) 100 million salidos

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio for all banks is 10 percent,$1,000 of additional reserves can create up to

A) $100 of new money.

B) $1,000 of new money.

C) $10,000 of new money.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's assets equal its liabilities under

A) both 100-percent-reserve banking and fractional-reserve banking.

B) neither 100-percent-reserve banking nor fractional-reserve banking.

C) 100-percent-reserve banking but not under fractional-reserve banking.

D) fractional-reserve banking but not under 100-percent-reserve banking.

Correct Answer

verified

Correct Answer

verified

True/False

Assume that when $100 of new reserves enter the banking system,the money supply ultimately increases by $625.Assume also that no banks hold excess reserves and that the entire money supply consists of bank deposits.If,at a point in time,reserves for all banks amount to $500,then at that same point in time,loans for all banks amount to $2,625.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people decide to hold more currency relative to deposits,the money supply

A) falls.The larger the reserve ratio is,the more the money supply falls.

B) falls.The larger the reserve ratio is,the less the money supply falls.

C) rises.The larger the reserve ratio is,the more the money supply rises.

D) rises.The larger the reserve ratio is,the less the money supply rises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The New York Federal Reserve Bank

A) president always gets to vote at the FOMC meetings.

B) conducts open market transactions.

C) is one of 12 regional Federal Reserve Banks.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Speaking at a conference in 2002 as a member of the Board of Governors,Ben Bernanke

A) acknowledged that the Fed had been responsible for the Great Depression of the 1930s.

B) asserted that the Fed was in no way responsible for the Great Depression of the 1930s.

C) asserted that the Fed should abandon,in the not-too-distant future,its reliance on open-market operations for control of the money supply.

D) asserted that the Fed should abandon,in the not-too-distant future,its fixation on the federal funds rate.

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve was created in 1913 after a series of bank failures in 1907.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States,currency holdings per person average about

A) $60;one explanation for this relatively small average is that many people use credit and debit cards to make transactions.

B) $60;one explanation for this relatively small average is that U.S.citizens hold a lot of foreign currency.

C) $3,300;one explanation for this relatively large amount is that criminals probably prefer currency as a medium of exchange.

D) $3,300;one explanation for this relatively large average is that U.S.citizens hold a lot of foreign currency.

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 366

Related Exams