A) 11.98 percent

B) 14.49 percent

C) 19.78 percent

D) 21.29 percent

E) 27.20 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past four years,a stock produced returns of 13,6,-5,and 18 percent,respectively.What is the standard deviation of these returns?

A) 8.63 percent

B) 9.93 percent

C) 9.97 percent

D) 10.11 percent

E) 10.15 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blume's formula is used to:

A) predict future rates of return.

B) convert an arithmetic average return into a geometric average return.

C) convert a geometric average return into an arithmetic average return.

D) measure past performance in a consistent manner.

E) compute the historical mean return over a multi-year period of time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following should be used as the mean return when you are defining the normal distribution of an investment's annual rates of return?

A) arithmetic average return for the period

B) geometric average return for the period

C) total return for the period divided by N - 1

D) arithmetic average return for the period divided by N - 1

E) geometric average return for the period divided by N - 1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

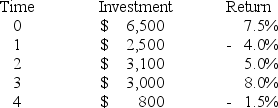

John began his investing program with a $5,500 initial investment.The table below recaps his returns each year as well as the amounts he added to his investment account.What is his dollar-weighted average return?

A) 1.5 percent

B) 1.8 percent

C) 2.0 percent

D) 2.2 percent

E) 2.8 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

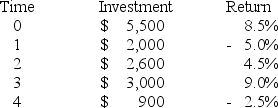

John began his investing program with a $5,500 initial investment.The table below recaps his returns each year as well as the amounts he added to his investment account.What is his dollar-weighted average return?

A) 1.5 percent

B) 1.8 percent

C) 2.0 percent

D) 2.2 percent

E) 2.6 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Louis owns a stock that has an average geometric return of 10.50 percent and an average arithmetic return of 11.00 percent over the past six years.What average annual rate of return should Louis expect to earn over the next four years?

A) 10.38 percent

B) 10.40 percent

C) 10.64 percent

D) 10.70 percent

E) 10.81 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past five years,an investment produced annual returns of 16.5,21,-18,4,and 17 percent,respectively.What is the geometric average return?

A) 6.42 percent

B) 7.06 percent

C) 8.00 percent

D) 15.60 percent

E) 16.00 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has an average historical risk premium of 5.6 percent.The expected risk-free rate for next year is 2.4 percent.What is the expected rate of return on this stock for next year?

A) 6.50 percent

B) 7.53 percent

C) 8.00 percent

D) 9.34 percent

E) 11.70 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,ABC stock returned 11.43 percent,the risk-free rate was 3.0 percent,and the inflation rate was 2.5 percent.What was the risk premium on ABC stock?

A) 8.20 percent

B) 8.43 percent

C) 8.60 percent

D) 8.88 percent

E) 8.97 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leeanne owns a stock that has an average geometric return of 12.30 percent and an average arithmetic return of 12.55 percent over the past six years.What average annual rate of return should Leeanne expect to earn over the next four years?

A) 12.38 percent

B) 12.40 percent

C) 12.44 percent

D) 12.47 percent

E) 12.51 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average risk premium on large-company stocks for the period 1926-2015 was:

A) 6.7 percent.

B) 8.3 percent.

C) 8.5 percent.

D) 12.3 percent.

E) 13.6 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past ten years,large-company stocks have returned an average of 9.8 percent annually,long-term corporate bonds have earned 4.6 percent,and U.S.Treasury bills have returned 3.0 percent.How much additional risk premium would you have earned if you had invested in large-company stocks rather than long-term corporate bonds over those ten years?

A) 1.7 percent

B) 3.7 percent

C) 5.2 percent

D) 5.8 percent

E) 8.1 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past four years,Jellystone Quarry stock produced returns of 12.5,15.1,8.7,and 2.6 percent,respectively.For the same time period,the risk-free rate 4.7,5.3,3.9,and 3.4 percent,respectively.What is the arithmetic average risk premium on this stock during these four years?

A) 5.13 percent

B) 5.25 percent

C) 5.40 percent

D) 5.83 percent

E) 5.97 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Celsius stock had year end prices of $42,$37,$44,and $46 over the past four years,respectively.What is the arithmetic average rate of return?

A) 3.17 percent

B) 3.85 percent

C) 4.28 percent

D) 10.63 percent

E) 11.79 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past four years,Hi-Tech Development stock returned 35.2,38.8,18.4,and -32.2 percent annually.What is the arithmetic average return?

A) 15.05 percent

B) 17.67 percent

C) 20.53 percent

D) 24.20 percent

E) 32.25 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct based on the historical returns for the period 1926-2016?

A) For the period, Treasury bills yielded a higher rate of return than long-term government bonds.

B) The inflation rate exceeded the rate of return on Treasury bills during some years.

C) Small-company stocks outperformed large-company stocks every year during the period.

D) Bond prices, in general, were more volatile than stock prices.

E) For the period, large-company stocks outperformed small-company stocks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has an average arithmetic return of 10.55 percent and an average geometric return of 10.41 percent based on the annual returns for the last 15 years.What is projected average annual return on this stock for the next 10 years?

A) 10.17 percent

B) 10.21 percent

C) 10.38 percent

D) 10.46 percent

E) 10.79 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jeremy owns a stock that has historically returned 7.5 percent annually with a standard deviation of 10.2 percent.There is only a 0.5 percent chance that the stock will produce a return greater than ________ percent in any one year.

A) 20.9

B) 22.9

C) 32.2

D) 38.1

E) 54.8

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital gains yield is equal to:

A) (Pt - Pt + 1 + Dt + 1) /Pt + 1.

B) (Pt + 1 - Pt + Dt) /Pt.

C) Dt + 1/Pt.

D) (Pt + 1 - Pt) /Pt.

E) (Pt + 1 - Pt) /Pt + 1.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 104

Related Exams