A) the nominal cost of inflation.

B) the shoe-leather cost of inflation.

C) the menu cost of inflation.

D) the implied cost of inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suzie Homemaker works in her home as a full-time caretaker and homemaker.Officially,she is:

A) employed.

B) unemployed.

C) not in the labor force.

D) a discouraged worker.

Correct Answer

verified

Correct Answer

verified

True/False

Unexpected inflation harms both debtors and individuals who live on fixed incomes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price index can be constructed by:

A) dividing the value of a market basket by the rate of inflation.

B) dividing the current-year value of a market basket by the base-year value of the same market basket and multiplying by 100.

C) multiplying the value of a market basket by the rate of inflation.

D) multiplying the current-year value of a market basket by the base-year value of the same market basket and dividing by 100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most significant real economic cost of high unemployment is:

A) the money cost of unemployment insurance payments to the unemployed.

B) the lost tax revenue that might have been paid by persons if they had worked.

C) the difference in income between a person's lost job and new job.

D) the potential goods and services that might have been produced but weren't.

Correct Answer

verified

Correct Answer

verified

True/False

Nearly every society desires to achieve the macroeconomic goals of high employment,a stable price level,and high economic growth.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

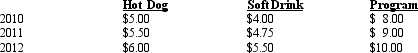

Exhibit 18-2 Assume that 2010 is the base year with a price index of 100 and that one of each good is included in the market basket.

Refer to Exhibit 18-2.What would the price index equal in 2011?

Refer to Exhibit 18-2.What would the price index equal in 2011?

A) 88.3

B) 101.1

C) 113.2

D) 126.5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The index of leading economic indicators:

A) provide accurate information on the duration of downturns in the economy.

B) virtually always predicts downturns in the economy with a lead time of six months.

C) can result in a self-fulfilling prophecy if business firms respond to leading economic indicator predictions.

D) provide accurate information on the depth of downturns in the economy.

Correct Answer

verified

Correct Answer

verified

True/False

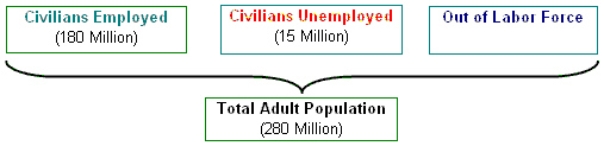

The unemployment rate measures the number of unemployed people expressed as a percentage of the total population.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 18-1  Refer to Exhibit 18-1.From the data provided,the unemployment rate is approximately ____ percent.

Refer to Exhibit 18-1.From the data provided,the unemployment rate is approximately ____ percent.

A) 4.5

B) 7.7

C) 9.2

D) 5.4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term full employment implies an unemployment rate of:

A) zero

B) approximately 5%

C) approximately 10%

D) 100%

Correct Answer

verified

Correct Answer

verified

True/False

Roughly 60 percent of women participate in the labor force today.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given a fixed nominal interest rate on a loan,unanticipated inflation:

A) decreases the burden of paying off the loan.

B) increases the burden of paying off the loan.

C) does not alter the burden of paying off the loan.

D) benefits savers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following observations is false?

A) Both CPI and GDP deflator tend to move in the same direction.

B) GDP deflator tends to be much more volatile than CPI.

C) Both CPI and GDP deflator probably overstate the inflation rate.

D) both a. and c. are false.

Correct Answer

verified

Correct Answer

verified

True/False

Cyclical unemployment rises and falls with fluctuations in the macroeconomy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true?

A) A depression is a recession that is mild and relatively brief.

B) The expansions and contractions of real world business cycles last varying lengths of time and often differ in magnitude.

C) The timing of business fluctuations is regular and therefore easily predictable.

D) During the contractionary phase of the business cycle, the rate of unemployment is generally quite low.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A discouraged worker is someone who:

A) has a job, but wants to get a different one.

B) is unemployed and looking for work.

C) quits a job and is unable to collect unemployment compensation.

D) gives up looking for work, and is no longer counted as unemployed.

Correct Answer

verified

Correct Answer

verified

True/False

Economists believe that the Consumer Price Index tends to overstate the actual rate of inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During an inflationary period,those most likely to suffer reduced wealth are those who are holding their wealth in:

A) gold.

B) real estate.

C) currency.

D) stocks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation:

A) can cause a redistribution of income from creditors to borrowers.

B) may discourage investment and economic growth.

C) can decrease the value of a nation's currency relative to other nations.

D) may result in any of the above.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 171

Related Exams