A) $760.

B) $1,080.

C) $1,440.

D) $1,920.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

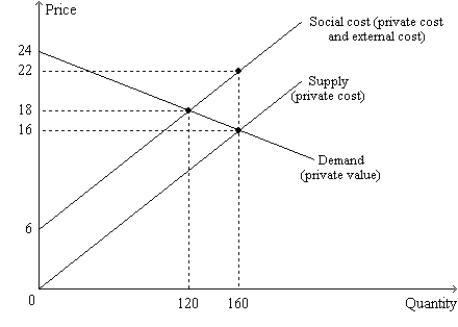

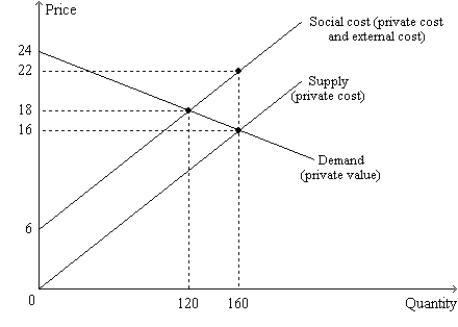

Figure 10-10  -Refer to Figure 10-10. A decrease in output from 160 units to 120 units would

-Refer to Figure 10-10. A decrease in output from 160 units to 120 units would

A) move the market from a socially efficient outcome to a socially inefficient outcome.

B) reduce the external cost per unit of output.

C) increase total economic well-being.

D) not be an action of which a benevolent social planner would approve.

Correct Answer

verified

Correct Answer

verified

True/False

The Coase theorem suggests that taxes should be enacted to alleviate the effects of negative externalities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

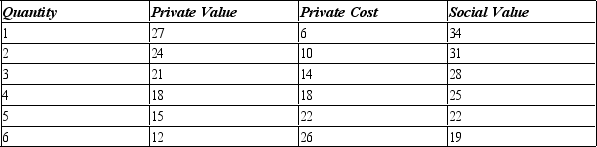

Table 10-2

The following table shows the private value, private cost, and social value for a market with a positive externality.

-Refer to Table 10-2. What is the socially-optimal level of output in this market?

-Refer to Table 10-2. What is the socially-optimal level of output in this market?

A) 3 units

B) 4 units

C) 5 units

D) 6 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming transaction costs are small, the Coase theorem would predict that private parties could arrive at an efficient solution for which of the following problems?

A) One neighbor doesn't mow his lawn.

B) One neighbor doesn't paint her house.

C) One neighbor comes home on his noisy motorcycle late at night.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gasoline tax

A) is similar to most other taxes in that it causes deadweight losses.

B) produces the unfortunate side-effect of making the roads more dangerous.

C) can be viewed as a corrective tax aimed at multiple negative externalities associated with driving.

D) can be viewed as a command-and-control policy aimed at discouraging people from driving.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a negative externality associated with driving cars?

A) congestion

B) pollution

C) repairs

D) accidents

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

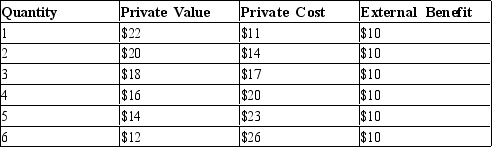

Table 10-3

-Refer to Table 10-3. The table represents a market in which

-Refer to Table 10-3. The table represents a market in which

A) there is no externality.

B) there is a positive externality.

C) there is a negative externality.

D) The answer cannot be determined from inspection of the table.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

University researchers create a positive externality because what they discover in their research labs can easily be learned by others who haven't contributed to the research costs. Suppose that the federal government gives grants to these researchers equal to the their per-unit production externality. What is the relationship between the equilibrium quantity of university research and the socially optimal quantity of university research produced?

A) The equilibrium quantity is greater than the socially optimal quantity.

B) They are equal.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) A patent is a way for the government to encourage the production of a good with technology spillovers.

B) A tax is a way for the government to reduce the production of a good with a negative externality.

C) A tax that accurately reflects social costs produces the socially optimal outcome.

D) Government policies cannot improve upon private market outcomes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corrective tax is also known as:

A) a command-and-control regulation.

B) a Coase tax.

C) a Pigovian tax.

D) a Smithian tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes that are enacted to mitigate the effects of negative externalities are sometimes called

A) control taxes.

B) command levies.

C) Pigovian taxes.

D) Marshallian taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internalizing a positive externality will cause the demand curve to

A) shift to the right.

B) shift to the left.

C) become more elastic.

D) remain unchanged.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A positive externality arises when a person engages in an activity that has

A) an adverse effect on a bystander who is not compensated by the person who causes the effect.

B) an adverse effect on a bystander who is compensated by the person who causes the effect.

C) a beneficial effect on a bystander who pays the person who causes the effect.

D) a beneficial effect on a bystander who does not pay the person who causes the effect.

Correct Answer

verified

Correct Answer

verified

True/False

A technology spillover is a type of negative externality.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-10  -Refer to Figure 10-10. "The social cost of the last unit produced exceeds the value to buyers of the last unit produced by $3." This statement is correct at which quantity of output?

-Refer to Figure 10-10. "The social cost of the last unit produced exceeds the value to buyers of the last unit produced by $3." This statement is correct at which quantity of output?

A) 120 units

B) 140 units

C) 160 units

D) The statement is true at all quantities of output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

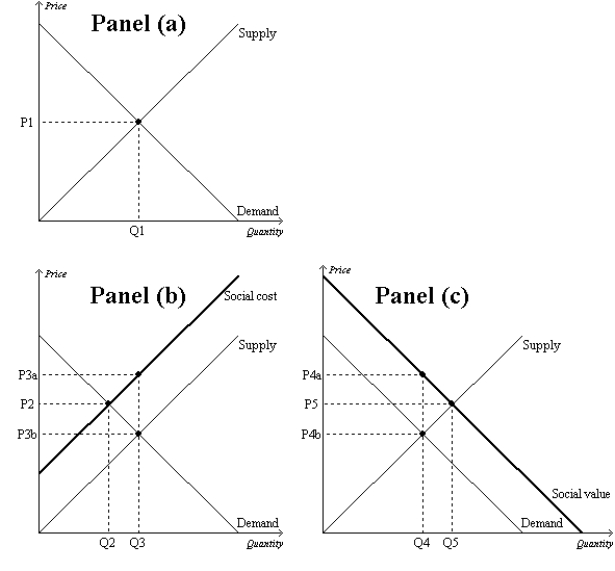

Figure 10-9

-Refer to Figure 10-9. The installation of a scrubber in a smokestack reduces the emission of harmful chemicals from the smokestack. Therefore, the market for smokestack scrubbers is shown in

-Refer to Figure 10-9. The installation of a scrubber in a smokestack reduces the emission of harmful chemicals from the smokestack. Therefore, the market for smokestack scrubbers is shown in

A) Panel (a) .

B) Panel (b) .

C) Panel (c) .

D) Both (b) and (c) are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two firms, A and B, each currently emit 100 tons of chemicals into the air. The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution emitted into the air. The government gives each firm 40 pollution permits, which it can either use or sell to the other firm. It costs Firm A $200 for each ton of pollution that it eliminates before it is emitted into the air, and it costs Firm B $100 for each ton of pollution that it eliminates before it is emitted into the air. After the two firms buy or sell pollution permits from each other, we would expect that Firm A will emit

A) 20 fewer tons of pollution into the air, and Firm B will emit 100 fewer tons of pollution into the air.

B) 100 fewer tons of pollution into the air, and Firm B will emit 20 fewer tons of pollution into the air.

C) 50 fewer tons of pollution into the air, and Firm B will emit 50 fewer tons of pollution into the air.

D) 20 more tons of pollution into the air, and Firm B will emit 100 fewer tons of pollution into the air.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that flu shots create a positive externality equal to $8 per shot. Further suppose that the government offers a $6-per-shot subsidy to producers. What is the relationship between the equilibrium quantity and the socially optimal quantity of flu shots produced?

A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A paper plant produces water pollution during the production process. If the government forces the plant to internalize the negative externality, then the

A) supply curve for paper would shift to the right.

B) supply curve for paper would shift to the left.

C) demand curve for paper would shift to the right.

D) demand curve for paper would shift to the left.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 524

Related Exams