A) Medicare tax

B) Employee address

C) Employee signature

D) Garnishments

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _______ is the master document that contains an employee's marital status,deductions,and year-to-date earnings.

A) Payroll register

B) Form W-4

C) Employee earnings record

D) Personnel file

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a financial report that is reflects the effects of debit and credit General Journal entries used in payroll accounting? (Select all that apply)

A) Income Statement

B) Trial Balance

C) Balance Sheet

D) Labor Distribution Report

Correct Answer

verified

Correct Answer

verified

Multiple Choice

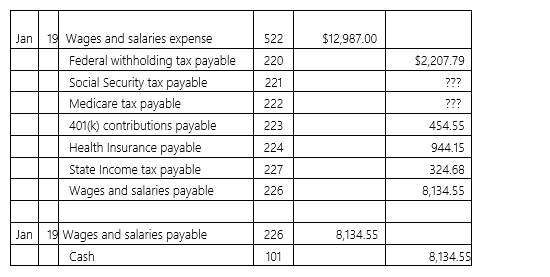

The following data is for the January 19 pay date for Waryzbok Inc.:

Which of the following represents the missing Social Security and Medicare taxes?

Which of the following represents the missing Social Security and Medicare taxes?

A) Social Security tax,$746.66;Medicare tax,$174.62

B) Social Security tax,$188.31;Medicare tax,$805.19

C) Social Security tax,$204.15: Medicare tax,$792.35

D) Social Security tax,$792.35;Medicare tax,$204.15

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To which items is information from the payroll register transferred (select all that apply) ?

A) Employee earnings record

B) General Journal

C) Labor reports

D) Company website

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does a payroll accountant keep track of employee's year-to-date earnings for wage bases on taxes like FICA,FUTA,and SUTA?

A) Form W-4

B) Form W-2

C) Payroll register

D) Employee earnings record

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of the June 11 pay date,the General Ledger account for Burling Mills has a balance of $14,289 in its Federal withholding tax payable account.A credit of $16,250 is recorded on the June 25 pay date.What is the balance in the account?

A) Debit $1,961

B) Debit $30,539

C) Credit $1,961

D) Credit $30,539

Correct Answer

verified

Correct Answer

verified

True/False

The General Journal contains records of a firm's financial transactions,which appear chronologically.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

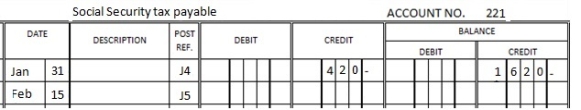

Rushing River Boats has the following data in its Social Security tax payable General Ledger account:  It is a monthly schedule depositor.What entry should appear in the General Ledger to reflect the tax remittance on February 15?

It is a monthly schedule depositor.What entry should appear in the General Ledger to reflect the tax remittance on February 15?

A) Credit $420

B) Debit $420

C) Credit $1,620

D) Debit $1,620

Correct Answer

verified

Correct Answer

verified

True/False

The payroll register is identical for each company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is important that the payroll accountant understand the flow of the payroll transactions,especially when working with ______________.

A) The payroll register

B) The employee earnings record

C) Accounting software packages

D) Payroll tax reports

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is true about the trial balance?

A) It contains a detailed listing of every transaction during a period.

B) It may contain whatever accounts the accountant wishes to include.

C) Payroll accounts do not appear on it because of their changeable nature.

D) The total of the debits must equal the total of the credits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On which financial report will employer-paid portions of health insurance premiums be listed?

A) The statement of owners' equity

B) The income statement

C) The balance sheet

D) The labor report

Correct Answer

verified

Correct Answer

verified

Multiple Choice

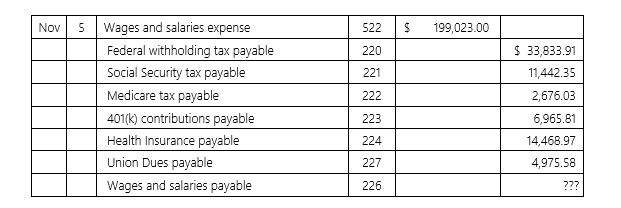

Kierofree Air Tours has the following payroll data for its November 5 pay date:

How much is the net pay?

How much is the net pay?

A) $199,023.00

B) $185,216.26

C) $142,578.94

D) $124,660.35

Correct Answer

verified

Correct Answer

verified

Multiple Choice

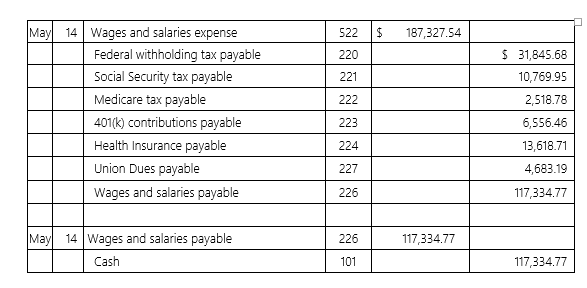

Supermeg Dry Cleaners had the following payroll data for its May 14 pay date:

When the firm remits the union dues for this pay period,what is the correct General Journal entry?

When the firm remits the union dues for this pay period,what is the correct General Journal entry?

A) Debit Cash $6,556.46;Credit Union Dues Payable $4,683.19

B) Debit Union Dues Payable $4,683.19;Credit Cash $4,683.19

C) Debit Cash $4,683.19;Credit Union Dues Payable $4,683.19

D) Debit Union Dues Payable $4,683.19;Credit Cash $6,556.46

Correct Answer

verified

Correct Answer

verified

True/False

In the General Ledger,the debit column reflects the balance of the account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

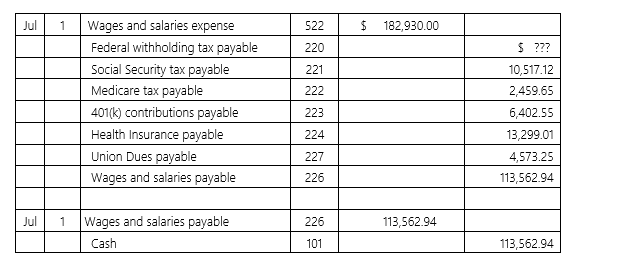

Dooley Publishing has the following payroll data for its July 1 pay date:

How much Federal withholding tax was deducted from employees' pay?

How much Federal withholding tax was deducted from employees' pay?

A) $15,203.14

B) $42,083.87

C) $32,115.48

D) $29,391.98

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A(n) ________________ is a collection of cash and other items that are used in the operation of the business.

A) Liability

B) Asset

C) Revenue

D) Equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _________________ reflects all unpaid payroll liabilities at any point in the financial period.

A) Income statement

B) Statement of Owners' Equity

C) Payroll register

D) Balance sheet

Correct Answer

verified

Correct Answer

verified

True/False

A debit always decreases the balance of an account.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 70