A) never pay back.

B) have a negative net present value.

C) have a negative internal rate of return.

D) produce more cash inflows than outflows in today's dollars.

E) have an internal rate of return that equals the required return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reinvestment approach to the modified internal rate of return:

A) individually discounts each separate cash flow back to the present.

B) reinvests all the cash flows, including the initial cash flow, to the end of the project.

C) discounts all negative cash flows to the present and compounds all positive cash flows to the end of the project.

D) discounts all negative cash flows back to the present and combines them with the initial cost.

E) compounds all of the cash flows, except for the initial cash flow, to the end of the project.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diamond Enterprises is considering a project that will produce cash inflows of $238,000 a year for three years followed by $149,000 in year four. What is the internal rate of return if the initial cost of the project is $749,000?

A) 3.43 percent

B) 4.29 percent

C) 5.81 percent

D) 6.32 percent

E) 7.55 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Professional Properties is considering remodeling the office building it leases to Heartland Insurance. The remodeling costs are estimated at $3.4 million. If the building is remodeled, Heartland Insurance has agreed to pay an additional $820,000 a year in rent for the next 5 years. The discount rate is 15 percent. What is the benefit of the remodeling project to Professional Properties?

A) -$651,233

B) -$489,072

C) $5,214

D) $128,399

E) $311,417

Correct Answer

verified

Correct Answer

verified

Multiple Choice

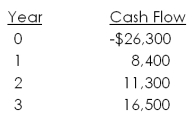

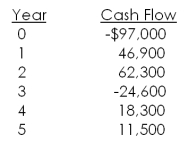

What is the IRR of the following set of cash flows?

A) 12.93 percent

B) 14.90 percent

C) 15.81 percent

D) 16.33 percent

E) 17.78 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are using a net present value profile to compare investments A and B, which are mutually exclusive. Which one of the following statements correctly applies to the crossover point between these two?

A) The internal rate of return for project A equals that of project B, but generally does not equal zero.

B) The internal rate of return of each project is equal to zero.

C) The net present value of each project is equal to zero.

D) The net present value of project A equals that of project B, but generally does not equal zero.

E) The net present value of each project is equal to the respective project's initial cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The modified internal rate of return is specifically designed to address the problems associated with which one of the following?

A) Mutually exclusive projects

B) Unconventional cash flows

C) Long-term projects

D) Negative net present values

E) Crossover points

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A proposed project requires an initial cash outlay of $749,000 for equipment and an additional cash outlay of $48,500 in year one to cover operating costs. During years 2 through 4, the project will generate cash inflows of $354,000 a year. What is the net present value of this project at a discount rate of 16 percent?

A) -$105,427

B) -$41,209

C) $67,333

D) $128,612

E) $239,602

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

What is the payback period for a $27,500 investment with the following cash flows?

A) 3.54 years

B) 3.89 years

C) 4.22 years

D) 4.54 years

E) The project never pays back.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

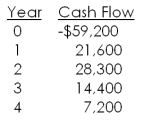

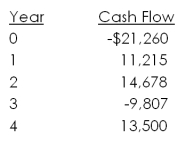

What is the net present value of a project with the following cash flows if the discount rate is 17 percent?

A) -$8,406.11

B) -$7,231.71

C) -$3,089.16

D) $1,407.92

E) $3,508.01

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are making a $120,000 investment and feel that a 10 percent rate of return is reasonable given the nature of the risks involved. You feel you will receive $48,000 in the first year, $54,000 in the second year, and $56,000 in the third year. You expect to pay out $12,000 as an additional investment in the fourth year. What is the net present value of this investment given your expectations?

A) $2,141.93

B) $5,607.16

C) $14,206.10

D) $16,233.33

E) $18,534.25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

EEG, Inc. is considering a new project that will require an initial cash investment of $388,000. The project will produce no cash flows for the first two years. The projected cash flows for years 3 through 7 are $69,000, $88,000, $102,000, $140,000, and $160,000, respectively. How long will it take the firm to recover its initial investment in this project?

A) 3.81 years

B) 3.98 years

C) 5.57years

D) 5.92 years

E) The project never pays back.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

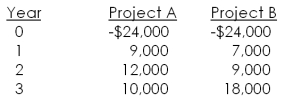

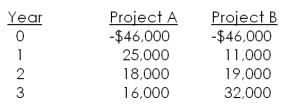

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. Which project should you accept and what is the best reason for that decision?

A) Project A; because it pays back faster

B) Project A; because it has the higher profitability index

C) Project B; because it has the higher profitability index

D) Project A; because it has the higher net present value

E) Project B; because it has the higher net present value

Correct Answer

verified

Correct Answer

verified

Multiple Choice

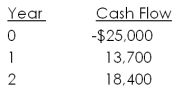

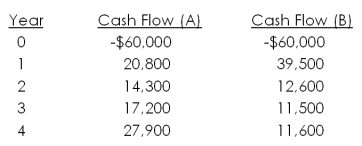

Joe and Rich are both considering investing in a project with the following cash flows. Joe is content earning a 9 percent return but Rich desires a return of 16 percent. Who, if either, should accept this project?

A) Joe, but not Rich

B) Rich, but not Joe

C) neither Joe nor Rich

D) both Joe and Rich

E) Joe, and possibly Rich, who will be neutral on this decision as his net present value will equal zero

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. Which project should you accept and what is the best reason for that decision?

A) Project A; because it pays back faster

B) Project A; because it has the higher internal rate of return

C) Project B; because it has the higher internal rate of return

D) Project A; because it has the higher net present value

E) Project B; because it has the higher net present value

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of the following cash flows if the relevant discount rate is 8.6 percent?

A) $3,560.87

B) $5,006.19

C) $8,215.46

D) $13,058.39

E) $18,874.45

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chestnut Tree Farms has identified the following two mutually exclusive projects:  Over what range of discount rates would you choose Project A?

Over what range of discount rates would you choose Project A?

A) 8.28 percent or less

B) 8.28 percent or more

C) 9.33 percent or more

D) 9.55 percent or less

E) 9.55 percent or more

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of the following cash flows if the relevant discount rate is 8 percent?

A) $1,587.61

B) $2,311.92

C) $2,900.15

D) $3,248.87

E) $3,545.60

Correct Answer

verified

Correct Answer

verified

Multiple Choice

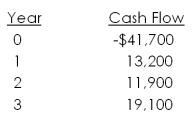

What is the NPV of the following set of cash flows at a discount rate of zero percent? What if the discount rate is 15 percent?

A) -$41,700; -$8,665.07

B) -$41,700; $1,208.19

C) $0; $1,208.19

D) $2,500; $1,208.19

E) $2,500; -$8,665.07

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

The average accounting return:

A) measures profitability rather than cash flow.

B) discounts all values to today's dollars.

C) is expressed as a percentage of an investment's current market value.

D) will equal the required return when the net present value equals zero.

E) is used more often by CFOs than the internal rate of return.

Correct Answer

verified

A

Correct Answer

verified

Showing 1 - 20 of 114

Related Exams