A) Payback

B) Profitability index

C) Accounting rate of return

D) Internal rate of return

E) Net present value

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Budget Place is considering opening a new store at a start up cost of $700,000. The initial investment will be depreciated straight line to zero over the 15-year life of the project. What is the average accounting rate of return?

A) 13.05 percent

B) 13.68 percent

C) 14.01 percent

D) 14.59 percent

E) 14.76 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

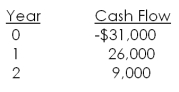

Soft and Cuddly is considering a new toy that will produce the following cash flows. Should the company produce this toy if the firm requires a 15 percent rate of return?

A) Yes; the project's rate of return is 10.21 percent

B) Yes; the project's rate of return is 11.47 percent

C) No; the project's rate of return is 10.21 percent

D) No; the project's rate of return is 11.47 percent

E) No; the internal rate of return is zero percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) If the IRR exceeds the required return, the profitability index will be less than 1.0.

B) The profitability index will be greater than 1.0 when the net present value is negative.

C) When the internal rate of return is greater than the required return, the net present value is positive.

D) Projects with conventional cash flows have multiple internal rates of return.

E) If two projects are mutually exclusive, you should select the project with the shortest payback period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following analytical methods is based on net income?

A) Profitability index

B) Internal rate of return

C) Average accounting return

D) Modified internal rate of return

E) Payback

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis ignores cash flows?

A) Profitability index

B) Net present value

C) Average accounting return

D) Modified internal rate of return

E) Internal rate of return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following can be defined as a benefit-cost ratio?

A) Net present value

B) Internal rate of return

C) Profitability index

D) Accounting rate of return

E) Modified internal rate of return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is true if the managers of a firm only accept projects that have a profitability index greater than 1.5?

A) The firm should increase in value each time the firm accepts a new project.

B) The firm is most likely steadily losing value.

C) The price of the firm's stock should remain constant.

D) The net present value of each new project is zero.

E) The internal rate of return on each new project is zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The net present value is a measure of profits expressed in today's dollars.

B) The net present value is positive when the required return exceeds the internal rate of return.

C) If the initial cost of a project is increased, the net present value of that project will also increase.

D) If the internal rate of return equals the required return, the net present value will equal zero.

E) Net present value is equal to an investment's cash inflows discounted to today's dollars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lester's Feed Mill is spending $230,000 to update its facility. The company estimates that this investment will improve its cash inflows by $46,500 a year for 10 years. What is the payback period?

A) 4.03 years

B) 4.95 years

C) 5.39 years

D) 5.67 years

E) The project never pays back.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback period is the length of time it takes an investment to generate sufficient cash flows to enable the project to:

A) produce a positive annual cash flow.

B) produce a positive cash flow from assets.

C) offset its fixed expenses.

D) offset its total expenses.

E) recoup its initial cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicators offers the best assurance that a project will produce value for its owners?

A) PI equal to zero

B) Negative rate of return

C) Positive AAR

D) Positive IRR

E) Positive NPV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You're trying to determine whether or not to expand your business by building a new manufacturing plant. The plant has an installation cost of $26 million, which will be depreciated straight-line to zero over its three-year life. If the plant has projected net income of $2,348,000, $2,680,000, and $1,920,000 over these three years, what is the project's average accounting return (AAR) ?

A) 11.69 percent

B) 14.14 percent

C) 15.08 percent

D) 17.82 percent

E) 19.21 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of a project that has an initial cost of $40,000 and produces cash inflows of $8,000 a year for 11 years if the discount rate is 15 percent?

A) $798.48

B) $1,240.23

C) $1,869.69

D) $2,111.41

E) $2,470.01

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average net income of a project divided by the project's average book value is referred to as the project's:

A) required return.

B) market rate of return.

C) internal rate of return.

D) average accounting return.

E) discounted rate of return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis is most appropriate to use when two investments are mutually exclusive?

A) Internal rate of return

B) Profitability index

C) Net present value

D) Modified internal rate of return

E) Average accounting return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charles Henri is considering investing $36,000 in a project that is expected to provide him with cash inflows of $12,000 in each of the first two years and $18,000 for the following year. At a discount rate of zero percent this investment has a net present value of _____, but at the relevant discount rate of 17 percent the project's net present value is _____.

A) $0; -$5,739

B) $0; -$3,406

C) $6,000; -$5,739

D) $6,000; -$3,406

E) $6,000; $1,897

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicates that a project is definitely acceptable?

A) Profitability index greater than 1.0

B) Negative net present value

C) Modified internal rate return that is lower than the requirement

D) Zero internal rate of return

E) Positive average accounting return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Auto Shop is buying some new equipment at a cost of $218,900. This equipment will be depreciated on a straight line basis to a zero book value its 8-year life. The equipment is expected to generate net income of $36,000 a year for the first four years and $22,000 a year for the last four years. What is the average accounting rate of return?

A) 15.48 percent

B) 17.76 percent

C) 18.09 percent

D) 23.72 percent

E) 26.50 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Blue Goose is considering a project with an initial cost of $42,700. The project will produce cash inflows of $8,000 a year for the first two years and $12,000 a year for the following three years. What is the payback period?

A) 2.87 years

B) 3.23 years

C) 3.41 years

D) 3.79 years

E) 4.23 years

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 114

Related Exams