Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding a tax on a good and the resulting deadweight loss?

A) The greater are the price elasticities of supply and demand,the greater is the deadweight loss.

B) The greater is the price elasticity of supply and the smaller is the price elasticity of demand,the greater is the deadweight loss.

C) The smaller are the decreases in quantity demanded and quantity supplied,the greater the deadweight loss.

D) The smaller is the wedge between the effective price to sellers and the effective price to buyers,the greater is the deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

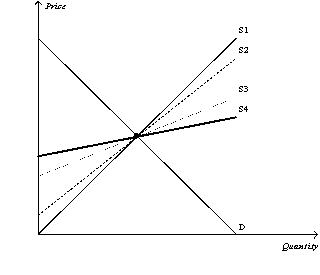

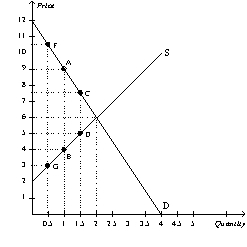

Figure 8-16  -Refer to Figure 8-16.Suppose the government imposes a $1 tax in each of the four markets represented by supply curves S1,S2,S3,and S4.The deadweight will be the largest in the market represented by

-Refer to Figure 8-16.Suppose the government imposes a $1 tax in each of the four markets represented by supply curves S1,S2,S3,and S4.The deadweight will be the largest in the market represented by

A) S1.

B) S2.

C) S3.

D) S4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

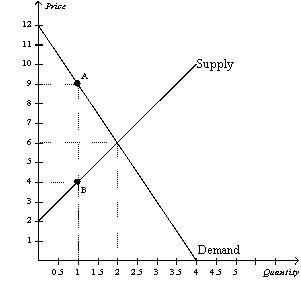

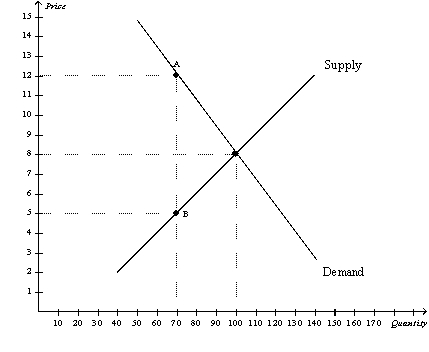

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2.The loss of consumer surplus associated with some buyers dropping out of the market as a result of the tax is

-Refer to Figure 8-2.The loss of consumer surplus associated with some buyers dropping out of the market as a result of the tax is

A) $0.

B) $1.50.

C) $3.

D) $4.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

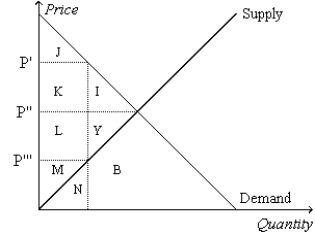

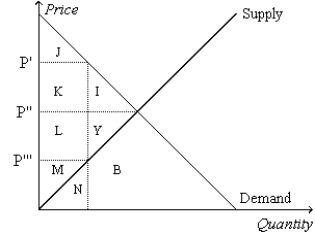

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by I+J+K+L+M+Y represents

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The area measured by I+J+K+L+M+Y represents

A) total surplus before the tax.

B) total surplus after the tax.

C) consumer surplus before the tax.

D) deadweight loss from the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-2 Tom mows Stephanie's lawn for $25.Tom's opportunity cost of mowing Stephanie's lawn is $20,and Stephanie's willingness to pay Tom to mow her lawn is $28. -Refer to Scenario 8-2.Assume Tom is required to pay a tax of $3 each time he mows a lawn.Which of the following results is most likely?

A) Stephanie now will decide to mow her own lawn,and Tom will decide it is no longer in his interest to mow Stephanie's lawn.

B) Stephanie is willing to pay Tom to mow her lawn,but Tom will decline her offer.

C) Tom is willing to mow Stephanie's lawn,but Stephanie will decide to mow her own lawn.

D) Tom and Stephanie still can engage in a mutually-agreeable trade.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A decrease in the size of a tax always decreases the tax revenue raised by that tax.

B) A decrease in the size of a tax always decreases the deadweight loss of that tax.

C) Tax revenue decreases when there is a small decrease in the tax rate and the economy is on the downward-sloping part of the Laffer curve.

D) An increase in the size of a tax leads to an increase in the deadweight loss of the tax only if the economy is on the upward-sloping part of the Laffer curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

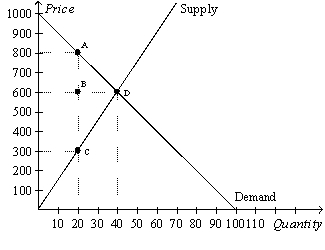

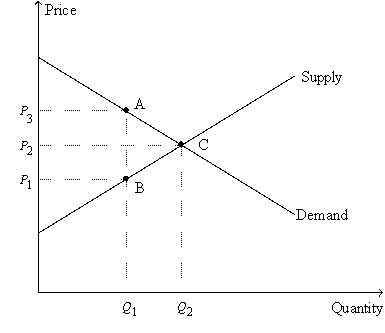

Figure 8-9

The vertical distance between points A and C represent a tax in the market.  -Refer to Figure 8-9.The amount of the tax on each unit of the good is

-Refer to Figure 8-9.The amount of the tax on each unit of the good is

A) $20.

B) $200.

C) $300.

D) $500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

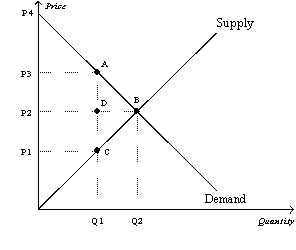

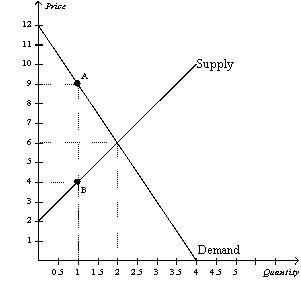

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3.The loss in consumer surplus caused by the tax is measured by the area

-Refer to Figure 8-3.The loss in consumer surplus caused by the tax is measured by the area

A) P1P3AC.

B) P3ABP2.

C) P1P3ABC.

D) ABC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-1  -Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The producer surplus before the tax is measured by the area

-Refer to Figure 8-1.Suppose the government imposes a tax of P' - P'''.The producer surplus before the tax is measured by the area

A) I+J+K.

B) I+Y.

C) L+M+Y.

D) M.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

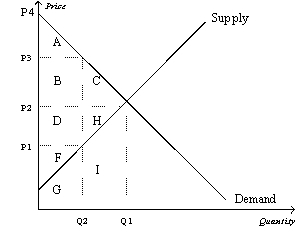

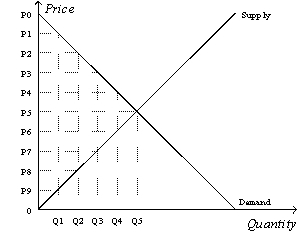

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5.Producer surplus before the tax was levied is represented by area

-Refer to Figure 8-5.Producer surplus before the tax was levied is represented by area

A) A.

B) A+B+C.

C) D+H+F.

D) F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-11  -Refer to Figure 8-11.The price labeled as P1 on the vertical axis represents the price

-Refer to Figure 8-11.The price labeled as P1 on the vertical axis represents the price

A) received by sellers before the tax is imposed.

B) received by sellers after the tax is imposed.

C) paid by buyers before the tax is imposed.

D) paid by buyers after the tax is imposed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-17

The vertical distance between points A and B represents the original tax.  -Refer to Figure 8-17.The original tax can be represented by the vertical distance AB.Suppose the government is deciding whether to lower the tax to CD or raise it to FG.Which of the following statements is not correct?

-Refer to Figure 8-17.The original tax can be represented by the vertical distance AB.Suppose the government is deciding whether to lower the tax to CD or raise it to FG.Which of the following statements is not correct?

A) Compared to the original tax,the larger tax will increase tax revenue.

B) Compared to the original tax,the smaller tax will decrease deadweight loss.

C) Compared to the original tax,the smaller tax will decrease tax revenue.

D) Compared to the original tax,the larger tax will increase deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-10  -Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The tax revenue is

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The tax revenue is

A) (P0-P2) x Q2.

B) (P2-P8) x Q2.

C) (P2-P5) x Q5.

D) (P5-P8) x Q5.

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on sellers,consumer surplus and producer surplus both decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4.The per-unit burden of the tax on sellers is

-Refer to Figure 8-4.The per-unit burden of the tax on sellers is

A) $7.

B) $5.

C) $4.

D) $3.

Correct Answer

verified

Correct Answer

verified

True/False

A tax raises the price received by sellers and lowers the price paid by buyers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the supply curve for cigars is a typical,upward-sloping straight line,and the demand curve for cigars is a typical,downward-sloping straight line.Suppose the equilibrium quantity in the market for cigars is 1,000 per month when there is no tax.Then a tax of $0.50 per cigar is imposed.The effective price paid by buyers increases from $1.50 to $1.90 and the effective price received by sellers falls from $1.50 to $1.40.The government's tax revenue amounts to $475 per month.Which of the following statements is correct?

A) After the tax is imposed,the equilibrium quantity of cigars is 900 per month.

B) The demand for cigars is more elastic than the supply of cigars.

C) The deadweight loss of the tax is $12.50.

D) The tax causes a decrease in consumer surplus of $380.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on a good for which the supply is relatively elastic and the demand is relatively inelastic,

A) buyers of the good will bear most of the burden of the tax.

B) sellers of the good will bear most of the burden of the tax.

C) buyers and sellers will each bear 50 percent of the burden of the tax.

D) both equilibrium price and quantity will increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2.The per-unit burden of the tax on buyers is

-Refer to Figure 8-2.The per-unit burden of the tax on buyers is

A) $2.

B) $3.

C) $4.

D) $5.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 421

Related Exams