A) equal proportions of Shares A and B

B) more of Share A than Share B

C) more of Share B than Share A

D) more information is needed to answer this question

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Suppose that over the same period two portfolios have the same average return and the same standard deviation of return, but Portfolio A has a higher beta than Portfolio B. According to the Sharpe measure, the performance of Portfolio A ________.

A) is better than the performance of Portfolio B

B) is the same as the performance of Portfolio B

C) is poorer than the performance of Portfolio B

D) cannot be measured since there is no data on the alpha of the portfolio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Treynor-Black model, the weight of each analysed security in the portfolio should be proportional to its ________.

A) alpha/beta

B) alpha/residual variance

C) beta/residual variance

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Perfect timing ability is equivalent to having ________ on the market portfolio.

A) a call option

B) a futures contract

C) a put option

D) a forward contract

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the contribution of security selection to relative performance?

A) -0.15%

B) 0.15%

C) -0.3%

D) 0.3%

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Portfolio managers Paul Martin and Kevin Krueger each manage $1 000 000 funds. Paul Martin has perfect foresight and the call option value of his perfect foresight is $150 000. Kevin Krueger is an imperfect forecaster and correctly predicts 50% of all bull markets and 70% of all bear markets. The value of Kevin Krueger's imperfect forecasting ability is ________.

A) $30 000

B) $67 500

C) $108 750

D) $217 500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio generates an annual return of 13%, a beta of 0.7 and a standard deviation of 17%. The market index return is 14% and has a standard deviation of 21%. What is the M2 measure of the portfolio if the risk-free rate is 5%?

A) 0.58%

B) 0.68%

C) 0.78%

D) 0.88%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is very hard to statistically verify abnormal fund performance because of all except which one of the following?

A) Inevitably some fund managers experience streaks of good performance that may just be due to luck

B) The noise in realised rates of return is so large as to make it hard to identify abnormal performance in competitive markets

C) Portfolio composition is rarely stable long enough to identify abnormal performance

D) Even if successful, there is really not much value to be added by active strategies such as market timing

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

A portfolio generates an annual return of 17%, a beta of 1.2 and a standard deviation of 19%. The market index return is 12% and has a standard deviation of 16%. What is the M2 measure of the portfolio if the risk-free rate is 4%?

A) 2.15%

B) 2.76%

C) 2.94%

D) 3.14%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The comparison universe is ________.

A) the bogey portfolio

B) a set of mutual funds with similar risk characteristics to your mutual fund

C) the set of all mutual funds in the USA

D) the set of all mutual funds in the world

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A managed portfolio has a standard deviation equal to 22% and a beta of 0.9 when the market portfolio's standard deviation is 26%. The adjusted portfolio P________ needed to calculate the M2 measure will have ________ invested in the managed portfolio and the rest in T-bonds.

A) 84.6%

B) 118%

C) 18%

D) 15.4%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Henriksson found that, on average, betas of funds ________ during market advances.

A) decreased slightly

B) decreased very significantly

C) increased slightly

D) increased very significantly

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shares A and B have alphas of .01 and betas of .90. Share A has a residual variance of .020 while share B has a residual variance of .016. If Share A represents 2% of an active portfolio, share B should represent ________ of an active portfolio.

A) 1.6%

B) 2.0%

C) 2.2%

D) 2.5%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

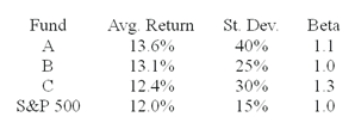

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

A) Fund A

B) Fund B

C) Fund C

D) indeterminable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio generates an annual return of 13%, a beta of 0.7 and a standard deviation of 17%. The market index return is 14% and has a standard deviation of 21%. What is the Treynor measure of the portfolio if the risk-free rate is 5%?

A) .1143

B) .1233

C) .1354

D) .1477

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The M2 measure is a variant of ________.

A) the Sharpe measure

B) the Treynor measure

C) Jensen's alpha

D) the appraisal ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The portfolio that contains the benchmark asset allocation against which a manager will be measured is often called ________.

A) the bogey portfolio

B) the Vanguard Index

C) Jensen's alpha

D) the Treynor measure

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A market timing strategy is one where asset allocation in the share market ________ when one forecasts the share market will outperform treasury bonds.

A) decreases

B) increases

C) remains the same

D) may increase or decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

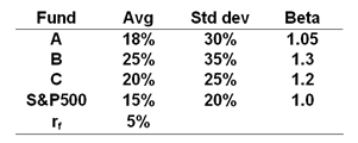

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?

A) 12.4%

B) 2.38%

C) 0.91%

D) 3.64%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the theory of active portfolio management. Shares A and B have the same beta and the same positive alpha. Share A has higher non-systematic risk than share B. You should want ________ in your active portfolio.

A) equal proportions of shares A and B

B) more of Share A than Share B

C) more of Share B than Share A

D) more information is needed to answer this question

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 54

Related Exams