A) $65.00

B) $87.00

C) $90.00

D) Both yield the same tax amount

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jesse is a part-time nonexempt employee who earns $12.50 per hour.During the last biweekly pay period he worked 35 hours.He is married with zero withholding allowances,which means his Federal income tax deduction is $10.00,and has additional Federal tax withholding of $30 per pay period.What is his net pay? (Do not round interim calculations,only round final answer to two decimal points.)

A) $354.28

B) $374.03

C) $364.03

D) $378.03

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage method of determining an employee's Federal income tax deductions __________________.

A) Is used to promote complexity in payroll practices

B) Allows payroll accountants to determine Federal income tax for the firm itself

C) Is used primarily for high wage earners and computerized payroll programs

D) Is less accurate than the results gained from using the wage-bracket method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is used in the determination of the amount of Federal income tax to be withheld from an employee per pay period?

A) Date of birth

B) Annual salary

C) Marital status

D) Prior year's tax return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steve is a full-time exempt employee at a local electricity co-operative.He earns an annual salary of $43,325 and is paid biweekly.What is his Social Security tax deduction for each pay period? (Do not round interim calculations,only round final answer to two decimal points.)

A) $123.95

B) $103.31

C) $98.67

D) $106.34

Correct Answer

verified

Correct Answer

verified

Multiple Choice

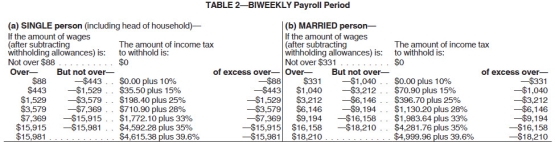

Amanda is a full-time exempt employee who earns $84,000 annually.She is married with 1 deduction and is paid biweekly.She contributes $150.00 per pay period to her 401(k) and has pre-tax health insurance and AFLAC deductions of $50.00 and $75.00,respectively.Amanda contributes $25.00 per pay period to the United Way.What is her net pay? (Use the percentage method.Do not round intermediate calculations. Round final answers to 2 decimal places.)

A) $2,394.47

B) $2,193.60

C) $2,352.25

D) $2,605.44

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adam is a part-time employee who earned $495.00 during the most recent pay period.He is married with two withholding allowances.Prior to this pay period,his year-to-date pay is $6,492.39.How much should be withheld from Adam's gross pay for Social Security tax?

A) $40.02

B) $30.69

C) $37.92

D) $28.46

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do employers use checks as an employment payment method?

A) Paying employees by check allows the employer flexibility with its bank accounts.

B) Paying employees by check increases the complexity of the payroll process.

C) Paying employees by check requires the employer to keep currency on the premises.

D) Paying employees by check offers a level of security of employee payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

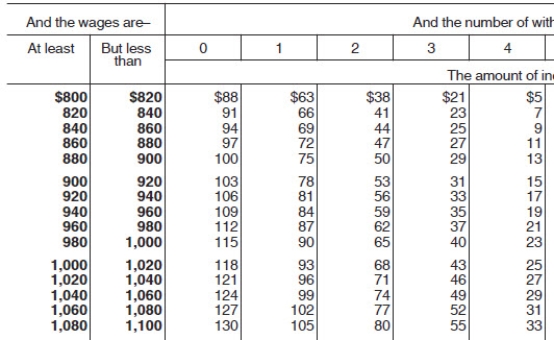

Max earned $1,019.55 during the most recent semimonthly pay period.He is single with 1 withholding allowance.Using the following table,how much should be withheld for Federal income tax?

A) $118.00

B) $94.00

C) $96.00

D) $93.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of paycards as a pay method is to ______________________________.

A) Prevent employees from opening bank accounts

B) Promote accessibility and portability of employee compensation

C) Protect payroll processes against embezzlement

D) Promote debit card use as a means of economic stimulus

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The annual payroll tax guide that the IRS distributes is called __________________.

A) The IRS tax guide

B) Publication E

C) Circular 15

D) Publication 15

Correct Answer

verified

Correct Answer

verified

Multiple Choice

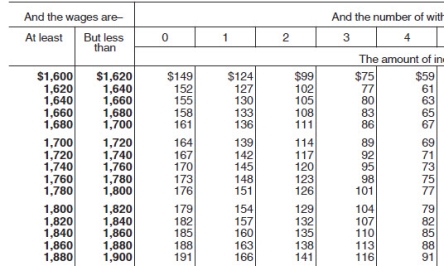

Melody is a full-time employee who earns $3,600 per month and is paid semimonthly.She is married with 1 withholding allowance (use the wage-bracket tables) .She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k) ,both of which are Identify Pre-Tax Deductions .What is her net pay? (Do not round interim calculations,only round final answer to two decimal points.)

A) $1,696.00

B) $1,524.27

C) $1,426.13

D) $1,394.87

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct sequence for computing net pay?

A) Compute gross pay then deduct withholding and add FICA taxes to obtain net pay.

B) Compute gross pay, compute FICA, deduct pre-tax amounts, and deduct taxes.

C) Compute gross pay, deduct taxes, and add voluntary deductions.

D) Compute gross pay, deduct pre-tax amounts, compute FICA, deduct taxes, and deduct post-tax amounts.

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

What is an advantage of direct deposit from the employee's perspective?

A) Long processing times for pay disbursements.

B) Secure access to compensation.

C) The requirement to have a bank account.

D) Access to payroll data on non-secured website.

Correct Answer

verified

Correct Answer

verified

True/False

The amount of Federal income tax decreases as the number of allowances increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about cash as a method of paying employees?

A) Cash is the most secure payment method.

B) Cash is the most widely used payment method.

C) Cash is readily transferable and highly liquid.

D) Cash is the most convenient pay method for employers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Disposable income is defined as:

A) An employee's net pay less living expenses like rent and utilities.

B) An employee's taxable income less Understand Post-Tax Deductions.

C) An employee's gross pay less Identify Pre-Tax Deductions.

D) An employee's pay after legally required deductions have been withheld.

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which body issued Regulation E to protect consumers from loss of deposited funds?

A) Department of Homeland Security

B) Internal Revenue Service

C) American Banking Association

D) Federal Deposit Insurance Corporation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm has fewer than 100 employees,which of the following is true?

A) It may not offer an ESOP.

B) It is not required to offer disability insurance.

C) It must match employee contributions to Federal income tax.

D) It may offer a SIMPLE defined contribution plan.

Correct Answer

verified

Correct Answer

verified

True/False

The regular Medicare tax deduction is 1.45% for employee and employer and must be paid by all employees.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 70

Related Exams