A) $2,404.91

B) $2,531.49

C) $2,658.06

D) $2,790.96

E) $2,930.51

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two equally risky annuities,each of which pays $25,000 per year for 10 years.Investment ORD is an ordinary (or deferred) annuity,while Investment DUE is an annuity due.Which of the following statements is CORRECT?

A) If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant.

B) A rational investor would be willing to pay more for DUE than for ORD, so their market prices should differ.

C) The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD.

D) The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE.

E) The present value of ORD exceeds the present value of DUE, while the future value of DUE exceeds the future value of ORD.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An uncle of yours who is about to retire wants to sell some of his stock and buy an annuity that will provide him with income of $50,000 per year for 30 years,beginning a year from today.The going rate on such annuities is 7.25%.How much would it cost him to buy such an annuity today?

A) $574,924

B) $605,183

C) $635,442

D) $667,214

E) $700,575

Correct Answer

verified

Correct Answer

verified

True/False

Time lines can be constructed in situations where some of the cash flows occur annually but others occur quarterly.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your father is considering purchasing an annuity that pays $5,000 at the beginning of each year for 5 years.He could earn 4.5% on his money in other investments with equal risk.What is the most he should pay for the annuity?

A) 20,701

B) $21,791

C) $22,938

D) $24,085

E) $25,289

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an ordinary annuity with 10 payments of $2,700 if the appropriate interest rate is 5.5%?

A) $16,576

B) $17,449

C) $18,367

D) $19,334

E) $20,352

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank account pays a 5% nominal rate of interest.The interest is compounded quarterly.Which of the following statements is CORRECT?

A) The periodic rate of interest is 5% and the effective rate of interest is also 5%.

B) The periodic rate of interest is 1.25% and the effective rate of interest is 2.5%.

C) The periodic rate of interest is 5% and the effective rate of interest is greater than 5%.

D) The periodic rate of interest is 1.25% and the effective rate of interest is greater than 5%.

E) The periodic rate of interest is 2.5% and the effective rate of interest is 5%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What's the present value of $4,500 discounted back 5 years if the appropriate interest rate is 4.5%,compounded semiannually?

A) $3,089

B) $3,251

C) $3,422

D) $3,602

E) $3,782

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1,250?

A) $77.19

B) $81.25

C) $85.31

D) $89.58

E) $94.06

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following investments,which would have the lowest present value? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2,500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you earned a $275,000 bonus this year and invested it at 8.25% per year.How much could you withdraw at the end of each of the next 20 years?

A) $28,532

B) $29,959

C) $31,457

D) $33,030

E) $34,681

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a future sum increases as either the discount rate or the number of periods per year increases,other things held constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cyberhost Corporation's sales were $225 million last year.If sales grow at 6% per year,how large (in millions) will they be 5 years later?

A) $271.74

B) $286.05

C) $301.10

D) $316.16

E) $331.96

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You agree to make 24 deposits of $500 at the beginning of each month into a bank account.At the end of the 24th month,you will have $13,000 in your account.If the bank compounds interest monthly,what nominal annual interest rate will you be earning?

A) 7.62%

B) 8.00%

C) 8.40%

D) 8.82%

E) 9.26%

Correct Answer

verified

Correct Answer

verified

True/False

The greater the number of compounding periods within a year,then (1)the greater the future value of a lump sum investment at Time 0 and (2)the smaller the present value of a given lump sum to be received at some future date.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your business has just taken out a 1-year installment loan for $72,500 at a nominal rate of 11.0% but with equal end-of-month payments.What percentage of the 2nd monthly payment will go toward the repayment of principal?

A) 73.67%

B) 77.55%

C) 81.63%

D) 85.93%

E) 90.45%

Correct Answer

verified

Correct Answer

verified

True/False

If the discount (or interest)rate is positive,the future value of an expected series of payments will always exceed the present value of the same series.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

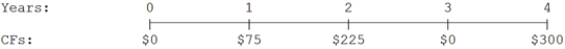

At a rate of 6.5%,what is the future value of the following cash flow stream?

A) $526.01

B) $553.69

C) $582.83

D) $613.51

E) $645.80

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a future sum decreases as either the discount rate or the number of periods per year increases,other things held constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you inherited $275,000 and invested it at 8.25% per year.How much could you withdraw at the beginning of each of the next 20 years?

A) $22,598.63

B) $23,788.03

C) $25,040.03

D) $26,357.92

E) $27,675.82

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 168

Related Exams