A) $94,243

B) $271,743

C) $264,685

D) $358,929

Correct Answer

verified

Correct Answer

verified

Multiple Choice

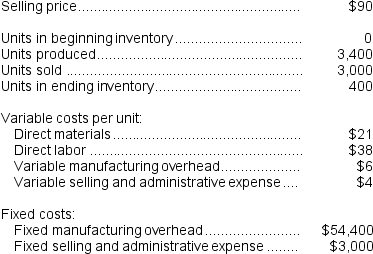

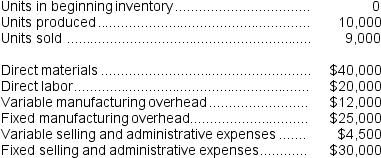

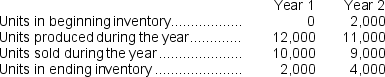

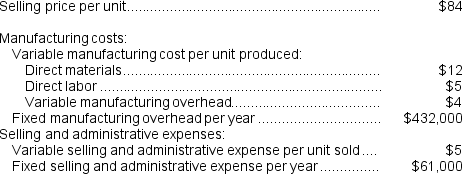

Aaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

-What is the total period cost for the month under the absorption costing?

-What is the total period cost for the month under the absorption costing?

A) $54,400

B) $3,000

C) $69,400

D) $15,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

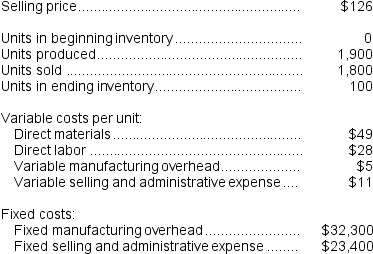

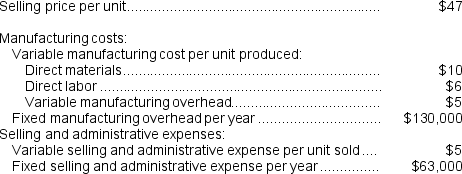

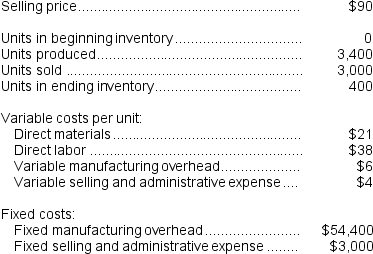

Hadley Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

-What is the unit product cost for the month under variable costing?

-What is the unit product cost for the month under variable costing?

A) $99 per unit

B) $110 per unit

C) $82 per unit

D) $93 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tubaugh Corporation has two major business segments--East and West. In December, the East business segment had sales revenues of $690,000, variable expenses of $352,000, and traceable fixed expenses of $104,000. During the same month, the West business segment had sales revenues of $140,000, variable expenses of $56,000, and traceable fixed expenses of $24,000. The common fixed expenses totaled $162,000 and were allocated as follows: $89,000 to the East business segment and $73,000 to the West business segment. -The contribution margin of the West business segment is:

A) $84,000

B) $234,000

C) $422,000

D) $145,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

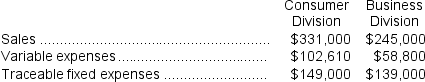

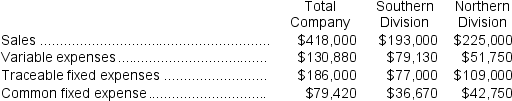

Carriveau Corporation has two divisions: Consumer Division and Business Division. The following data are for the most recent operating period:

The company's common fixed expenses total $63,360.

-The Business Division's break-even sales is closest to:

The company's common fixed expenses total $63,360.

-The Business Division's break-even sales is closest to:

A) $488,153

B) $218,355

C) $266,263

D) $182,895

Correct Answer

verified

Correct Answer

verified

Multiple Choice

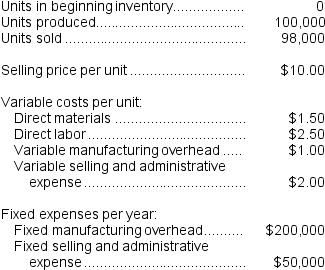

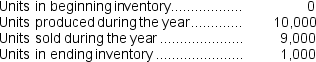

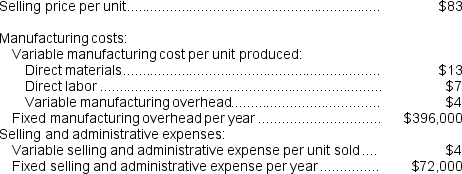

The following data pertain to last year's operations at Clarkson,Incorporated,a company that produces a single product:

What was the absorption costing net operating income last year?

What was the absorption costing net operating income last year?

A) $44,000

B) $48,000

C) $50,000

D) $49,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

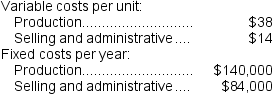

Kern Corporation produces a single product. Selected information concerning the operations of the company follow:

Assume that direct labor is a variable cost.

-Which costing method,absorption or variable costing,would show a higher operating income for the year and by what amount?

Assume that direct labor is a variable cost.

-Which costing method,absorption or variable costing,would show a higher operating income for the year and by what amount?

A) Absorption costing net operating income would be higher than variable costing net operating income by $2,500.

B) Variable costing net operating income would be higher than absorption costing net operating income by $2,500.

C) Absorption costing net operating income would be higher than variable costing net operating income by $5,500.

D) Variable costing net operating income would be higher than absorption costing net operating income by $5,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sipho Corporation manufactures a single product.Last year,the company's variable costing net operating income was $90,900.Fixed manufacturing overhead costs released from inventory under absorption costing amounted to $21,900.What was the absorption costing net operating income last year?

A) $69,000

B) $90,900

C) $21,900

D) $112,800

Correct Answer

verified

Correct Answer

verified

True/False

If a cost must be arbitrarily allocated in order to be assigned to a particular segment,then that cost should be considered a common cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Baraban Corporation has provided the following data for its most recent year of operation:

-The net operating income (loss) under absorption costing closest to:

-The net operating income (loss) under absorption costing closest to:

A) ($4,000)

B) $9,000

C) $117,000

D) $72,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When unit sales are constant,but the number of units produced fluctuates and everything else remains the same,net operating income under variable costing will:

A) fluctuate in direct proportion to changes in production.

B) remain constant.

C) fluctuate inversely with changes in production.

D) be greater than net operating income under absorption costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Southern Corporation manufactures a single product and has the following cost structure:

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

-The carrying value on the balance sheet of the ending inventory of finished goods under variable costing would be:

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

-The carrying value on the balance sheet of the ending inventory of finished goods under variable costing would be:

A) the same as absorption costing.

B) $6,800 greater than under absorption costing.

C) $6,800 less than under absorption costing.

D) $4,000 less than under absorption costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kaaua Corporation has provided the following data for its two most recent years of operation:

Which of the following statements is true for Year 2?

Which of the following statements is true for Year 2?

A) The amount of fixed manufacturing overhead deferred in inventories is $534,000

B) The amount of fixed manufacturing overhead released from inventories is $78,000

C) The amount of fixed manufacturing overhead released from inventories is $534,000

D) The amount of fixed manufacturing overhead deferred in inventories is $78,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that direct labor is a variable cost,the primary difference between the absorption and variable costing is that:

A) variable costing treats only direct materials and direct labor as product cost while absorption costing treats direct materials, direct labor, and the variable portion of manufacturing overhead as product costs.

B) variable costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs while absorption costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs.

C) variable costing treats only direct materials, direct labor, the variable portion of manufacturing overhead, and the variable portion of selling and administrative expenses as product cost while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs.

D) variable costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of a company that uses absorption costing?

A) Net operating income fluctuates directly with changes in sales volume.

B) Fixed production and fixed selling costs are considered to be product costs.

C) Unit product costs can change as a result of changes in the number of units manufactured.

D) Variable selling expenses are included in product costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

-What is the total period cost for the month under variable costing?

-What is the total period cost for the month under variable costing?

A) $54,400

B) $69,400

C) $57,400

D) $15,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Neelon Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period:

The common fixed expenses have been allocated to the divisions on the basis of sales.

-The Northern Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.

-The Northern Division's break-even sales is closest to:

A) $141,558

B) $197,078

C) $244,701

D) $386,408

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Higado Confectionery Corporation has a number of store locations throughout North America.In income statements segmented by store,which of the following would be considered a common fixed cost with respect to the stores?

A) store manager salaries

B) store building depreciation expense

C) the cost of corporate advertising aired during the Super Bowl

D) cost of goods sold at each store

Correct Answer

verified

Correct Answer

verified

True/False

The salary paid to a store manager is not a traceable fixed expense of the store.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Neef Corporation has provided the following data for its two most recent years of operation:

-Which of the following statements is true for Year 2?

-Which of the following statements is true for Year 2?

A) The amount of fixed manufacturing overhead released from inventories is $12,000

B) The amount of fixed manufacturing overhead released from inventories is $654,000

C) The amount of fixed manufacturing overhead deferred in inventories is $12,000

D) The amount of fixed manufacturing overhead deferred in inventories is $654,000

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 291

Related Exams