A) $650

B) $500

C) $150

D) $0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

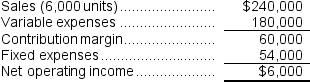

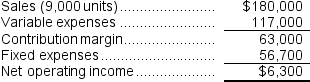

Bois Corporation has provided its contribution format income statement for January.

-The degree of operating leverage is closest to:

-The degree of operating leverage is closest to:

A) 0.11

B) 9.37

C) 0.27

D) 3.66

Correct Answer

verified

Correct Answer

verified

Multiple Choice

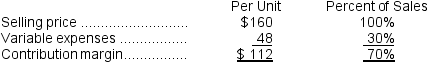

Valdez Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

-The break-even point in unit sales is closest to:

-The break-even point in unit sales is closest to:

A) 5,850 units

B) 4,500 units

C) 0 units

D) 5,400 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Derst Inc.sells a particular textbook for $140.Variable expenses are $25 per book.At the current volume of 6,000 books sold per year the company is just breaking even.Given these data,the annual fixed expenses associated with the textbook total:

A) $400,000

B) $690,000

C) $840,000

D) $150,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

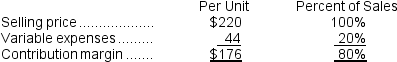

Cobble Corporation produces and sells a single product.Data concerning that product appear below:

Fixed expenses are $499,000 per month.The company is currently selling 5,000 units per month.The marketing manager would like to cut the selling price by $13 and increase the advertising budget by $33,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 900 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $499,000 per month.The company is currently selling 5,000 units per month.The marketing manager would like to cut the selling price by $13 and increase the advertising budget by $33,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 900 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $56,100

B) decrease of $8,900

C) increase of $99,300

D) decrease of $56,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

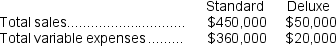

Sunnripe Corporation manufactures and sells two types of beach towels,standard and deluxe.Sunnripe expects the following operating results next year:

Sunnripe expects to have a total of $57,600 in fixed expenses next year.What is Sunnripe's overall break-even point next year in sales dollars?

Sunnripe expects to have a total of $57,600 in fixed expenses next year.What is Sunnripe's overall break-even point next year in sales dollars?

A) $72,000

B) $144,000

C) $192,000

D) $240,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

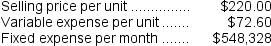

Maziarz Corporation produces and sells a single product. Data concerning that product appear below:

-Assume the company's target profit is $14,000.The unit sales to attain that target profit is closest to:

-Assume the company's target profit is $14,000.The unit sales to attain that target profit is closest to:

A) 7,746 units

B) 2,556 units

C) 4,706 units

D) 3,815 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales at East Corporation declined from $100,000 to $80,000,while net operating income declined by 300%.Given these data,the company must have had an operating leverage of:

A) 15

B) 2.7

C) 30

D) 12

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nussbaum Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

-The number of units that must be sold to achieve a target profit of $16,100 is closest to:

-The number of units that must be sold to achieve a target profit of $16,100 is closest to:

A) 32,000 units

B) 19,400 units

C) 10,400 units

D) 23,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thornbrough Corporation produces and sells a single product with the following characteristics:

The company is currently selling 7,000 units per month. Fixed expenses are $901,000 per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Thornbrough Corporation.Refer to the original data when answering this question. The marketing manager would like to cut the selling price by $18 and increase the advertising budget by $53,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,000 units.What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 7,000 units per month. Fixed expenses are $901,000 per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Thornbrough Corporation.Refer to the original data when answering this question. The marketing manager would like to cut the selling price by $18 and increase the advertising budget by $53,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,000 units.What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $105,000

B) increase of $149,000

C) increase of $105,000

D) decrease of $21,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ploeger Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  The break-even point in dollar sales is closest to:

The break-even point in dollar sales is closest to:

A) $234,000

B) $237,900

C) $156,000

D) $0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carver Corporation produces a product which sells for $40.Variable manufacturing costs are $18 per unit.Fixed manufacturing costs are $5 per unit based on the current level of activity,and fixed selling and administrative costs are $4 per unit.A selling commission of 15% of the selling price is paid on each unit sold.The contribution margin per unit is:

A) $7

B) $17

C) $22

D) $16

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Coultrap Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  The contribution margin per unit is closest to:

The contribution margin per unit is closest to:

A) $21.00

B) $60.00

C) $39.00

D) $4.90

Correct Answer

verified

Correct Answer

verified

True/False

The break-even point can be determined by simply adding together all of the expenses from the income statement.

Correct Answer

verified

Correct Answer

verified

Essay

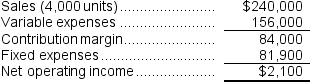

Muzzillo Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.

Required:

a.If the selling price increases by $4 per unit and the sales volume decreases by 300 units,what would be the estimated net operating income?

b.If the variable cost per unit increases by $6,spending on advertising increases by $3,000,and unit sales increase by 1,800 units,what would be the estimated net operating income?

Required:

a.If the selling price increases by $4 per unit and the sales volume decreases by 300 units,what would be the estimated net operating income?

b.If the variable cost per unit increases by $6,spending on advertising increases by $3,000,and unit sales increase by 1,800 units,what would be the estimated net operating income?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bristo Corporation has sales of 2,000 units at $35 per unit.Variable expenses are 40% of the selling price.If total fixed expenses are $22,000,the degree of operating leverage is:

A) 0.79

B) 1.40

C) 2.10

D) 3.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

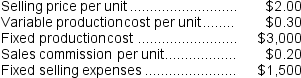

Given the following data:

The break-even point in dollars is:

The break-even point in dollars is:

A) $6,000

B) $4,500

C) $2,647

D) $4,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

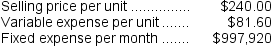

Caneer Corporation produces and sells a single product.Data concerning that product appear below:

The unit sales to attain the company's monthly target profit of $44,000 is closest to:

The unit sales to attain the company's monthly target profit of $44,000 is closest to:

A) 7,896

B) 12,769

C) 6,578

D) 4,341

Correct Answer

verified

Correct Answer

verified

Multiple Choice

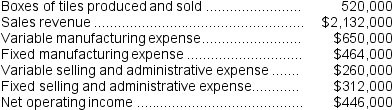

A tile manufacturer has supplied the following data:

-The company's contribution margin ratio is closest to:

-The company's contribution margin ratio is closest to:

A) 42.7%

B) 57.3%

C) 45.8%

D) 21.0%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

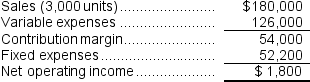

Remmel Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range.

-If the selling price increases by $3 per unit and the sales volume decreases by 400 units,the net operating income would be closest to:

-If the selling price increases by $3 per unit and the sales volume decreases by 400 units,the net operating income would be closest to:

A) $19,000

B) $16,800

C) $13,800

D) $17,733

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 260

Related Exams