A) 6.89 percent

B) 7.01 percent

C) 7.22 percent

D) 7.34 percent

E) 7.57 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invested $5,000 eight years ago. The arithmetic average return on your investment is 10.6 percent and the geometric average return is 10.23 percent. What is the value of your portfolio today?

A) $9,092

B) $10,623

C) $10,899

D) $10,947

E) $11,195

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the period of 1926-2009, the risk premium for small-company stocks averaged:

A) 12.3 percent.

B) 13.9 percent.

C) 15.0 percent.

D) 16.8 percent.

E) 17.4 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has an average arithmetic return of 12.55 percent and an average geometric return of 12.40 percent based on the annual returns for the last 15 years. What is projected average annual return on this stock for the next 10 years?

A) 12.17 percent

B) 12.21 percent

C) 12.38 percent

D) 12.50 percent

E) 12.69 percent

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which one of the following should be used to compare the overall performance of three different investments?

A) holding period dollar return

B) capital gains yield

C) dividend yield

D) holding period percentage return

E) effective annual return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Capital gains are included in the return on an investment:

A) when either the investment is sold or the investment has been owned for at least one year.

B) only if the investment is sold and the capital gain is realized.

C) whenever dividends are paid.

D) whether or not the investment is sold.

E) only if the investment incurs a loss in value or is sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shane purchased a stock this morning at a cost of $11 a share. He expects to receive an annual dividend of $.27 a share next year. What will the price of the stock have to be one year from today if Shane is to earn a 15 percent rate of return on this investment?

A) $12.38

B) $12.60

C) $12.88

D) $13.14

E) $14.28

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following had the narrowest bell curve for the period 1926-2009?

A) large-company stocks

B) long-term corporate bonds

C) long-term government bonds

D) small-company stocks

E) U. S. Treasury bills

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The geometric return on a stock over the past 10 years was 8.42 percent. The arithmetic return over the same period was 9.02 percent. What is the best estimate of the average return on this stock over the next 5 years?

A) 8.75 percent

B) 9.05 percent

C) 9.08 percent

D) 9.13 percent

E) 9.47 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk premium is defined as the rate of return on:

A) a risky asset minus the risk-free rate.

B) the overall market.

C) a U.S. Treasury bill.

D) a risky asset minus the inflation rate.

E) a riskless investment.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

An initial investment of $25,000 forty years ago is worth $1,533,913 today. What is the geometric average return on this investment?

A) 9.47 percent

B) 10.84 percent

C) 11.23 percent

D) 11.47 percent

E) 12.08 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Elise just sold a stock and realized a 6.2 percent return for a 4-month holding period. What was her annualized rate of return?

A) 11.98 percent

B) 14.78 percent

C) 19.78 percent

D) 21.29 percent

E) 27.20 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One year ago, you purchased 100 shares of Southern Foods common stock for $40.7 a share. Today, you sold your shares for $39.70 a share. During this past year, the stock paid $1.40 in dividends per share. What is your dividend yield on this investment?

A) 3.30 percent

B) 3.37 percent

C) 3.44 percent

D) 3.53 percent

E) 3.61 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An asset had annual returns of 14, 11, -15, 2, and 37 percent, respectively, for the past five years. What is the standard deviation of these returns?

A) 8.96 percent

B) 16.05 percent

C) 17.92 percent

D) 18.91 percent

E) 20.03 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Big Town Markets common stock returned 13.8, 14.2, 9.7, 5.3, and 12.2 percent, respectively, over the past five years. What is the arithmetic average return?

A) 10.99 percent

B) 11.04 percent

C) 11.56 percent

D) 12.20 percent

E) 13.80 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

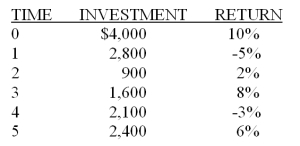

Jim began his investing program with a $4000 initial investment. The table below recaps his returns each year as well as the amounts he added to his investment account. What is his dollar- weighted average return?

A) 1.6 percent

B) 2.2 percent

C) 2.6 percent

D) 3.2 percent

E) 3.6 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital gains yield is equal to:

A) (Pt - Pt + 1 + Dt + 1) /Pt + 1.

B) (Pt + 1 - Pt + Dt) /Pt.

C) Dt + 1/Pt.

D) (Pt + 1 - Pt) /Pt.

E) (Pt + 1 - Pt) /Pt + 1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past four years, a stock produced returns of 13, 6, -5, and 18 percent, respectively. What is the standard deviation of these returns?

A) 8.63 percent

B) 9.93 percent

C) 9.97 percent

D) 10.11 percent

E) 10.15 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the period 1926-2009, long-term government bonds had an average return that ______ the average return on long-term corporate bonds while having a standard deviation that _______ the standard deviation of the long-term corporate bonds.

A) exceeded; was less than

B) exceeded; equaled

C) exceeded; exceeded

D) was less than; exceeded

E) was less than; was less than

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

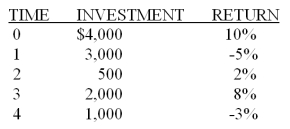

Jim began his investing program with a $4000 initial investment. The table below recaps his returns each year as well as the amounts he added to his investment account. What is his dollar- weighted average return?

A) 0.5 percent

B) 0.8 percent

C) 1.0 percent

D) 1.2 percent

E) 1.5 percent

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams