A) net income.

B) projected income.

C) forecasted income.

D) operating income.

E) nonoperating income.

Correct Answer

verified

Correct Answer

verified

True/False

In the presence of fixed costs,the degree of operating leverage is the same at different levels of sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the outcomes are measured in monetary terms,expected value is often called:

A) unknown fund values.

B) unexpected probabilities.

C) expected monetary fund.

D) expected monetary value.

E) expected probability statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the equation method,revenues in each column are calculated as:

A) revenues = Selling price (SP) - Quantity of units sold (Q) .

B) revenues = Selling price (SP) / Quantity of units sold (Q) .

C) revenues = Selling price (SP) × Variable cost per unit (VCU) .

D) revenues = Selling price (SP) × Quantity of units sold (Q) .

E) revenues = Selling price (SP) - Variable cost per unit (VCU) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ ________ is a "what-if" technique that managers use to examine how an outcome will change if the original predicted data are not achieved or if an underlying assumption changes.

A) Electronic Spreadsheet

B) Weighted average

C) Manufacturing option

D) Electronic analysis

E) Sensitivity analysis

Correct Answer

verified

Correct Answer

verified

True/False

Strategic decisions never involve risk.

Correct Answer

verified

Correct Answer

verified

Essay

Write a short essay and define the profit-volume (PV)graph.What are the benefits of the PV graph to managers?

Correct Answer

verified

The PV graph shows how changes in the quantity of units sold affect operating income.Recall that managers want to know how many units of a product they must sell to earn a specific level of operating income.The PV graph is beneficial to the manager because the illustration makes it easier to determine the precise point at which the difference between the total revenues line and the total costs line equal the target amount.

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of CVP-based sensitivity analysis?

A) Disregards the various fixed-cost structures.

B) Helps managers evaluate various fixed-cost structures.

C) Helps managers evaluate various variable-cost structures.

D) Highlights the risks as fixed costs are substituted for variable costs in a company's cost structure.

E) Highlights the returns as fixed costs are substituted for various costs in a company's cost structure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tool useful for calculating contribution margin and operating income is:

A) margin of safety.

B) sensitivity analysis.

C) the breakeven point.

D) contribution margin per unit.

E) operating leverage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Resort Operating Center plans a targeted operating income of $210,000 and the tax rate is 30%,what is the organization's target net income?

A) $63,000.

B) $89,000.

C) $109,000.

D) $118,000.

E) $147,000.

Correct Answer

verified

Correct Answer

verified

True/False

Gross margin and contribution margin are related but give different insights to managers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The store has fixed costs of $25,000 and a contribution margin per unit of $90 per unit. Compute the breakeven quantity in units.

A) 266.55 units.

B) 275.77 units.

C) 277.77 units.

D) 288.88 units.

E) 299.99 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine the margin of safety,managers compute:

A) budgeted revenues / breakeven sales.

B) budgeted sales + breakeven sales.

C) budgeted revenues + breakeven revenues.

D) budgeted sales - breakeven sales.

E) budgeted revenues - breakeven revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

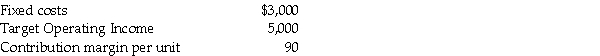

Sunny Pastures reported the following information:

Required:

Compute the quantity of units required to be sold to have an operating income of $5,000.

Required:

Compute the quantity of units required to be sold to have an operating income of $5,000.

A) 24.44 units

B) 40.22 units

C) 64.44 units

D) 88.88 units

E) 94.44 units

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The store has a contribution margin per unit of $90 and the products sells for $225.The manager needs to know the contribution margin percentage. Required: Compute the contribution margin percentage.

A) 2.5%

B) 40%

C) 45%

D) 245%

E) 250%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between total revenues and total variable costs is:

A) margin of safety.

B) sensitivity analysis.

C) the breakeven point.

D) contribution margin.

E) operating leverage.

Correct Answer

verified

Correct Answer

verified

True/False

Contribution margin percentage is not a useful tool to calculate the effect of a change in revenues on contribution margin.

Correct Answer

verified

Correct Answer

verified

True/False

The quantities (or proportion)of various products (or services)that constitute total unit sales of a company is known as the sales mix.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about net income?

A) Income targets are expressed in terms of operating income.

B) Income targets are expressed in terms of net income.

C) Income targets are not expressed in terms of net income.

D) Managers always ignore the effect of net income on income taxes.

E) Decisions do not result in large operating incomes and never have favorable tax consequences.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manager at the Film Shoppe at the mall reported that the company had a contribution margin of $3,000 and total variable costs were $25.00. Required: Compute the operating income.

A) $.83

B) $120

C) $2,750

D) $2,780

E) $75,000

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 126

Related Exams