Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vasudevan Inc.recently reported operating income of $2.75 million,depreciation of $1.20 million,and had a tax rate of 40%.The firm's expenditures on fixed assets and net operating working capital totaled $0.6 million.How much was its free cash flow,in millions?

A) $1.93

B) $2.03

C) $2.14

D) $2.25

E) $2.36

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Assets other than cash are expected to produce cash over time, and the amounts of cash they eventually produce should be exactly the same as the amounts at which the assets are carried on the books.

B) The primary reason the annual report is important in finance is that it is used by investors when they form expectations about the firm's future earnings and dividends, and the riskiness of those cash flows.

C) The annual report is an internal document prepared by a firm's managers solely for the use of its creditors/lenders.

D) The four most important financial statements provided in the annual report are the balance sheet, income statement, cash budget, and statement of stockholders' equity.

E) Prior to the Enron scandal in the early 2000s, companies would put verbal information in their annual reports, along with the financial statements. That verbal information was often misleading, so today annual reports can contain only quantitative information: audited financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solarcell Corporation has $20,000 that it plans to invest in marketable securities.It is choosing between AT&T bonds that yield 11%,State of Florida municipal bonds that yield 8%,and AT&T preferred stock with a dividend yield of 9%.Solarcell's corporate tax rate is 40%,and 70% of the preferred stock dividends it receives are tax exempt.Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns,which security should be selected? Answer by giving the after-tax rate of return on the highest yielding security.

A) 7.80%

B) 8.00%

C) 8.20%

D) 8.41%

E) 8.62%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since companies can deduct dividends paid but not interest paid, our tax system favors the use of equity financing over debt financing, and this causes companies' debt ratios to be lower than they would be if interest and dividends were both deductible.

B) Interest paid to an individual is counted as income for federal tax purposes and taxed at the individual's regular tax rate, which in 2014 could go up to 39.6%, but qualified dividends received were taxed at a maximum tax rate of 15% for individuals earning less than $400,000 and married taxpayers filing jointly earning less than $450,000.

C) The maximum federal tax rate on corporate income in 2014 was 50%.

D) Corporations obtain capital for use in their operations by borrowing and by raising equity capital, either by selling new common stock or by retaining earnings. The cost of debt capital is the interest paid on the debt, and the cost of the equity is the dividends paid on the stock. Both of these costs are deductible from income when calculating income for tax purposes.

E) The maximum federal tax rate on personal income in 2014 was 50%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Besset Company's operations provided a negative cash flow,yet the cash shown on its balance sheet increased.Which of the following statements could explain the increase in cash,assuming the company's financial statements were prepared under generally accepted accounting principles (GAAP) ?

A) The company repurchased some of its common stock.

B) The company dramatically increased its capital expenditures.

C) The company retired a large amount of its long-term debt.

D) The company sold some of its fixed assets.

E) The company had high depreciation expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

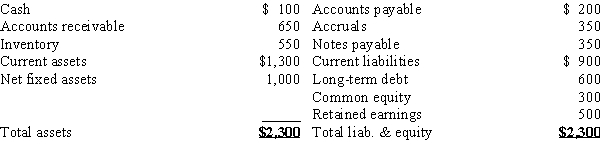

Wu Systems has the following balance sheet.How much net operating working capital does the firm have?

A) $675

B) $750

C) $825

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with a 15% tax rate buys preferred stock in another company.The preferred stock has a before-tax yield of 8%.What is the preferred stock's after-tax return?

A) 6.90%

B) 7.26%

C) 7.64%

D) 8.02%

E) 8.42%

Correct Answer

verified

Correct Answer

verified

True/False

The fact that 70% of the interest income received by corporations is excluded from its taxable income encourages firms to finance with more debt than they would in the absence of this tax law provision.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lovell Co.purchased preferred stock in another company.The preferred stock's before-tax yield was 8.4%.The corporate tax rate is 40%.What is the after-tax return on the preferred stock,assuming a 70% dividend exclusion?

A) 7.02%

B) 7.39%

C) 7.76%

D) 8.15%

E) 8.56%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hartzell Inc.had the following data for 2013,in millions: Net income = $600; after-tax operating income [EBIT(1 − T) ] = $700; and Total assets = $2,000.Information for 2014 is as follows: Net income = $825; after-tax operating income [EBIT(1 − T) ] = $925; and Total assets = $2,500.How much free cash flow did the firm generate during 2014?

A) $383

B) $425

C) $468

D) $514

E) $566

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The four most important financial statements provided in the annual report are the balance sheet, income statement, cash budget, and the statement of stockholders' equity.

B) The balance sheet gives us a picture of the firm's financial position at a point in time.

C) The income statement gives us a picture of the firm's financial position at a point in time.

D) The statement of cash flows tells us how much cash the firm must pay out in interest during the year.

E) The statement of cash needs tells us how much cash the firm will require during some future period, generally a month or a year.

Correct Answer

verified

Correct Answer

verified

True/False

If the tax laws were changed so that $0.50 out of every $1.00 of interest paid by a corporation was allowed as a tax-deductible expense,this would probably encourage companies to use more debt financing than they presently do,other things held constant.

Correct Answer

verified

Correct Answer

verified

True/False

Both interest and dividends paid by a corporation are deductible operating expenses,hence they decrease the firm's taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The more depreciation a firm reports, the higher its tax bill, other things held constant.

B) People sometimes talk about the firm's cash flow, which is shown as the lowest entry on the income statement, hence it is often called "the bottom line."

C) Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's cash flow.

D) Operating income is derived from the firm's regular core business. Operating income is calculated as Revenues less Operating costs. Operating costs do not include interest or taxes.

E) Depreciation is not a cash charge, so it does not have an effect on a firm's reported profits.

Correct Answer

verified

Correct Answer

verified

True/False

The retained earnings account on the balance sheet does not represent cash.Rather,it represents part of the stockholders' claims against the firm's existing assets.Put another way retained earnings are stockholders' reinvested earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is NOT normally considered to be a current asset?

A) Accounts receivable.

B) Inventory.

C) Bonds.

D) Cash.

E) Short-term, highly-liquid, marketable securities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The statement of cash flows reflects cash flows from operations, but it does not reflect the effects of buying or selling fixed assets.

B) The statement of cash flows shows where the firm's cash is located; indeed, it provides a listing of all banks and brokerage houses where cash is on deposit.

C) The statement of cash flows reflects cash flows from continuing operations, but it does not reflect the effects of changes in working capital.

D) The statement of cash flows reflects cash flows from operations and from borrowings, but it does not reflect cash obtained by selling new common stock.

E) The statement of cash flows shows how much the firm's cash, the total of currency, bank deposits, and short-term liquid securities (or cash equivalents) , increased or decreased during a given year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the years,O'Brien Corporation's stockholders have provided $20,000,000 of capital,when they purchased new issues of stock and allowed management to retain some of the firm's earnings.The firm now has 1,000,000 shares of common stock outstanding,and it sells at a price of $38.50 per share.How much value has O'Brien's management added to stockholder wealth over the years,i.e.,what is O'Brien's MVA?

A) $18,500,000

B) $18,870,000

C) $19,247,400

D) $19,632,348

E) $20,024,995

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Almazan Software reported $10.50 million of sales,$6.25 million of operating costs other than depreciation,and $1.30 million of depreciation.The company had $5.00 million of bonds that carry a 6.5% interest rate,and its federal-plus-state income tax rate was 35%.This year's data are expected to remain unchanged except for one item,depreciation,which is expected to increase by $0.70 million.By how much will net income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes.

A) −$0.432

B) −$0.455

C) −$0.478

D) −$0.502

E) −$0.527

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 130

Related Exams