A) Project X has more stand-alone risk than Project Y.

B) Project X has more corporate (or within-firm) risk than Project Y.

C) Project X has more market risk than Project Y.

D) Project X has the same level of corporate risk as Project Y.

E) Project X has the same market risk as Project Y since its cash flows are not correlated with the cash flows of existing projects.

Correct Answer

verified

Correct Answer

verified

True/False

The use of accelerated versus straight-line depreciation causes net income reported to stockholders to be lower,and cash flows higher,during every year of a project's life,other things held constant.

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's projects differ in risk,then one way of handling this problem is to evaluate each project with the appropriate risk-adjusted discount rate.

Correct Answer

verified

Correct Answer

verified

True/False

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is considering a new project whose risk is greater than the risk of the firm's average project,based on all methods for assessing risk.In evaluating this project,it would be reasonable for management to do which of the following?

A) Increase the estimated IRR of the project to reflect its greater risk.

B) Increase the estimated NPV of the project to reflect its greater risk.

C) Reject the project, since its acceptance would increase the firm's risk.

D) Ignore the risk differential if the project would amount to only a small fraction of the firm's total assets.

E) Increase the cost of capital used to evaluate the project to reflect its higher-than-average risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since depreciation is a cash expense, the faster an asset is depreciated, the lower the projected NPV from investing in the asset.

B) Under current laws and regulations, corporations must use straight-line depreciation for all assets whose lives are 5 years or longer.

C) Corporations must use the same depreciation method for both stockholder reporting and tax purposes.

D) Using accelerated depreciation rather than straight line normally has the effect of speeding up cash flows and thus increasing a project's forecasted NPV.

E) Using accelerated depreciation rather than straight line normally has the effect of slowing down cash flows and thus reducing a project's forecasted NPV.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If an asset is sold for less than its book value at the end of a project's life, it will generate a loss for the firm, hence its terminal cash flow will be negative.

B) Only incremental cash flows are relevant in project analysis, the proper incremental cash flows are the reported accounting profits, and thus reported accounting income should be used as the basis for investor and managerial decisions.

C) It is unrealistic to believe that any increases in net operating working capital required at the start of an expansion project can be recovered at the project's completion. Operating working capital like inventory is almost always used up in operations. Thus, cash flows associated with operating working capital should be included only at the start of a project's life.

D) If equipment is expected to be sold for more than its book value at the end of a project's life, this will result in a profit. In this case, despite taxes on the profit, the end-of-project cash flow will be greater than if the asset had been sold at book value, other things held constant.

E) Changes in net operating working capital refer to changes in current assets and current liabilities, not to changes in long-term assets and liabilities, hence they should not be considered in a capital budgeting analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dalrymple Inc.is considering production of a new product.In evaluating whether to go ahead with the project,which of the following items should NOT be explicitly considered when cash flows are estimated?

A) The company will produce the new product in a vacant building that was used to produce another product until last year. The building could be sold, leased to another company, or used in the future to produce another of the firm's products.

B) The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment.

C) The company has spent and expensed for tax purposes $3 million on research related to the new product. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.

D) The new product will cut into sales of some of the firm's other products.

E) If the project is accepted, the company must invest an additional $2 million in net operating working capital. However, all of these funds will be recovered at the end of the project's life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

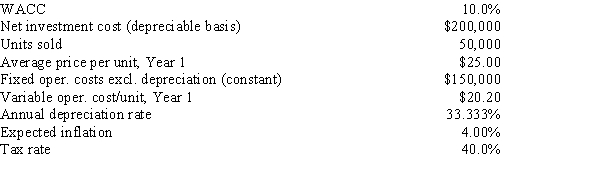

Your company,CSUS Inc.,is considering a new project whose data are shown below.The required equipment has a 3-year tax life,and the accelerated rates for such property are 33%,45%,15%,and 7% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

A) $11,814

B) $12,436

C) $13,090

D) $13,745

E) $14,432

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following rules is CORRECT for capital budgeting analysis?

A) The interest paid on funds borrowed to finance a project must be included in estimates of the project's cash flows.

B) Only incremental cash flows, which are the cash flows that would result if a project is accepted, are relevant when making accept/reject decisions for capital budgeting projects.

C) Sunk costs are not included in the annual cash flows, but they must be deducted from the PV of the project's other costs when reaching the accept/reject decision.

D) A proposed project's estimated net income as determined by the firm's accountants, using generally accepted accounting principles (GAAP) , is discounted at the WACC, and if the PV of this income stream exceeds the project's cost, the project should be accepted.

E) If a product is competitive with some of the firm's other products, this fact should be incorporated into the estimate of the relevant cash flows. However, if the new product is complementary to some of the firm's other products, this fact need not be reflected in the analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marshall-Miller & Company is considering the purchase of a new machine for $50,000,installed.The machine has a tax life of 5 years,and it can be depreciated according to the depreciation rates below.The firm expects to operate the machine for 4 years and then to sell it for $12,500.If the marginal tax rate is 40%,what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $ 8,878

B) $ 9,345

C) $ 9,837

D) $10,355

E) $10,900

Correct Answer

verified

Correct Answer

verified

True/False

The two methods discussed in the text for dealing with unequal project lives are (1)the replacement chain approach and (2)the present value approach.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carlyle Inc.is considering two mutually exclusive projects.Both require an initial investment of $15,000 at t = 0.Project S has an expected life of 2 years with after-tax cash inflows of $7,000 and $12,000 at the end of Years 1 and 2,respectively.In addition,Project S can be repeated at the end of Year 2 with no changes in its cash flows.Project L has an expected life of 4 years.Each project has a WACC of 9%.What is the equivalent annual annuity of the most profitable project?

A) $569.67

B) $792.34

C) $865.31

D) $1,522.18

E) $1,846.54

Correct Answer

verified

Correct Answer

verified

True/False

Typically,a project will have a higher NPV if the firm uses accelerated rather than straight-line depreciation.This is because the total cash flows over the project's life will be higher if accelerated depreciation is used,other things held constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When evaluating a new project,firms should include in the projected cash flows all of the following EXCEPT:

A) Changes in net operating working capital attributable to the project.

B) Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes.

C) The value of a building owned by the firm that will be used for this project.

D) A decline in the sales of an existing product, provided that decline is directly attributable to this project.

E) The salvage value of assets used for the project that will be recovered at the end of the project's life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Sensitivity analysis as it is generally employed is incomplete in that it fails to consider the probability of occurrence of the key input variables.

B) In comparing two projects using sensitivity analysis, the one with the steeper lines would be considered less risky, because a small error in estimating a variable such as unit sales would produce only a small error in the project's NPV.

C) The primary advantage of simulation analysis over scenario analysis is that scenario analysis requires a relatively powerful computer, coupled with an efficient financial planning software package, whereas simulation analysis can be done efficiently using a PC with a spreadsheet program or even with just a calculator.

D) Sensitivity analysis is a type of risk analysis that considers both the sensitivity of NPV to changes in key input variables and the probability of occurrence of these variables' values.

E) As computer technology advances, simulation analysis becomes increasingly obsolete and thus less likely to be used than sensitivity analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poulsen Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an inflation adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made versus if it is not made?

A) $12,018

B) $12,650

C) $13,316

D) $13,982

E) $14,681

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wilson Co.is considering two mutually exclusive projects.Both require an initial investment of $10,000 at t = 0.Project X has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,500 at the end of Years 1 and 2,respectively.In addition,Project X can be repeated at the end of Year 2 with no changes in its cash flows.Project Y has an expected life of 4 years with after-tax cash inflows of $4,600 at the end of each of the next 4 years.Each project has a WACC of 11%.What is the equivalent annual annuity of the most profitable project?

A) $1,345.50

B) $1,346.30

C) $1,361.52

D) $1,376.74

E) $1,411.15

Correct Answer

verified

Correct Answer

verified

True/False

We can identify the cash costs and cash inflows to a company that will result from a project.These could be called "direct inflows and outflows," and the net difference is the direct net cash flow.If there are other costs and benefits that do not flow from or to the firm,but to other parties,these are called externalities,and they need not be considered as a part of the capital budgeting analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Sensitivity analysis is a good way to measure market risk because it explicitly takes into account diversification effects.

B) One advantage of sensitivity analysis relative to scenario analysis is that it explicitly takes into account the probability of specific effects occurring, whereas scenario analysis cannot account for probabilities.

C) Well-diversified stockholders do not need to consider market risk when determining required rates of return.

D) Market risk is important, but it does not have a direct effect on stock prices because it only affects beta.

E) Simulation analysis is a computerized version of scenario analysis where input variables are selected randomly on the basis of their probability distributions.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 81

Related Exams