A) Since debt financing raises the firm's financial risk, increasing the target debt ratio will always increase the WACC.

B) Since debt financing is cheaper than equity financing, raising a company's debt ratio will always reduce its WACC.

C) Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing. However, this action still may raise the company's WACC.

D) Increasing a company's debt ratio will typically increase the marginal costs of both debt and equity financing. However, this action still may lower the company's WACC.

E) Since a firm's beta coefficient is not affected by its use of financial leverage, leverage does not affect the cost of equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

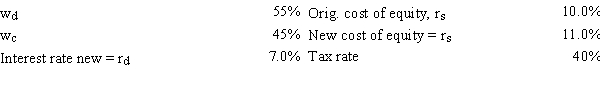

Gator Fabrics Inc.currently has zero debt .It is a zero growth company,and additional firm data are shown below.Now the company is considering using some debt,moving to the new capital structure indicated below.The money raised would be used to repurchase stock at the current price.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat,as indicated below.If this plan were carried out,by how much would the WACC change,i.e.,what is WACCOld − WACCNew?

A) 2.74%

B) 3.01%

C) 3.32%

D) 3.65%

E) 4.01%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events is likely to encourage a company to raise its target debt ratio,other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) An increase in the company's operating leverage.

D) The Federal Reserve tightens interest rates in an effort to fight inflation.

E) The company's stock price hits a new high.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the information below,what is the firm's optimal capital structure?

A) Debt = 40%; Equity = 60%; EPS = $2.95; Stock price = $26.50.

B) Debt = 50%; Equity = 50%; EPS = $3.05; Stock price = $28.90.

C) Debt = 60%; Equity = 40%; EPS = $3.18; Stock price = $31.20.

D) Debt = 80%; Equity = 20%; EPS = $3.42; Stock price = $30.40.

E) Debt = 70%; Equity = 30%; EPS = $3.31; Stock price = $30.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Business risk is affected by a firm's operations.Which of the following is NOT directly associated with (or does not directly contribute to) business risk?

A) Demand variability.

B) Sales price variability.

C) The extent to which operating costs are fixed.

D) The extent to which interest rates on the firm's debt fluctuate.

E) Input price variability.

Correct Answer

verified

Correct Answer

verified

True/False

According to Modigliani and Miller (MM),in a world with corporate income taxes the optimal capital structure calls for approximately 100% debt financing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

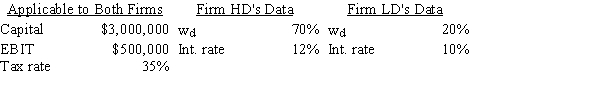

Firms HD and LD are identical except for their use of debt and the interest rates they pay⎯HD has more debt and thus must pay a higher interest rate.Based on the data given below,how much higher or lower will HD's ROE be versus that of LD,i.e.,what is ROEHD − ROELD?

A) 5.41%

B) 5.69%

C) 5.99%

D) 6.29%

E) 6.61%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you and your brother plan to open a business that will make and sell a newly designed type of sandal.Two robotic machines are available to make the sandals,Machine A and Machine B.The price per pair will be $20.00 regardless of which machine is used.The fixed and variable costs associated with the two machines are shown below.What is the difference between the break-even points for Machines A and B? (Hint: Find BEB − BEA)

A) 3,154

B) 3,505

C) 3,894

D) 4,327

E) 4,760

Correct Answer

verified

Correct Answer

verified

True/False

In a world with no taxes,Modigliani and Miller (MM)show that a firm's capital structure does not affect its value.However,when taxes are considered,MM show a positive relationship between debt and value,i.e.,the firm's value rises as it uses more and more debt,other things held constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Congress lowered corporate tax rates while other things were held constant, and if the Modigliani-Miller tax-adjusted theory of capital structure were correct, this would tend to cause corporations to decrease their use of debt.

B) A change in the personal tax rate should not affect firms' capital structure decisions.

C) "Business risk" is differentiated from "financial risk" by the fact that financial risk reflects only the use of debt, while business risk reflects both the use of debt and such factors as sales variability, cost variability, and operating leverage.

D) The optimal capital structure is the one that simultaneously (1) maximizes the price of the firm's stock, (2) minimizes its WACC, and (3) maximizes its EPS.

E) If changes in the bankruptcy code made bankruptcy less costly to corporations, this would likely reduce the average corporation's debt ratio.

Correct Answer

verified

Correct Answer

verified

True/False

Provided a firm does not use an extreme amount of debt,operating leverage typically affects only EPS,while financial leverage affects both EPS and EBIT.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms U and L each have the same amount of assets,investor-supplied capital,and both have a return on investors' capital (ROIC) of 12%.Firm U is unleveraged,i.e.,it is 100% equity financed,while Firm L is financed with 50% debt and 50% equity.Firm L's debt has an after-tax cost of 8%.Both firms have positive net income and a 35% tax rate.Which of the following statements is CORRECT?

A) The two companies have the same times interest earned (TIE) ratio.

B) Firm L has a lower ROA than Firm U.

C) Firm L has a lower ROE than Firm U.

D) Firm L has the higher times interest earned (TIE) ratio.

E) Firm L has a higher EBIT than Firm U.

Correct Answer

verified

Correct Answer

verified

True/False

If a firm borrows money,it is using financial leverage.

Correct Answer

verified

Correct Answer

verified

True/False

Financial risk refers to the extra risk borne by stockholders as a result of a firm's use of debt as compared with their risk if the firm had used no debt.

Correct Answer

verified

Correct Answer

verified

True/False

The Modigliani and Miller (MM)articles implicitly assumed that bankruptcy did not exist.That led to the development of the "trade-off" model,where the firm's value first rises with the use of debt due to the tax shelter of debt,but later falls as more debt is added because the potential costs of bankruptcy begin to more than offset the tax shelter benefits.Under the trade-off theory,an optimal capital structure exists.

Correct Answer

verified

Correct Answer

verified

True/False

A firm's treasurer likes to be in a position to raise funds to support operations whenever such funds are needed,even in "bad times." This is called "financial flexibility," and the lower the firm's debt ratio,the greater its financial flexibility,other things held constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southeast U's campus book store sells course packs for $15.00 each,the variable cost per pack is $11.00,fixed costs for this operation are $300,000,and annual sales are 100,000 packs.The unit variable cost consists of a $4.00 royalty payment,VR,per pack to professors plus other variable costs of VO = $7.00.The royalty payment is negotiable.The book store's directors believe that the store should earn a profit margin of 10% on sales,and they want the store's managers to pay a royalty rate that will produce that profit margin.What royalty per pack would permit the store to earn a 10% profit margin on course packs,other things held constant?

A) $2.55

B) $2.84

C) $3.15

D) $3.50

E) $3.85

Correct Answer

verified

Correct Answer

verified

Multiple Choice

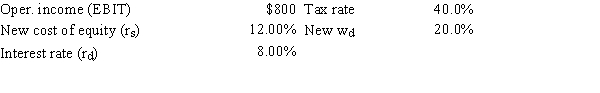

As a consultant to First Responder Inc.,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 20.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 8.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 − T) because no new operating capital is needed,and then divide by (WACC − g) .

A) $2,982

B) $3,314

C) $3,682

D) $4,091

E) $4,545

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm can use retained earnings without paying a flotation cost. Therefore, while the cost of retained earnings is not zero, its cost is generally lower than the after-tax cost of debt.

B) The capital structure that minimizes a firm's weighted average cost of capital is also the capital structure that maximizes its stock price.

C) The capital structure that minimizes the firm's weighted average cost of capital is also the capital structure that maximizes its earnings per share.

D) If a firm finds that the cost of debt is less than the cost of equity, increasing its debt ratio must reduce its WACC.

E) Other things held constant, if corporate tax rates declined, then the Modigliani-Miller tax-adjusted theory would suggest that firms should increase their use of debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have identical tax rates,total assets,total investor-supplied capital,and returns on investors' capital (ROIC) ,and their ROICs exceed their after-tax costs of debt,rd(1 − T) .However,Company HD has a higher debt ratio and thus more interest expense than Company LD.Which of the following statements is CORRECT?

A) Company HD has a higher net income than Company LD.

B) Company HD has a lower ROA than Company LD.

C) Company HD has a lower ROE than Company LD.

D) The two companies have the same ROA.

E) The two companies have the same ROE.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams