A) Aside from taxes,another important difference between debt and equity financing is that debt payments must be made to avoid bankruptcy,whereas firms have no similar obligation to pay dividends or realize capital gains.

B) Increasing the level of debt increases the probability of bankruptcy.

C) A firm receives a tax benefit only if it is paying taxes in the first place.

D) To the extent that a firm has other tax shields,its taxable earnings will be increased and it will rely more heavily on the interest tax shield.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

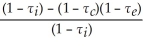

Consider the following formula:

Τ* =  The term τi is:

The term τi is:

A) the effective personal tax rate on interest income.

B) the effective personal tax rate on equity.

C) the effective corporate tax rate on income.

D) the effective tax advantage of debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following formula: VL = VU + τcD The term τcD represents:

A) the present value of the interest tax shield.

B) the value of the firm with leverage.

C) the preset value of the future interest payments.

D) the interest tax shield each year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total amount available to payout to all the investors in Kroger in 2005 is closest to:

A) $190 million

B) $847 million

C) $745 million

D) $290 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taggart Transcontinental currently has no debt and an equity cost of capital of 16%.Suppose that Taggart decides to increase its leverage and maintain a market debt-to-value ratio of 1/3.Suppose Taggart's debt cost of capital is 9% and its corporate tax rate is 35%.Assuming that Taggart's pre-tax WACC remains constant,then with the addition of leverage its effective after-tax WACC will be closest to:

A) 12.9%

B) 13.0%

C) 15.0%

D) 16.0%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) Once investors know the recap will occur,the share price will rise immediately to a level that reflects the value of the interest tax shield that the firm will receive from its recapitalization.

B) When securities are fairly priced,the original shareholders of a firm capture the full benefit of the interest tax shield from an increase in leverage.

C) In the presence of corporate taxes,we do not include the interest tax shield as one of the firm's assets on its market value balance sheet.

D) We can analyze the recapitalization using the market value balance sheet;it states that the total market value of a firm's securities must equal the total market value of the firm's assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following formula:

VL = VU +  The term

The term  Represents:

Represents:

A) the value of the firm with leverage.

B) the present value of the interest tax shield.

C) the preset value of the future interest payments.

D) the interest tax shield each year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of LCMS' interest tax shield is closest to:

A) $45.5 million

B) $20.0 million

C) $24.5 million

D) $35.0 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the recapitalization,the value of KD's levered equity is closest to:

A) $670 million

B) $400 million

C) $330 million

D) $470 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2000,assuming an average dividend payout ratio of 50%,the effective tax rate for equity holders was closest to:

A) 69%

B) 65%

C) 55%

D) 30%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Galt Industries has 125 million shares outstanding and has a marginal corporate tax rate of 35%.Galt announces that it will use $75 million in excess cash to repurchase shares.Shareholders had previously assumed that Galt would retain this excess cash permanently.The amount Galt's share price can be expected to change upon this announcement is closest to:

A) $0.21

B) $0.24

C) $0.36

D) $0.39

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Rosewood had no interest expense,its net income would be closest to:

A) $405 million

B) $160 million

C) $450 million

D) $290 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of Shepard Industries with leverage is closest to:

A) $64 million

B) $100 million

C) $135 million

D) $114 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Flagstaff currently maintains a .5 debt to equity ratio,then the value of Flagstaff as an all equity firm would be closest to:

A) $80 million

B) $100 million

C) $73 million

D) $115 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following formula:

Rwacc =  RE +

RE +  RD -

RD -  RDτc

The term

RDτc

The term  RDτc represents:

RDτc represents:

A) the reduction due to the interest tax shield.

B) the present value of the interest tax shield.

C) the preset value of the future interest payments.

D) the interest tax shield each year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that investors hold Google stock in retirement accounts that are free from personal taxes.Also assume that Google's current pre-tax WACC is 14%.If Google were to issue sufficient debt at a pre-tax cost of 7% to give them a debt to value ratio of 0.5,then the Google's after-tax WACC would be closest to:

A) 10.4%

B) 12.8%

C) 13.0%

D) 15.0%

E) 16.0%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate tax shield for Kroger in 2005 is closest to:

A) $362 million

B) $36 million

C) $102 million

D) $195 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is FALSE?

A) To determine the true tax benefit of leverage,we need to evaluate the combined effect of both corporate and personal taxes.

B) A personal tax disadvantage for debt causes the WACC to decline more slowly with leverage than it otherwise would.

C) Personal taxes have an indirect effect on the firm's weighted average cost of capital.

D) In the United States and many other countries,capital gains from equity have historically been taxed more heavily than interest income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following equations is INCORRECT?

A) VL = VU + ![]()

B) VL = VU + τcD

C) rwacc = ![]()

RE +

![]()

RD -

![]()

RDτc

D) rwacc = ![]()

RE +

![]()

RD(1 + τc)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information for the question(s) below. LCMS Industries has $70 million in debt outstanding.The firm will pay only interest on this debt (the debt is perpetual) .LCMS' marginal tax rate is 35% and the firm pays a rate of 8% interest on its debt. -LCMS' annual interest tax shield is closest to:

A) $2.8 million

B) $2.0 million

C) $3.6 million

D) $5.6 million

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 95

Related Exams