Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following terms to their correct definition: a.equity security j.held-to-maturity securities b.debt security k.amortized cost method c.passive l.fair value method d.significant influence m.unrealized gains and losses e.control n.equity method f.parent o.consolidation worksheet g.subsidiary p.minority interest h.trading securities q.business combination i.available-for-sale securities r.goodwill -Represents an ownership interest in a corporation, usually common stock

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following terms to their correct definition: a.equity security j.held-to-maturity securities b.debt security k.amortized cost method c.passive l.fair value method d.significant influence m.unrealized gains and losses e.control n.equity method f.parent o.consolidation worksheet g.subsidiary p.minority interest h.trading securities q.business combination i.available-for-sale securities r.goodwill -Method of accounting for investments where the investor possesses significant influence (20% to 50% common stock ownership)over the operating and financial policies of the investee

Correct Answer

verified

N

Correct Answer

verified

Short Answer

If the investor holds 50% or more of the common stock of the investee, then the investor is referred to as the ____________________ and the investee is referred to as the ____________________.

Correct Answer

verified

parent

subsidiary

Correct Answer

verified

Short Answer

Match the following terms to their correct definition: a.equity security j.held-to-maturity securities b.debt security k.amortized cost method c.passive l.fair value method d.significant influence m.unrealized gains and losses e.control n.equity method f.parent o.consolidation worksheet g.subsidiary p.minority interest h.trading securities q.business combination i.available-for-sale securities r.goodwill -Method of accounting for all investments in debt securities that are classified as held-to-maturity securities

Correct Answer

verified

Correct Answer

verified

True/False

Held-to-maturity securities are equity and debt investments that management intends to sell in the future, but not necessarily in the near term.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following terms to their correct definition: a.equity security j.held-to-maturity securities b.debt security k.amortized cost method c.passive l.fair value method d.significant influence m.unrealized gains and losses e.control n.equity method f.parent o.consolidation worksheet g.subsidiary p.minority interest h.trading securities q.business combination i.available-for-sale securities r.goodwill -Equity or debt investments that management intends to sell in the near term, typically within a single month

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The practice of adjusting the market value of securities that are accounted for using the fair value method is referred to as

A) consolidation.

B) marking-to-market.

C) passive investing.

D) segregation of investments.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following terms to their correct definition: a.equity security j.held-to-maturity securities b.debt security k.amortized cost method c.passive l.fair value method d.significant influence m.unrealized gains and losses e.control n.equity method f.parent o.consolidation worksheet g.subsidiary p.minority interest h.trading securities q.business combination i.available-for-sale securities r.goodwill -Name given to an investor who owns over 50% of the outstanding common stock of the investee

Correct Answer

verified

Correct Answer

verified

Essay

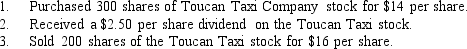

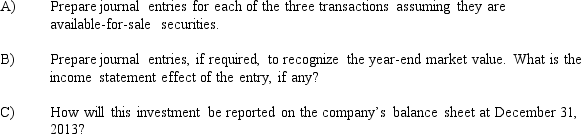

Tidewater Management, Inc. had no investments in short-term marketable securities prior to 2013. During 2013, the company engaged in the following investment transactions:

At the end of 2013, the Toucan Taxi stock had a market value of $15 per share.

At the end of 2013, the Toucan Taxi stock had a market value of $15 per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the correct statement from the following:

A) Consolidation worksheet adjustments are not entered on the accounting records of either Parent or Sub.

B) Consolidation worksheet adjustments are entered on the accounting records of the Parent but not the Sub.

C) Consolidation worksheet adjustments are entered on the accounting records of the Sub but not the Parent.

D) Consolidation worksheet adjustments are entered on the accounting records of both the Parent and the Sub.

Correct Answer

verified

Correct Answer

verified

Short Answer

If the investor holds 50% or more of the common stock of the investee, then the two corporations are no longer separate accounting entities and therefore must prepare ____________________ financial statements, which combine information about the two corporations as if they were a single company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the effects on the accounting equation from the recognition of an unrealized loss on trading securities?

A) Assets and stockholders' equity decrease.

B) No effects; unrealized gains and losses should not be recorded.

C) Assets and liabilities decrease.

D) Stockholders' equity decreases and liabilities increase.

Correct Answer

verified

Correct Answer

verified

True/False

A debt security exists when another entity owes the security holder some combination of interest and principal.

Correct Answer

verified

Correct Answer

verified

True/False

The excess of acquisition cost over the current value of the investee's identifiable net assets, referred to as goodwill, may not be recorded by the investor under current generally accepted accounting principles.

Correct Answer

verified

Correct Answer

verified

True/False

Any transaction or set of transactions that brings together two or more previously separate entities to form a single accounting entity is called a business combination.

Correct Answer

verified

Correct Answer

verified

Short Answer

Business combinations can occur through either an asset or ____________________ acquisition.

Correct Answer

verified

Correct Answer

verified

True/False

If the investor holds 50% or more of the investee's outstanding common stock, then the investor is referred to as the parent and the investee is called the subsidiary.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following terms to their correct definition: a.equity security j.held-to-maturity securities b.debt security k.amortized cost method c.passive l.fair value method d.significant influence m.unrealized gains and losses e.control n.equity method f.parent o.consolidation worksheet g.subsidiary p.minority interest h.trading securities q.business combination i.available-for-sale securities r.goodwill -Result when the value of securities must be written up or down to fair market value at the balance sheet date, a process referred to as "marking to market"

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2011, P Company purchased all of the outstanding common stock of S Company. Which of the following represents the worksheet entry needed to consolidate the balance sheets of the two companies?

A) Investment in S XXX Common stock XXX

Retained earnings XXX

B) Investment in S XXX Retained earnings XXX

C) Common stock XXX Retained earnings XXX

Investment in S XXX

D) Retained earnings XXX Investment in S XXX

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 73

Related Exams