Correct Answer

verified

Correct Answer

verified

True/False

Making a loan to another party is considered an investing activity on the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account. -What is the amount of uncollectible accounts expense recognized on the Year 2 income statement?

A) $320

B) $1,000

C) $2,080

D) $1,940

Correct Answer

verified

Correct Answer

verified

Multiple Choice

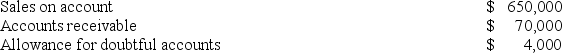

The following information is available for Blankenship Company for the most recent year. What was Blankenship's operating cycle for the most recent year? (Round to the nearest whole day.)

A) 30 days

B) 50 days

C) 80 days

D) 120 days

Correct Answer

verified

Correct Answer

verified

True/False

The longer it takes to collect accounts receivable,the greater the implicit interest cost that is incurred.

Correct Answer

verified

Correct Answer

verified

True/False

The net realizable value of accounts receivable decreases when an account receivable is written off.

Correct Answer

verified

Correct Answer

verified

True/False

The face value of Accounts Receivable plus the balance in the Allowance for Doubtful Accounts is equal to the net realizable value of the receivables.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glebe Company accepted a credit card account receivable in exchange for $1,100 of services provided to a customer.The credit card company charges a 5% fee for handling the transaction.What effect will the collection of cash from the credit card company have on the elements of the financial statements?

A) Increase assets by $1,045

B) Decrease assets and stockholders' equity by $55

C) Increase assets by $1,100

D) None of these answer choices are correct

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

Which of the following is not considered a "cost" of extending credit to customers?

A) The opportunity cost of lost interest

B) Keeping the records for accounts receivable

C) The increased sales resulting from the extension of credit

D) The possibility of unpaid accounts

Correct Answer

verified

Correct Answer

verified

True/False

A company that uses the direct write-off method must still prepare a year-end adjustment to estimate its uncollectible accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rhodes Company reports the following information for the Year 1 fiscal year:

Determine the average number of days it takes Rhodes to collect its accounts receivable.(Round intermediate calculations to 2 decimal places.)

Determine the average number of days it takes Rhodes to collect its accounts receivable.(Round intermediate calculations to 2 decimal places.)

A) 37

B) 14

C) 39

D) 20

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the accounts receivable turnover ratio computed?

A) Sales ÷ Net accounts receivable

B) Net accounts receivable ÷ Sales

C) Cost of goods sold ÷ Inventory

D) 365 days ÷ Net accounts receivable

Correct Answer

verified

Correct Answer

verified

True/False

Other things being equal,the longer a company's operating cycle,the higher the company's operating costs are likely to be.

Correct Answer

verified

Correct Answer

verified

Matching

On December 31,Year 1,the West Corporation estimated that $6,000 of its receivables might not be collected.At the end of Year 1,the unadjusted balances of Accounts Receivable and Allowance for Doubtful Accounts were $150,000 and zero.On February 1,Year 2,West wrote-off of a delinquent account from one of its customers.West Corp.uses the allowance method.Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

[The following information applies to the questions displayed below.] The Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account. -What is the net realizable value of Miller's receivables at the end of Year 1?

A) $54,000

B) $49,920

C) $59,700

D) $48,300

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would accountants estimate the amount of a company's uncollectible accounts expense?

A) Consider new circumstances that are anticipated to be experienced in the future.

B) Compute as a percentage of credit sales.

C) Consult with trade association and business associates.

D) All of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

True/False

The longer an account receivable has been outstanding,the less likely it is to be collected.

Correct Answer

verified

Correct Answer

verified

True/False

The collection of an account receivable is an asset source transaction.

Correct Answer

verified

Correct Answer

verified

True/False

Many businesses find it more efficient to offer credit directly to customers rather than to accept third-party credit cards.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 93

Related Exams