A) Abercrombie and Fitch

B) Sam's Clubs

C) Amazon

D) Regal Cinemas

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which factor has removed most of the practical limitations associated with use of the perpetual inventory system?

A) A more honest work force

B) Recent changes in GAAP

C) Recent changes in federal and state laws

D) Advancements in technology

Correct Answer

verified

Correct Answer

verified

Multiple Choice

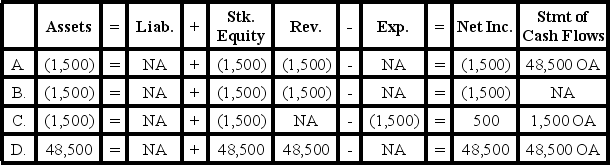

On April 1,Snell Company made a $50,000 sale giving the customer terms of 3/10,n/30.The receivable was collected from the customer on April 8.How does the collection of cash from the customer affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company recognizes cost of goods sold,how does that event impact the elements of the financial statements? (Ignore the effects of recognizing sales revenue.)

A) Assets increase.

B) Liabilities increase.

C) stockholders' equity decreases.

D) Dividends decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ashton Company uses the perpetual inventory system.The company's inventory account had a $6,600 balance as of December 31,Year 1.A physical count of inventory shows only $5,900 of merchandise in stock at December 31,Year 1.How will recognizing the missing inventory affect the company's financial statements?

A) Increase assets.

B) Increase expense.

C) Decrease cash flow from operating activities.

D) All of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

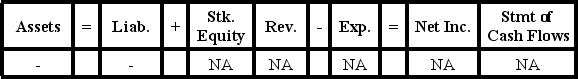

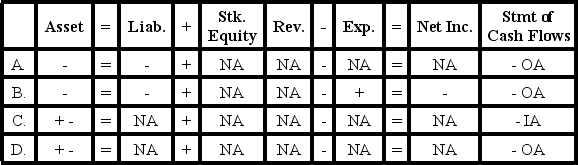

Kenyon Company experienced a transaction that had the following effect on the financial statements:

Which of the following business events would result in this effect on the financial statements?

Which of the following business events would result in this effect on the financial statements?

A) Paid for merchandise that had been purchased on account

B) A loss on land that was sold for cash

C) Return by a customer of a sale that was made on account

D) Return to a supplier of merchandise purchased on account

Correct Answer

verified

Correct Answer

verified

True/False

A company that purchases merchandise treats a cash discount as a reduction to the cost of merchandise inventory.

Correct Answer

verified

Correct Answer

verified

True/False

A common size income statement is prepared by dividing all amounts on the statement by net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What type of account is the Cost of Goods Sold account?

A) Liability

B) Asset

C) Contra asset

D) Expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Butte Company recognized $24,000 of revenue on the cash sale of merchandise that cost $11,000.How will the sale be reported on the statement of cash flows?

A) Cash inflow from investing activities

B) Cash inflow from operating activities

C) Cash inflow from financing activities

D) Cash inflow from principal activities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:

![[The following information applies to the questions displayed below.] A company's chart of accounts includes, in part, the following account numbers and corresponding account titles: -Which accounts would appear on the balance sheet? A) Account numbers 1, 2, 4, and 5 B) Account numbers 1, 3, 7, and 8 C) Account numbers 1, 2, and 6 D) Account numbers 3, 4, 8, and 9](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f65_e936_ace2_1d414f84598a_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which accounts would appear on the balance sheet?

-Which accounts would appear on the balance sheet?

A) Account numbers 1, 2, 4, and 5

B) Account numbers 1, 3, 7, and 8

C) Account numbers 1, 2, and 6

D) Account numbers 3, 4, 8, and 9

Correct Answer

verified

Correct Answer

verified

Multiple Choice

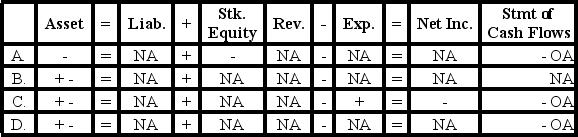

A company using the perpetual inventory system paid cash for a transportation-in cost.Which of the following choices reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

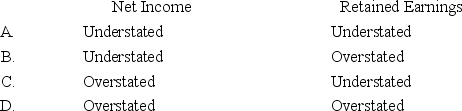

Aaron Company uses the periodic inventory system.If Aaron's ending inventory is understated due to an accounting error,what is the effect on net income and the ending balance of retained earnings?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

True/False

The return on sales ratio indicates the amount of each sales dollar that is left over after covering the cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Llewelyn Company paid the amount due on a purchase of merchandise on account.Llewelyn uses the perpetual inventory system.Which of the following reflects the effect of the payment on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

Which of the following is considered a period cost?

A) Transportation cost on goods received from suppliers

B) Advertising expense for the current month

C) Cost of merchandise purchased

D) None of these answer choices are considered a period cost

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the gross margin that results from these four transactions?

A) $5,100

B) $7,726

C) $6,550

D) $11,074

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a multistep income statement is true?

A) When a company sells inventory for more than its cost, the difference between the sales revenue and the cost of goods sold is called the operating income.

B) A single-step income statement shows sales, gross margin, and net income.

C) Gross margin is calculated as sales revenue minus cost of goods sold.

D) Gross margin equals net income.

Correct Answer

verified

Correct Answer

verified

True/False

The term FOB shipping point indicates that the seller is responsible for freight costs.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 106

Related Exams