Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the purpose of the accrual basis of accounting?

A) Recognize revenue when it is collected from customers.

B) Match assets with liabilities during the proper accounting period.

C) Recognize expenses when cash disbursements are made.

D) Recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash changes hands.

Correct Answer

verified

Correct Answer

verified

True/False

Providing services to customers on account is an asset exchange transaction.

Correct Answer

verified

Correct Answer

verified

Matching

Wheaton Co.performed services for a customer on account.Indicate whether each of the following statements about this transaction is true or false.

Correct Answer

True/False

The balance in accounts receivable represents the amount of cash the company is required to pay in the future.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fancy Foods Incorporated had an ending balance in accounts payable of $6,000.The company incurred $72,000 of operating expenses on account and paid $90,000 cash to settle accounts payable.Determine the beginning balance in accounts payable.

A) $12,000

B) $24,000

C) $96,000

D) $156,000

Correct Answer

verified

Correct Answer

verified

True/False

The matching concept leads accountants to select the recognition alternative that produces the lowest amount of net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warren Enterprises began operations during Year 1.The company had the following events during Year 1: 1) The business issued $40,000 of common stock to its stockholders. 2) The business purchased land for $24,000 cash. 3) Services were provided to customers for $32,000 cash. 4) Services were provided to customers for $10,000 on account. 5) The company borrowed $32,000 from the bank. 6) Operating expenses of $24,000 were incurred and paid in cash. 7) Salary expense of $1,600 was accrued. "8) A dividend of $8,000 was paid to the stockholders of Warren Enterprises. After closing,what is the balance of the Retained Earnings account as of December 31,Year 1?"

A) $10,000

B) $8,400

C) $16,400

D) $42,000

Correct Answer

verified

Correct Answer

verified

True/False

A payment to an employee in settlement of salaries payable decreases an asset and decreases equity.

Correct Answer

verified

Correct Answer

verified

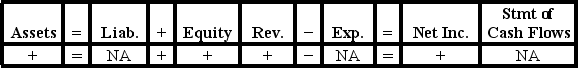

Multiple Choice

Which of the following choices accurately reflects how the recording of accrued salary expense affects the financial statements of a business?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenue on account amounted to $9,000.Cash collections of accounts receivable amounted to $8,100.Cash paid for operating expenses was $7,500.The amount of employee salaries accrued at the end of the year was $900.What was the net cash flow from operating activities?

A) $900

B) $600

C) $1,500

D) $8,700

Correct Answer

verified

Correct Answer

verified

True/False

Accrued interest expense is an asset use transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

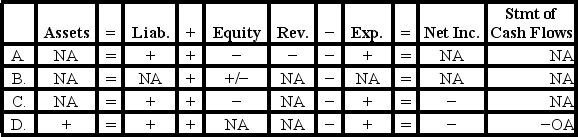

Chico Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Chico's financial statements?

Which of the following accounting events could have caused these effects on the elements of Chico's financial statements?

A) Issued common stock

B) Earned cash revenue

C) Borrowed money from a bank

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What action did the U.S.Congress take because of the audit failures at Enron,WorldCom and other companies?

A) Required publicly-traded companies to be audited by a government agency

B) Passed the Sarbanes-Oxley Act

C) Required companies to begin preparing an additional financial statement

D) Passed an amendment to the Securities and Exchange Act

Correct Answer

verified

Correct Answer

verified

True/False

The term "recognition" means to report an economic event in the financial statements.

Correct Answer

verified

Correct Answer

verified

True/False

Expenses incurred on account increase the accounts receivable balance.

Correct Answer

verified

Correct Answer

verified

True/False

Certified public accountants are obligated to act in a way that serves the public interest.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31,Year 1,Gaskins Co.owed $4,500 in salaries to employees who had worked during December but will not be paid until January,Year 2.If the year-end adjustment is properly recorded on December 31,Year 1,what will be the effect of this accrual on net income and cash flows from operating activities reported for Year 1?

A) No effect on net income; no effect on cash flow from operating activities

B) Decrease in net income; no effect on cash flow from operating activities

C) Increase in net income; decrease in cash flow from operating activities

D) No effect on net income; decrease in cash flow from operating activities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenue on account amounted to $5,000.Cash collections of accounts receivable amounted to $2,300.Expenses for the period were $2,100.The company paid dividends of $450.What was net income for the period?

A) $1,200

B) $2,900

C) $2,850

D) $2,450

Correct Answer

verified

Correct Answer

verified

Multiple Choice

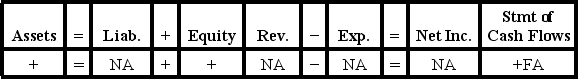

Addison Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on Addison's statements?

Which of the following accounting events could have caused these effects on Addison's statements?

A) Issued common stock

B) Earned revenue on account

C) Earned cash revenue

D) Collected cash from customers in partial settlement of its accounts receivable.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 84

Related Exams