A) Sick leave

B) Annual leave

C) Long service leave

D) Sabbatical leave

E) None of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Employee benefits include:

A) Wages and salaries, sick leave, payroll tax, annual leave.

B) Superannuation, wages and salaries, sick leave and annual leave.

C) Sick leave, annual leave, unemployment benefits, salaries and wages.

D) Annual leave, wages and salaries, post-employment benefits, payroll tax.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

AASB 119 "Employee Benefits" prescribes that all obligations relating to wages and salaries,annual leave and sick-leave entitlements,regardless of whether they were expected to be settled within 12 months of the reporting date be measured at nominal (undiscounted)amounts.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following: Current service cost 12,785 Interest cost 983 Expected return on plan assets (1,150) Net actuarial gain recognised in period (1,835) 10,783 The $10,783 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

What discount rate does AASB 119 require to be used to discount estimated future cash outflows associated with the relevant employee entitlements?

A) Risk-adjusted, organisation-specific discount rate.

B) Market-determined, organisation-specific discount rate.

C) Inflation adjusted, real rate of return required on equity financing.

D) The interest rate on high quality corporate bonds with terms to maturity that match the terms of the related liabilities.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

Any employee benefits that have been earned but not paid as at the reporting date are assets of the employer:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A non-contributory superannuation fund means:

A) No contributions are made to the fund by either the employer or employee.

B) Only the employer makes contributions to the fund.

C) Only the employee makes contributions to the fund.

D) It is a solely Government-funded scheme.

E) The fund is not taxed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

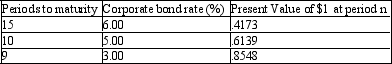

Annette French joined Paris Ltd on 1 July 2011 as a bookkeeper.She is the only permanent employee of Paris Ltd.On 30 June 2012 her salary was $35,000.Annette French's salary is expected to increase with inflation at a rate of 3%.Paris Ltd provides long service leave entitlement of 13 weeks after 15 years of service.A pro rata payment is made after 10 years of service.The probability of Annette French staying in the job until the obligation vests is 35%. Other information:

What is the long service leave liability (to the nearest $) of Paris Ltd as at 30 June 2012?

What is the long service leave liability (to the nearest $) of Paris Ltd as at 30 June 2012?

A) $133

B) $228

C) $253

D) $976

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

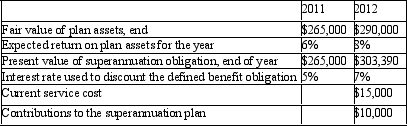

Mackay Ltd provides defined superannuation benefits to two (2) of its employees which represents an entitlement of three times their final salary on retirement.The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:  In accordance with AASB 119 "Employee Benefits",what is the interest cost and actuarial gain (loss) for the defined benefit obligation for the year ending 2012?

In accordance with AASB 119 "Employee Benefits",what is the interest cost and actuarial gain (loss) for the defined benefit obligation for the year ending 2012?

A) $13 250; $10 140

B) $13 250; ($10 140)

C) $18 550; $4 840

D) $18 550; ($4 840)

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

Defined benefit plans are fairly simplistic and AASB 119 devotes only a small section to them:

Correct Answer

verified

Correct Answer

verified

True/False

Any employee benefit that is incurred by the employer during the period and that contributes to the generation of items expected to provide future economic benefits for the employer may be capitalised as an asset:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The causes of actuarial gains and losses when accounting for defined benefit superannuation plans includes:

A) The effect of changes in the CPI.

B) The effect of changes of future employee turnover.

C) The effect of changes to strategic direction for the entity.

D) The effect of differences between the actual return on plan assets and the actual payments on plan liabilities.

E) The effect of the change of Government.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

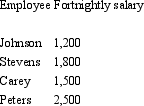

Trailers of the World has a small group of four employees.Trailers take part in a defined contribution plan and pay the required government contribution of 9 per cent plus an additional 4 per cent to reward its employees.Based on the employee earnings below,what is Trailers' superannuation obligation for the year?

A) $10,920.

B) $23,660.

C) $47,320.

D) $16,380.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

When determining accounting entries to be made in relation to the defined benefit liability of an entity,AASB 119 "Employee Benefits" requires actuarial gains and losses to be recognised as part of the income or expense of the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A defined contribution scheme:

A) Moves any actuarial and investment risk from the employer to the employee.

B) Requires the contribution made by an employer to be recognised as an expense.

C) Will only create a liability for the employer to the extent that any agreed contribution remains unpaid at the end of the financial year.

D) Requires employers to measure their obligations on an undiscounted basis, unless they are not wholly due within the 12 months after the period in which the employee rendered their services.

E) All of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Junior Ltd employs three workers to develop and test games.The employees are currently earning $30,000 each and are expected to cease their employment in 20 years.At the end of their employment each employee is entitled to a lump sum payment equal to 10 per cent of their final salary.Actuarial analysis suggests salaries will increase evenly at a rate of 5 per cent per year over the 20 years.At the end of the 20 years Junior's undiscounted obligation is $477,593.Assuming an interest rate of 8 per cent,calculate the obligation that would be recorded at the end of year 1 (rounded to the nearest dollar) :

A) $5,123.

B) $23,898.

C) $21,986.

D) $102,466.

E) None of the given answers.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Danish Ltd has an average weekly payroll of $200,000.The employees are entitled to 2 weeks',non-vesting sick leave per annum.Past experience suggests that 56 per cent of employees will take the full 2 weeks' sick leave and 22 per cent will take 1 week's leave each year.The rest of the employees take no sick leave.In the current week an employee with a weekly salary of $600 has been off sick for the first time this year.The employee took 2 days off out of her normal 5-day working week.Assuming that a weekly entry has been made to record the accumulated liability for sick leave and that PAYG tax is deducted at 30 per cent,what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar) ?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a step in accounting for contributions to a defined benefit superannuation plan?

A) Determine the fair value of any plan.

B) Discount any benefit employees have earned.

C) Estimate the amount of benefits the employees have earned in return for their service in the current and prior periods.

D) Establish the numbers of years until retirement for each employee to accurately calculate their likely benefit.

E) Determine the total amount of actuarial gains and losses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Australia,employee entitlements are protected in the case of company insolvency because:

A) Employees are given first priority for payment after the taxation department and the company administrators.

B) Employees are given some preferential access to payment, but after secured creditors.

C) ASIC monitors companies' annual reports to ensure that their assets are greater than the total secured debt and employee entitlements.

D) Employees are encouraged to withdraw their labour in the case of a company beginning to fail in order to minimise their loss of employee entitlements.

E) None of the given answers.

Correct Answer

verified

Correct Answer

verified

True/False

When employees finish their time with their employer,it is normal practice to pay them for any annual leave earned but not taken:

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 67

Related Exams