A) $2695

B) $4312

C) $5390

D) $3234

Correct Answer

verified

Correct Answer

verified

Multiple Choice

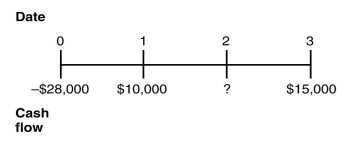

You are offered an investment opportunity that costs you $28,000, has a net present value (NPV) of $2278, lasts for three years, has interest rate of 10%, and produces the following cash flows:  The missing cash flow from year 2 is closest to ________.

The missing cash flow from year 2 is closest to ________.

A) $12,500

B) $12,000

C) $13,000

D) $10,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A rich donor gives a hospital $1,040,000 one year from today. Each year after that, the hospital will receive a payment 6% larger than the previous payment, with the last payment occurring in ten years' time. What is the present value (PV) of this donation, given that the interest rate is 11%?

A) $3,840,628.87

B) $5,376,880.42

C) $6,913,131.97

D) $7,681,257.74

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matthew wants to take out a loan to buy a car. He calculates that he can make repayments of $5000 per year. If he can get a four-year loan with an interest rate of 7.9%, what is the maximum price he can pay for the car?

A) $16,598

B) $19,918

C) $23,237

D) $26,557

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value (PV) of an investment that will pay $500 in one year's time, and $500 every year after that, when the interest rate is 10%?

A) $2500

B) $4000

C) $3000

D) $5000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given two choices of investments, Investment A and Investment B. Both investments have the same future cash flows. Investment A has a discount rate of 4%, and Investment B has a discount rate of 5%. Which of the following is true?

A) The present value of cash flows in Investment A is higher than the present value of cash flows in Investment B.

B) The present value of cash flows in Investment A is lower than the present value of cash flows in Investment B.

C) The present value of cash flows in Investment A is equal to the present value of cash flows in Investment B.

D) No comparison can be made-we need to know the cash flows to calculate the present value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

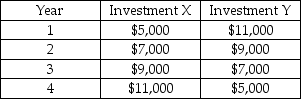

Which of the following investments has a higher present value, assuming the same (strictly positive) interest rate applies to both investments?

A) Investment X has a higher present value.

B) Investment Y has a higher present value.

C) Investment X and Investment Y have the same present value, since the total of the cash flows is the same for both.

D) No comparison can be made-we need to know the interest rate to calculate the present value.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 67 of 67

Related Exams