Correct Answer

verified

Correct Answer

verified

Multiple Choice

Outsourcing decisions are sometimes referred to as

A) make-or-buy decisions.

B) make decisions.

C) buy decisions.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

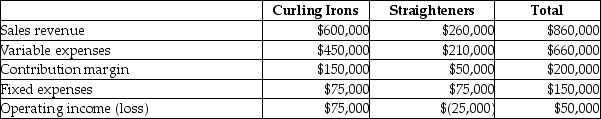

The income statement for Lovely Locks is divided by its two product lines,Curling Irons and Straighteners,as follows:

If Lovely Locks can eliminate fixed costs of $32,000 by discontinuing the Straightener line,then discontinuing it should result in which of the following?

If Lovely Locks can eliminate fixed costs of $32,000 by discontinuing the Straightener line,then discontinuing it should result in which of the following?

A) Increase in total operating income of $50,000

B) Decrease in total operating income of $18,000

C) Increase in total operating income of $18,000

D) Decrease in total operating income of $50,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mountaintop golf course is planning for the coming season.Investors would like to earn a 12% return on the company's $45 million of assets.The company primarily incurs fixed costs to groom the greens and fairways.Fixed costs are projected to be $20,000,000 for the golfing season.About 400,000 golfers are expected each year.Variable costs are about $15 per golfer.Mountaintop golf course is a price-taker and won't be able to charge more than its competitors who charge $75 per round of golf.What profit will it earn as a percent of assets?

A) Loss of 8.89%

B) Profit of 35.56%

C) Profit of 8.89%

D) Loss of 57.67%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A "constraint" is best described by which of the following?

A) The distribution of all products to be sold

B) A factor that restricts production or sales of a product

C) Benefits foregone by choosing a particular alternative course of action

D) Expected future costs that differ among alternatives

Correct Answer

verified

Correct Answer

verified

Multiple Choice

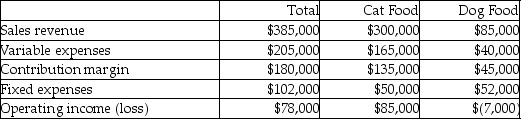

Contribution margin income statement data for the most recent year follow:

Assuming the Dog food line is discontinued,total fixed costs remain unchanged,and the space formerly used to produce the Dog food line is used to double the production of Cat food,how will operating income be affected?

Assuming the Dog food line is discontinued,total fixed costs remain unchanged,and the space formerly used to produce the Dog food line is used to double the production of Cat food,how will operating income be affected?

A) Increase $90,000

B) Increase $246,000

C) Increase $168,000

D) Decrease $90,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

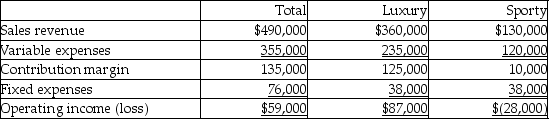

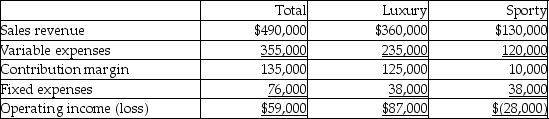

Westfall Watches has two product lines: Luxury watches and Sporty watches.Income statement data for the most recent year follow:

If $20,000 of fixed costs will be eliminated by discontinuing the Sporty line,how will operating income be affected?

If $20,000 of fixed costs will be eliminated by discontinuing the Sporty line,how will operating income be affected?

A) Decrease $30,000

B) Increase $10,000

C) Increase $69,000

D) Increase $128,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

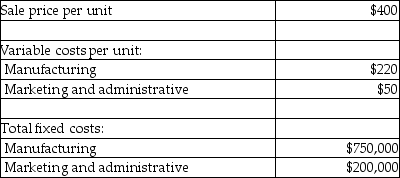

Sky High Seats manufactures seats for airplanes.The company has the capacity to produce 100,000 seats per year,but currently produces and sells 75,000 seats per year.The following information relates to the current production of the product:

If a special sales order is accepted for 7,000 seats at a price of $350 per unit,and fixed costs remain unchanged,how would operating income be affected? (NOTE: Assume regular sales are not affected by the special order. )

If a special sales order is accepted for 7,000 seats at a price of $350 per unit,and fixed costs remain unchanged,how would operating income be affected? (NOTE: Assume regular sales are not affected by the special order. )

A) Increase by $560,000

B) Decrease by $560,000

C) Increase by $2,450,000

D) Increase by $8,000,000

Correct Answer

verified

Correct Answer

verified

True/False

Managers need to consider variable costs,fixed costs,inventoriable product costs and period costs when setting prices.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Managers should consider which of the following when deciding whether to outsource a product or service?

A) Quality of the product or service

B) Delivery schedule of the product or service

C) Cost charged for the product or service

D) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benace Parts and Supply makes a variety of car parts.The company produces 6,000 A90 parts each year.Each A90 sells for $7 and has a contribution margin of $2.Currently,$16,000 of fixed manufacturing overhead is allocated to the A90 product line.If Benace Parts and Supply discontinues the A90 product line,$7,000 of fixed manufacturing overhead costs would be avoided.What would be the impact on total operating income if the A90 product line were to be discontinued?

A) Increase in total operating income of $5,000

B) Decrease in total operating income of $5,000

C) Increase in total operating income of $4,000

D) Decrease in total operating income of $4,000

Correct Answer

verified

Correct Answer

verified

True/False

For some merchandisers,the primary constraint may be cubic feet of display space.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Westfall Watches has two product lines: Luxury watches and Sporty watches.Income statement data for the most recent year follow:

Assuming the Sporty line is discontinued,total fixed costs remain unchanged,and the space formerly used to produce the Sporty line is used to increase the production of Luxury watches by 250%,how will operating income be affected?

Assuming the Sporty line is discontinued,total fixed costs remain unchanged,and the space formerly used to produce the Sporty line is used to increase the production of Luxury watches by 250%,how will operating income be affected?

A) Increase $299,500

B) Increase $177,500

C) Increase $236,500

D) Decrease $177,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

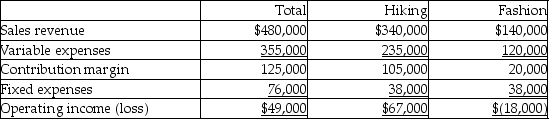

Boots Plus has two product lines: Hiking boots and Fashion boots.Income statement data for the most recent year follow:

If $25,000 of fixed costs will be eliminated by discontinuing the Fashion line,how will operating income be affected?

If $25,000 of fixed costs will be eliminated by discontinuing the Fashion line,how will operating income be affected?

A) Increase $5,000

B) Decrease $45,000

C) Increase $54,000

D) Increase $103,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are relevant to the decision to replace equipment except the

A) cost of old equipment.

B) selling price of old equipment.

C) future maintenance costs of old equipment.

D) cost of new equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An "opportunity cost" is best described by which of the following?

A) Benefits foregone by choosing a particular alternative course of action

B) Costs that were incurred in the past and cannot be changed

C) The distribution of all products to be sold

D) Expected future costs that differ among alternatives

Correct Answer

verified

Correct Answer

verified

Multiple Choice

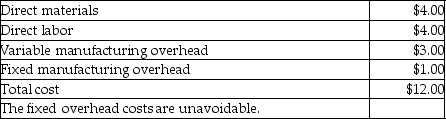

Cruise Company produces a part that is used in the manufacture of one of its products.The unit manufacturing costs of this part,assuming a production level of 6,000 units,are as follows:

Assume Cruise Company can purchase 6,000 units of the part from Suri Company for $14.00 each,and the facilities currently used to make the part could be used to manufacture 6,000 units of another product that would have an $8 per unit contribution margin.If no additional fixed costs would be incurred,what should Cruise Company do?

Assume Cruise Company can purchase 6,000 units of the part from Suri Company for $14.00 each,and the facilities currently used to make the part could be used to manufacture 6,000 units of another product that would have an $8 per unit contribution margin.If no additional fixed costs would be incurred,what should Cruise Company do?

A) Make the new product and buy the part to earn an extra $5.00 per unit contribution to profit.

B) Make the new product and buy the part to earn an extra $6.00 per unit contribution to profit.

C) Continue to make the part to earn an extra $2.00 per unit contribution to profit.

D) Continue to make the part to earn an extra $4.00 per unit contribution to profit.

Correct Answer

verified

Correct Answer

verified

True/False

When setting prices,managers need to consider all costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In pricing a product,managers should consider which of the following?

A) Only fixed costs

B) Only variable costs

C) Only period costs

D) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Contribution margin per unit" is best described by which of the following?

A) Sales price per unit minus fixed cost per unit

B) Sales price per unit minus variable cost unit

C) Sales price per unit minus fixed and variable costs per unit

D) Units sold time contribution margin ratio

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 253

Related Exams