A) B, because of higher NPV.

B) B, because of higher IRR.

C) A, because of higher NPV.

D) A, because of higher IRR.

E) Neither, because both have IRRs less than the cost of capital.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project requires an investment outlay of $100 immediately.The project will generate after-tax cash flows of $50 one year from now and $60 two years from now.What is the IRR of the project?

A) 5.39%

B) 6.39%

C) 10.39%

D) 12.39%

E) 14.39%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a purely theoretical basis,the NPV is the better approach to capital budgeting due to all the following reasons EXCEPT:

A) that it measures the benefits relative to the amount invested.

B) for the reasonableness of the reinvestment rate assumption.

C) that there may be multiple solutions for an IRR computation.

D) that it maximizes shareholder wealth.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An NPV profile is most helpful in dealing with what type of problem?

A) Difficulty in forecasting cash flows

B) The technical sophistication required to interpret NPV results

C) The fact that some projects may have multiple NPVs

D) Problems in estimating a firm's cost of capital

E) Making a decision about a project when recommendations from the payback and NPV calculations conflict

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The modified internal rate of return corrects which problem inherent in IRR?

A) Adjustments for scale differences

B) Difficulty in ranking projects

C) Differing risk attributes of projects

D) Incorporates the time value of money

E) It allows for reinvestment of cash inflows from the project at the firm's cost of capital.

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Pear Computer Corp.plans to introduce a new model called the Bartlett,whose sales are expected to grow rapidly until the computer becomes obsolete in five years.Net cash inflows to be realized at the end of the first year are $1 million,and they are expected to increase $1 million per year for each of the remaining 4 years.Cash outflows for production expenses are $3.5 million today and an additional $1.5 million at the end of the second year to increase capacity.If Pear's cost of capital is 10%,what is the project's NPV? Round to nearest whole dollar amount.

A) $9,412,700

B) $5,912,919

C) $6,173,452

D) $5,123,936

E) $8,998,418

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the net present value technique,a project is considered acceptable if:

A) the sum of all cash inflows and outflows is positive.

B) the difference between all discounted cash inflows and outflows exceeds zero.

C) it lowers costs below an acceptable hurdle rate.

D) its rate of return is greater than the firm's cost of capital.

E) it returns the initial investment faster than competing projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are considered to be disadvantages of using the payback method except the fact that it:

A) ignores the time value of money.

B) has no clearly defined decision rule.

C) does not consider cash flows that occur beyond the payback period.

D) does not adjust for risk.

E) does not provide a good measure of the project's liquidity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) The NPV will be positive if the IRR is less than the cost of capital.

B) If the multiple IRR problem does not exist, any independent project acceptable by NPV method will also be acceptable by the IRR method.

C) When IRR = k (the cost of capital) , NPV = 0.

D) The IRR can be positive even if the NPV is negative.

E) The NPV method is not affected by the multiple IRR problem.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The Seattle Corporation has been presented with an investment opportunity which will yield end of year cash flows of $30,000 per year in Years 1 through 4,$35,000 per year in Years 5 through 9,and $40,000 in Year 10.This investment will cost the firm $150,000 today,and the firm's cost of capital is 10%.What is the NPV for this investment?

A) $135,984

B) $18,023

C) $219,045

D) $51,138

E) $92,146

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1967,Lockheed planned to build a wide-bodied passenger aircraft called the L-1011 Tri Star airbus.The pre-production phase of the Tri Star project was planned to end in 1971 and total $1B.Lockheed planned to sell 35 aircraft per year for six years between 1972 and 1977 with an operating profit of $2M per aircraft.This sales forecast was aggressive as it represented a market share of 45% of the world market for wide-bodied aircraft (which was forecast to be about 80 aircraft per year) . By 1971 the company was in financial distress and had to seek a government bailout. At the end of 1967,Lockheed had 11.3 million shares outstanding which traded at $70 per share.If the market had known the NPV of the L-1011 project at that time,then what would the stock price have been?

A) Larger than $70; hard to tell without more information

B) Much less than $70, as the project clearly had a large, negative NPV

C) About $70; the NPV of the project was close to zero

D) $70; the NPV of a project does not affect the stock price

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Two projects each require a current cash expenditure of $10,000.Project A will generate cash inflows of $2,000 per year for the next twelve years.Project B is expected to return $6,000 in 1 year,$4,000 at the end of year 2,and $3,000 in 3 years.Which project should be selected if funds are unavailable to finance both and capital costs are 6%?

A) Project B because it has a shorter payback period.

B) Project B because it has a higher IRR

C) Project A because it has a higher IRR

D) Project A because it has a higher NPV

E) Project B because it has a higher NPV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Los Angeles Lumber Company (LALC) is considering a project with a cost of $1,000 at Time = 0 and inflows of $300 at the end of Years 1-5.LALC's cost of capital is 10%.What is the project's modified IRR (MIRR) ?

A) 10.0%

B) 12.9%

C) 15.2%

D) 18.3%

E) 20.7%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is evaluating an investment proposal which has an initial investment of $5,000 and cash flows presently valued at $4,000.The net present value of the investment is:

A) -$1,000

B) $0

C) $1,000

D) $1.25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

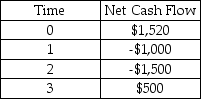

Given the following net cash flows,determine the IRR of the project: (to the nearest whole percent)

A) 36%

B) 32%

C) 28%

D) 24%

E) 20%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

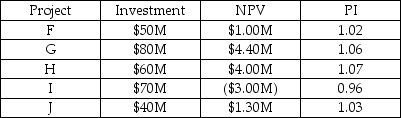

A firm is considering the following independent investments:

In the absence of capital rationing,what is the total NPV of the projects that should be selected? Which projects should be selected if the company only has $200M to invest?

In the absence of capital rationing,what is the total NPV of the projects that should be selected? Which projects should be selected if the company only has $200M to invest?

A) $7.70; F, G, H, J

B) $7.70; G, H, J

C) $10.70; F, G, H, J

D) $10.70; G, H, J

E) $13.70; F, G, H, J

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The underlying cause of ranking conflicts between the NPV and IRR methods is differing:

A) Initial cost.

B) Reinvestment rate assumption.

C) Cash flow timing.

D) Profitability indices.

E) Errors in calculating the discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comparing net present value and internal rate of return analysis:

A) always result in the same ranking of projects.

B) always result in the same accept/reject decision.

C) may give different accept/reject decisions.

D) is only necessary on mutually exclusive projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is evaluating two independent projects utilizing the internal rate of return technique.Project X has an initial investment of $80,000 and cash inflows at the end of each of the next five years of $25,000.Project Z has a initial investment of $120,000 and cash inflows at the end of each of the next four years of $40,000.The firm should:

A) accept both if their cost of capital is 15% at the maximum.

B) accept only Z if their cost of capital is 15% at the maximum.

C) accept only X if their cost of capital is 15% at the maximum.

D) reject both if their cost of capital is 12% at the maximum.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Going Postal Service Inc.is considering an upgrade of its sorting machines.The cost of the project is $10,000 per machine and the improvement is expected to save $5,000 each year,beginning one year after the adoption of the project and continuing for a total of 5 years.If Going's cost of capital is 10%,is the project acceptable? Round answer to the nearest whole dollar.

A) Yes, the NPV = $15,000

B) Yes, the NPV = 15%

C) No, the NPV = -$8,954

D) Yes, the NPV = +$8,954

E) No, the NPV = 8%

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 86

Related Exams