Correct Answer

verified

True

Correct Answer

verified

True/False

Agents of corporate owners are themselves owners of the firm and have been elected by all the corporate owners to represent them in decision-making and management of the firm.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

The dominant form of organization with respect to receipts and net profits is the

A) sole proprietorship.

B) partnership.

C) corporation.

D) S-corporation.

Correct Answer

verified

Correct Answer

verified

True/False

The financial manager places primary emphasis on cash flows, the inflow and outflow of cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

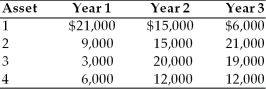

A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. Each asset costs $35,000 and is expected to provide earnings over a three-year period as described below.  Based on the profit maximization goal, the financial manager would choose

Based on the profit maximization goal, the financial manager would choose

A) Asset 1.

B) Asset 2.

C) Asset 3.

D) Asset 4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate owner's receive realizable return through

A) earnings per share and cash dividends.

B) increase in share price and cash dividends.

C) increase in share price and earnings per share.

D) profit and earnings per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate ethics policies typically apply to ________ in dealing with ________.

A) employee actions; customers and creditors

B) employee actions; customers, vendors, and regulators

C) management actions; all corporate constituents

D) employee actions; all corporate constituents

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Sarbanes-Oxley Act of 2002 did all of the following EXCEPT

A) tighten audit regulations and controls.

B) toughen penalties against overcompensated executives.

C) toughen penalties against executives who commit corporate fraud.

D) All of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flow and risk are the key determinants in share price. Increased cash flow results in ________, other things remaining the same.

A) a lower share price

B) a higher share price

C) an unchanged share price

D) an undetermined share price

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial manager is interested in the cash inflows and outflows of the firm, rather than the accounting data, in order to ensure

A) profitability.

B) the ability to pay dividends.

C) the ability to acquire new assets.

D) solvency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Steve Jobs, the CEO of Apple, were to pass away, what do you think would happen to price of Apple's stock?

A) It would decrease because of the perceived increased risk because of lack of near-term leadership.

B) It would increase because of the perceived increased risk because of lack of near-term leadership.

C) It would decrease because of the perceived decreased risk because of lack of near-term leadership.

D) It would increase because of the perceived decreased risk because of lack of near-term leadership.

Correct Answer

verified

Correct Answer

verified

True/False

The profit maximization goal ignores the timing of returns, does not directly consider cash flows, and ignores risk.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Profit maximization fails because it ignores all EXCEPT

A) the timing of returns.

B) earnings per share.

C) cash flows available to stockholders.

D) risk.

Correct Answer

verified

Correct Answer

verified

True/False

The financial manager prepares financial statements that recognize revenue at the point of sale and expenses when incurred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Managerial finance

A) involves tasks such as budgeting, financial forecasting, cash management, and funds procurement.

B) involves the design and delivery of advice and financial products.

C) recognizes funds on an accrual basis.

D) devotes the majority of its attention to the collection and presentation of financial data.

Correct Answer

verified

Correct Answer

verified

True/False

The capital expenditures analyst/manager is responsible for the evaluation and recommendation of proposed asset investments and may be involved in the financial aspects of implementation of approved investments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A financial manager must choose between three alternative investments. Each asset is expected to provide earnings over a three-year period as described below. Based on the wealth maximization goal, the financial manager would

A) choose Asset 1.

B) choose Asset 2.

C) choose Asset 3.

D) be indifferent between Asset 1 and Asset 2.

Correct Answer

verified

Correct Answer

verified

True/False

The board of directors is responsible for managing day-to-day operations and carrying out the policies established by the chief executive officer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By concentrating on cash flows within the firm the financial manager should be able to

A) prepare tax returns.

B) speak authoritatively to stockholders.

C) avoid insolvency.

D) control expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial manager may be responsible for any of the following EXCEPT

A) monitoring of quarterly tax payments.

B) analyzing budget and performance reports.

C) determining whether to accept or reject a capital asset acquisition.

D) analyzing the effects of more debt on the firm's capital structure.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 133

Related Exams