A) debt

B) price/earnings

C) return on equity

D) return on total assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm with sales of $1,000,000, net profits after taxes of $30,000, total assets of $1,500,000, and total liabilities of $750,000 has a return on equity of

A) 20 percent.

B) 15 percent.

C) 3 percent.

D) 4 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you were given the average collection period of a firm was currently 45 days, that the average collection of the firm for the past 3 years was 30 days and that the average collection period of the firm's industry for the past few years and currently was 30 days, would you want to know any other information to evaluate the effectiveness of the firm's credit and collection policies?

A) No, the firm obviously has a problem with its credit and collection policies.

B) Yes, you would also want to know what the firm's credit terms are and especially if they had recently changed from 30 to 45 days.

C) No, the firm does not seem to have any issues with its credit and collection policies.

D) Yes, you would want to know what the average collection period was for the past few years and currently of the market in general.

Correct Answer

verified

Correct Answer

verified

True/False

The Sarbanes-Oxley Act of 2002 was passed to eliminate many of the disclosure and conflict of interest problems of corporations.

Correct Answer

verified

Correct Answer

verified

True/False

Earnings per share represents amount earned during the period on each outstanding share of common stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 2002 Sarbanes-Oxley Act was designed to

A) limit the compensation that could be paid to corporate CEOs.

B) eliminate the many disclosure and conflict of interest problems of corporations.

C) provide uniform international accounting standards.

D) two of the above.

Correct Answer

verified

Correct Answer

verified

True/False

The firm's creditors are primarily interested in the short-term liquidity of the company and its ability to make interest and principal payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation had year end 2004 and 2005 retained earnings balances of $320,000 and $400,000, respectively. The firm reported net profits after taxes of $100,000 in 2005. The firm paid dividends in 2005 of ________.

A) $0

B) $20,000

C) $80,000

D) $100,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial leverage multiplier is an indicator of how much ________ a corporation is utilizing.

A) operating leverage

B) long-term debt

C) total debt

D) total assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

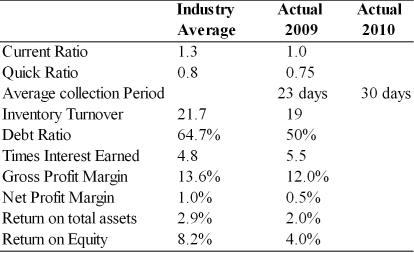

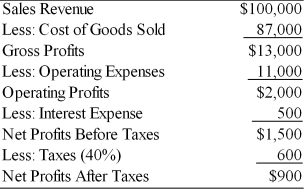

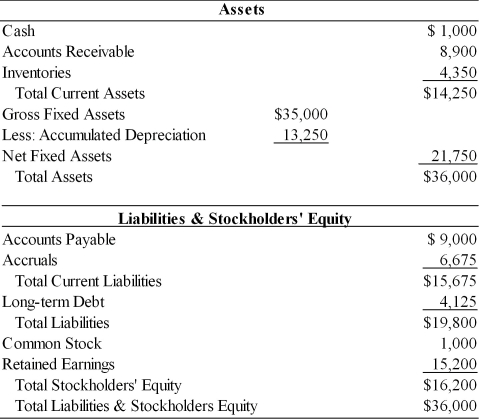

Table 3.2

Dana Dairy Products Key Ratios  Income Statement

Dana Dairy Products

For the Year Ended December 31, 2010

Income Statement

Dana Dairy Products

For the Year Ended December 31, 2010  Balance Sheet

Dana Dairy Products

December 31, 2010

Balance Sheet

Dana Dairy Products

December 31, 2010  -The current ratio for Dana Dairy Products in 2005 was ________. (See Table 3.2)

-The current ratio for Dana Dairy Products in 2005 was ________. (See Table 3.2)

A) 1.58

B) 0.63

C) 1.10

D) 0.91

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net value of fixed assets is also called its

A) market value.

B) par value.

C) book value.

D) price.

Correct Answer

verified

Correct Answer

verified

True/False

The financial leverage multiplier is the ratio of the firm's total assets to stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following groups of ratios primarily measure risk.

A) liquidity, activity, and profitability

B) liquidity, activity, and common stock

C) liquidity, activity, and debt

D) activity, debt, and profitability

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are examples of current liabilities EXCEPT

A) accounts receivable.

B) accounts payable.

C) accruals.

D) notes payable.

Correct Answer

verified

Correct Answer

verified

Essay

Ag Silver Mining, Inc. has $500,000 of earnings before interest and taxes at the year end. Interest expenses for the year were $10,000. The firm expects to distribute $100,000 in dividends. Calculate the earnings after taxes for the firm assuming a 40 percent tax on ordinary income.

Correct Answer

verified

Correct Answer

verified

True/False

Due to inflationary effects, inventory costs and depreciation write-offs can differ from their true values, thereby distorting profits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ ratio may indicate that the firm will not be able to meet interest obligations due on outstanding debt.

A) debt

B) net profit margin

C) return on total assets

D) times interest earned

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ measures the percentage of profit earned on each sales dollar before interest and taxes.

A) net profit margin

B) operating profit margin

C) gross profit margin

D) earnings available to common shareholders

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm ABC had operating profits of $100,000, taxes of $17,000, interest expense of $34,000 and preferred dividends of $5,000. What was the firm's net profit after taxes?

A) $66,000

B) $49,000

C) $44,000

D) $83,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross profits are defined as

A) operating profits minus depreciation.

B) operating profits minus cost of goods sold.

C) sales revenue minus operating expenses.

D) sales revenue minus cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 209

Related Exams