A) 0.58%

B) 0.68%

C) 0.78%

D) 0.88%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Treynor-Black model security analysts __________.

A) analyze a relatively small number of stocks

B) analyze all stocks which are publicly traded

C) are redundant

D) devote their attention to market timing rather than fundamental analysis

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portfolio managers Paul Martin and Kevin Krueger each manage $1,000,000 funds.Paul Martin has perfect foresight and the call option value of his perfect foresight is $150,000.Kevin Krueger is an imperfect forecaster and correctly predicts 50% of all bull markets and 70% of all bear markets.The correct measure of timing ability for Kevin Krueger is __________.

A) 20%

B) 60%

C) 75%

D) 120%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the theory of active portfolio management.Stocks A and B have the same beta and non-systematic risk.Stock A has higher positive alpha than stock B. You should want __________ in your active portfolio.

A) equal proportions of stocks A and B

B) more of stock A than stock B

C) more of stock B than stock A

D) more information is needed to answer this question

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

An attribution analysis will NOT likely contain which of the following components?

A) Asset allocation

B) Index returns

C) Risk free returns

D) Security selection

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chuck Douglass,an imperfect forecaster correctly predicts 57% of all bull markets and 68% of all bear markets.Roy Simmonds is a perfect forecaster.If Chuck Douglass is able to charge a fee of $125,000,the fee that Roy Simmonds should charge is __________.Assume that both forecasters manage similar size funds.

A) $31,250

B) $200,000

C) $500,000

D) $625,000

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A passive benchmark portfolio is _______________. I.a portfolio where the asset allocation across broad asset classes is neutral and not determined by forecasts of performance of the different asset classes II.one where an indexed portfolio is held within each asset class III.often called the bogey

A) I only

B) I and III only

C) II and III only

D) I, II and III

Correct Answer

verified

Correct Answer

verified

Multiple Choice

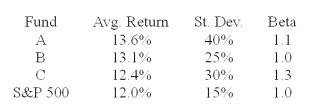

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.  -You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation.The fund with the highest Jensen measure of performance is __________.

-You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation.The fund with the highest Jensen measure of performance is __________.

A) Fund A

B) Fund B

C) Fund C

D) S&P500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term for the process used to assess portfolio manager performance?

A) Active analysis

B) Attribution analysis

C) Passive analysis

D) Treynor Black Analysis

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Perfect timing ability is equivalent to having __________ on the market portfolio.

A) a call option

B) a futures contract

C) a put option

D) a forward contract

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The portfolio that contains the benchmark asset allocation against which a manager will be measured is often called _____________.

A) the bogey portfolio

B) the Vanguard Index

C) Jensen's alpha

D) the Treynor measure

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the theory of active portfolio management.Stocks A and B have the same positive alpha and the same nonsystematic risk.Stock A has a higher beta than stock B. You should want __________ in your active portfolio.

A) equal proportions of stocks A and B

B) more of stock A than stock B

C) more of stock B than stock A

D) more information is needed to answer this question

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B have alphas of .01 and betas of .90.Stock A has a residual variance of .020 while stock B has a residual variance of .016.If stock A represents 2% of an active portfolio,stock B should represent __________ of an active portfolio.

A) 1.6%

B) 2.0%

C) 2.2%

D) 2.5%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Probably the biggest problem with evaluating portfolio performance of actively managed funds is the assumption that __________________________.

A) the markets are efficient

B) portfolio risk is constant over time

C) diversification pays off

D) security selection is more valuable than asset allocation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio generates an annual return of 13%,a beta of 0.7 and a standard deviation of 17%.The market index return is 14% and has a standard deviation of 21%.What is Jensen's alpha of the portfolio if the risk free rate is 5%?

A) .017

B) .034

C) .067

D) .078

Correct Answer

verified

Correct Answer

verified

Multiple Choice

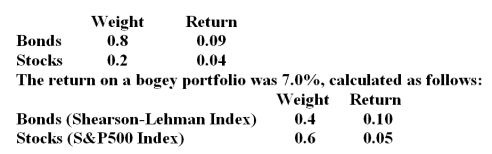

In a particular year, Lost Hope Mutual Fund made the following investments in asset classes:  -The total extra return on the managed portfolio was __________.

-The total extra return on the managed portfolio was __________.

A) 1%

B) 2%

C) 3%

D) 4%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The M2 measure is a variant of ________________.

A) the Sharpe measure

B) the Treynor measure

C) Jensen's alpha

D) the appraisal ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The correct measure of timing ability is ____________ for a portfolio manager who correctly forecasts 55% of bull markets and 55% of bear markets.

A) -5%

B) 5%

C) 10%

D) 95%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

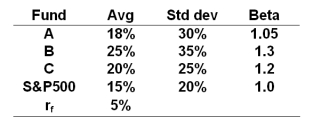

The risk free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  -What is the M2 measure for portfolio B?

-What is the M2 measure for portfolio B?

A) 0.43%

B) 1.25%

C) 1.77%

D) 1.43%

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Portfolio managers Paul Martin and Kevin Krueger each manage $1,000,000 funds.Paul Martin has perfect foresight and the call option value of his perfect foresight is $150,000.Kevin Krueger is an imperfect forecaster and correctly predicts 50% of all bull markets and 70% of all bear markets.The value of Kevin Krueger's imperfect forecasting ability is __________.

A) $30,000

B) $67,500

C) $108,750

D) $217,500

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 87

Related Exams